Following the attacks on Saudi Arabian oil facilities from the weekend, which knocked 5.7m b/d out of production, there have been indications that it could take weeks or even months before they are once again producing at full capacity. UAE energy minister Suhail al-Mazrouei has pledged support from the UAE and wider OPEC group, through bringing any spare capacity online as needed.

Data out of China yesterday indicated that ongoing trade tensions with the US, and the escalating tit-for-tat of punitive tariffs between the two, are taking their toll on the economy. Industrial production expanded just 4.4% y/y in August, down from 4.8% in July and missing consensus expectations of 5.2%. Retail sales also underperformed, growing by 7.5%, missing expectations of 7.9%. Fixed asset investment expanded 5.5% y/y, the slowest pace in 12 months. On the other side of the dispute, we also had fairly weak manufacturing data out of the US, where the Empire State manufacturing survey missed expectations, coming in at 2.0 rather than 4.0.

With an economy closely tied with that of China, Australian policymakers have been watching the trade dispute closely. In the minutes of its September 3 meeting – at which it held rates at a record low 1.0% – released this morning, the Reserve Bank of Australia ‘discussed the escalation of the US-China trade and technology disputes, which had intensified the downside risks to the global outlook.’

In Tunisia, with more than half of votes in the presidential election counted, it looks likely that there will be a second round run-off between law professor Kais Saied, and tv magnate Nabil Karoui, both outsider candidates. Final results of the initial ballot are expected later today.

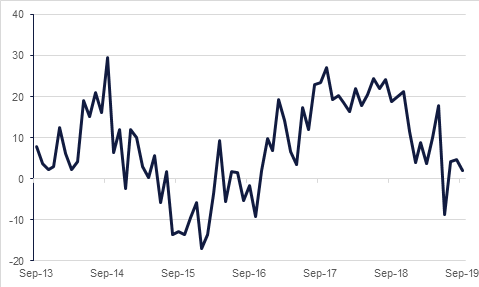

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Treasuries closed higher following a sharp rally in oil prices and as geopolitical tensions remained elevated. It is likely that the economic impact of a sustained higher oil price also weighed on investor sentiment ahead of the Fed meeting. Yields on the 2y UST, 5y UST and 10y UST closed at 1.75% (-4 bps), 1.69% (-6 bps) and 1.84% (-5 bps) respectively.

Regional bonds closed lower in reaction to developments over the weekend. However, the move was relatively contained. The YTW on Bloomberg Barclays GCC Credit and High Yield index rose +4 bps to 3.25% and credit spreads widened 9 bps to 145 bps.

The AUD is trading weaker against the other major currencies following the release of the RBA minutes from September’s meeting. The minutes re-iterated the central bank’s easing bias and highlighted that policy makers are ready to add more stimulus if they feel it is appropriate to support growth and inflation targets. At the same time, their view remained that risks to global growth remain tilted to the downside. With the market pricing in an additional rate cut by the RBA by November of this year, the AUD remains under pressure. As we go to print, AUDUSD is trading at 0.6838.

Equities

Global markets closed lower as investors remained cautious ahead of the Fed meeting and following the sharp rise in oil prices. The S&P 500 index and the Euro Stoxx 600 index dropped -0.3% and -0.6% respectively.

Regional markets closed mixed. However, major indices were able to recoup their losses from the previous session. The DFM index and the Tadawul added +0.3% and +1.0% respectively. Gains were led by market heavyweights with Al Rajhi Bank and Sabic closing +1.4% and +2.0% respectively.

Oil prices surged as markets assessed the impact of the attacks on Aramco facilities and the anticipated shortage of Saudi crude that could take “months” according to press reports. Brent futures jumped 14.6%, more than 6.6 standard deviations, to settle at USD 69.02/b while WTI rose by 14.7% to close just below USD 63/b. While the scale of damage and timeline for repair remain uncertain, oil markets will remain highly volatile.

Forward curves across both contracts jumped significantly with 1-2 month spreads in Brent closing above USD 1.30/b (compared with less than USD 1/b at the end of last week) while 1-12month spreads moved to nearly USD 8/b. Dubai time spreads also widened, closing the day at a one year peak of almost USD 2.7/b.

Importers of Saudi crude reported relatively few disruptions to volumes—not immediately likely given crude would already have been at export terminals—but that some have been asked to take differing grades. The UAE’s energy minister, Suhail al Mazrouei, said it was too early for OPEC to decide whether to increase production to compensate for the sudden drop in Saudi production while the heads of both OPEC and the IEA discussed whether markets need to see a release of strategic reserves or higher production.

Gold rallied on the escalation of geopolitical risk, gaining 0.6% while silver outperformed, adding more than 2.4%. However, the impact of higher energy costs dragged most other commodities lower with almost the entire base metals complex ending the day lower.