.jpg?h=457&w=800&la=en&hash=6CB76FC0C0DA2223AF60AABBEAF6797D)

President Trump escalated the risk of a trade war with China on Thursday, announcing a further USD 100bn of tariffs on Chinese goods, after China’s retaliatory USD 50bn target list on the US earlier in the week. Stocks fell on the news but both sides maintained the rhetoric. No tariffs will be implemented until after the end of the US’s 60-day public consultation period, meaning that there is still time for negotiations.

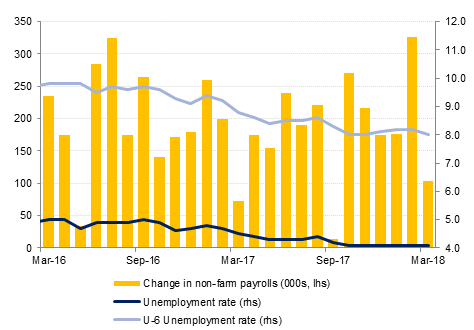

Federal Reserve chair Jerome Powell gave his first speech on the outlook for the US economy on Friday, reiterating that the risks were ‘evenly balanced’ and that ‘further gradual rate increases’ would best promote the Fed’s goals of economic expansion, 2% inflation and a strong labour market. He made no mention of the risk of a trade war in the speech, although he has said separately that it is too soon to know if it will make any impact on the economy. Despite Powell’s positive talk on the labour market, non-farm payroll numbers in the US disappointed to the downside last week, coming in at 103,000 in March, compared to consensus expectations of 193,000 and 326,000 in February. This marked the lowest level in six months, with bad weather being cited as a likely cause – the construction sector was one of the worst-performing. Wages rose 2.7% y/y, while unemployment was 4.1%, just missing expectations of 4.0%.

Qatar is reportedly meeting with investors this week ahead of a prospective bond issue, which would be the first international debt issuance in two years. Separately, S&P re-affirmed its A- sovereign credit rating on Saudi Arabia, and maintained a stable outlook. Growth is expected to recover modestly this year after contracting in 2017.

France is facing major rail strikes as President Emmanuel Macron looks to implement reforms, opening up the state-run SNCF to competition and relieving its debt burden. The strike is a major litmus test for Macron’s reform agenda, who currently enjoys broad support for the action. Air France unions have also been carrying out strikes, with the transport sector potentially significantly disrupted when they overlap with the rail workers.

Source: Emirates NBD Research, Bloomberg

Source: Emirates NBD Research, Bloomberg

US treasuries closed marginally lower for the week despite gains towards the end of the week. Renewed sell-off in stocks as trade tensions between the US and China escalated reignited risk-off mood. It appears that at the moment stock movements are driving treasuries with muted reaction to the Fed Chairman Powell’s speech in which he reiterated gradual rate increases. Yields on the 2y UST, 5y UST and 10y UST closed at 2.26% (flat w/w), 2.58% (+2 bps w/w) and 2.77% (+4 bps).

Regional bond market continue to remain in a tight range amid a strong pipeline of new issuances. The YTW on the Bloomberg Barclays GCC Credit and High Yield index dropped 1bp to 4.25% and credit spreads tightened by 1 bps to 171 bps.

Kingdom of Bahrain bonds gained sharply as they announced the discovery of new oil field which is said to be significantly bigger in size than current reserves. Bahrain 29s rose 2.3% to close at USD 95.6 and yield 7.3% (-30 bps w/w).

S&P affirmed Saudi Arabia’s ratings at A- with stable outlook. The rating agency said that it expects modest economic growth from 2018 supported by rising government investment.

Qatar has started the process to issue its first USD-denominated bonds in more than two years. The country which last sold bonds internationally in 2016 when it raised USD 9bn has sought meetings with fixed income investors in the US and UK.

The Dollar Index firmed 0.18% last week, reaching 90.132 and remaining above the 50 day moving average (89.795) and testing the former daily downtrend that has been in effect since November 2017. However, despite these modest gains, while the price remains below the 100 day moving average (91.116) the index remains vulnerable to further declines and a break of the 50 day moving average can result in a retest of the 38.2% five year Fibonacci retracement of 88.423.

EURUSD fell by 0.35% last week, closing at 1.2282. Of note is that over the course of the week, there was constant resistance encountered near the 50 day moving average (1.2337). The price action remains sideways on the daily candle chart with support likely to be found near the 100 day moving average of 1.2152.

Regional markets closed mixed with the ADX index losing -1.8% and the Kuwait Premier Market index adding +0.9%. The market breadth for the DFM index (-0.4%) remained weak with 21 stocks closing in negative territory and only 4 stocks rising.

Dana Gas closed -1.0% lower after the company informed that it had received a new injunction from the English High Court restricting its ability to pay dividends or increase its debt. Almarai rallied +3.4% after the company reported Q1 2018 earnings of SAR 344mn, ahead of analysts’ estimates of SAR 312mn.

Oil prices closed the week lower, down 4.4% for WTI futures and 4.5% for Brent. Market anxiety about a pending trade war between the US and China is overwhelming fundamental issues in the near term and dragging risk assets lower generally. In crude markets this is playing out with a marked uptick in volatility, at its highest level since Q3 2017.

The US drilling rig count recovered ground last week, adding 11 oil focused rigs to take the total back up above 800. The total count looks to be levelling off which likely reflects constraints in accessing rig crews and equipment more than a lack of desire by oil companies to carry on with new work. Speculators are closing out some long positions in both WTI and Brent futures with net length declining by more than 51k contracts in total last week, including more than 8.5k new short positions in WTI.

The WTI curve sank back into contango in the 1-2 month spread as trade war anxiety hangs on futures. Unlike the previous dip into contango in the middle of March which related to expiring contracts this flipping looks to be more related to a worried outlook for oil in the near term.