In the midst of an escalation of tit-for-tat trade wars with China, US President Donald Trump has deferred a decision on tariffs on EU and Japanese autos and spare parts by 180 days. The US has ascertained that the import of foreign vehicles is a threat to national security through its effect on domestic research and development. The US government is also in ongoing talks with Canada and Mexico regarding tariffs on steel and aluminium imposed last year. Canadian Foreign Minister, Chrystia Freeland, reitereated that ratification of the revised NAFTA deal agreed last year would be ‘very, very problematic’ for Canada if the tariffs remained in place.

Retail sales in the US underwent an unexpected decline in April, falling -0.2% m/m, missing expectations of 0.2% growth. While disappointing, March showed extraordinarily strong growth of 1.7%. Discretionary spending was particularly weak, likely impacted by higher pump prices as oil rose.

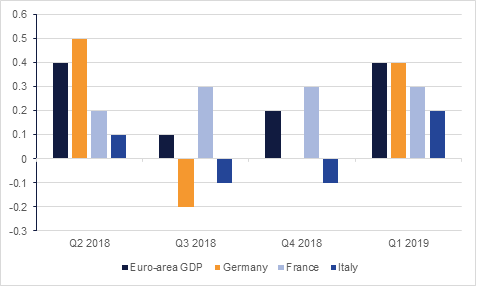

German real GDP was 0.4% q/q in Q1, in line with expectations and the Eurozone growth figure. This is a marked improvement on the 0.0% recorded in Q4 2018, but the economy remains under pressure. The six-month reprieve granted by US President Trump to the German autos sector will offer some respite, but the weak ZEW investor expectations index reading this week underscored concerns over the impact of trade wars on German production.

The IMF projects that Saudi Arabia will post a budget deficit equivalent to 7.0% of GDP in 2019, compared to government forecasts of 4.2% and our own expectation of 5.5%. Among its proposals to help balance the books is a hike to the VAT rate, though the likelihood, or the necessity, of this in the near term is slight. KSA posted a surplus of 3.6% of GDP in Q1, its first since 2014.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Treasuries closed higher as investors continued to remain cautious. Yields on the 2y UST, 5y UST and 10y UST closed at 2.15% (-4 bps), 2.14% (-4 bps) and 2.37% (-4 bps) respectively.

According to a report from the US, China sold the most USTs in more than two years in March. China sold USD 20.5bn worth of USTs.

Regional bonds rallied slightly recouping early week losses. The YTW on Bloomberg Barclays GCC credit and High Yield index dropped 2 bps to 3.98% while credit spreads rose 3 bps to 172 bps.

The AUD is the softest performing major currency in the Asia session, AUDUSD currently 0.19% lower at 0.69148, on target for a fourth day of losses. Earlier in the session, the price had traded below the 0.69 handle, trading as low as 0.6893 following softer than expected empoloyment data. 6,300 full time jobs were lost in April, compared to 49,200 created in March, taking the unemployment rate from 5.1% to 5.2%. While the price trades below the 23.6% one year Fibonacci retracement (0.6962), the price is vulnerable to further losses.

Developed market equities closed higher following comments from US official that some progress has been made on trade deals with other countries. The S&P 500 index and the Euro Stoxx 600 index added +0.6% and +0.5% respectively.

Regional markets closed mixed with the DFM index losing -1.1% and the Tadawul adding +1.3%. It was more of investor positioning following the MSCI review trade than anything else. Damac dropped -2.9% after reporting weaker than expected earnings.

Both benchmarks closed up moderately overnight, with Brent futures gaining 0.7% to USD 71.8/b and WTI up 0.4% at USD 62.0/b. The rise was prompted by ongoing political tensions in the Gulf region, and a greater-than-expected drawdown in US gasoline stockpiles, which dropped by 1.1mn barrels last week – although crude stockpiles rose by 5.4mn barrels.

OPEC+ are meeting in Jeddah this weekend and will likely discuss how long to maintain their policy of curbing supply in the face of rising prices.

Click here to Download Full article