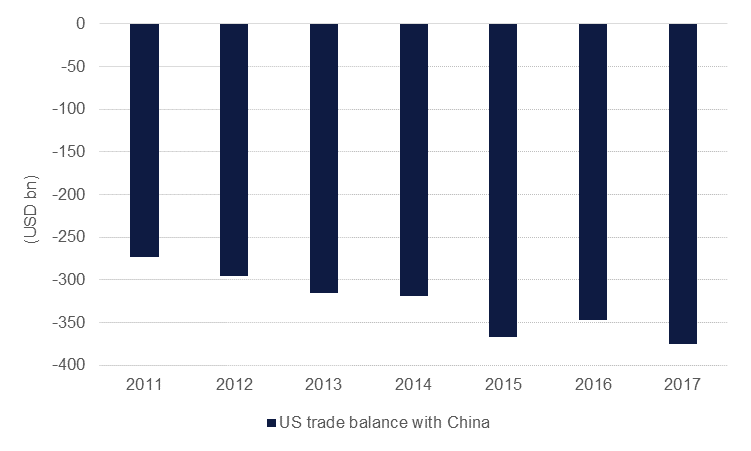

Trade disputes were again the theme of economic news to close the week as US tariffs on imports of aluminium and steel came into effect on Friday while on Thursday US president Donald Trump ordered USD 60bn of new tariffs directly targeting Chinese exports of aerospace material, information and communication technology and other machinery. The US has given several allies until May 1st to negotiate rates for exports of steel and aluminium, neutering the impact of the tariffs on metals markets to a degree. Trade will continue between these countries—including the EU—and US without duties until that time.

China has now retaliated in kind by announcing USD 3bn of tariffs on US agricultural products and metal products while its ambassador to the US warned the country could scale back its purchases of US Treasuries in retaliation to the trade dispute. Beyond the scale of the tariffs, the implication for a growing trade war between the US and China is casting a cloud over global growth prospects and equity markets reacted negatively to the news.

President Trump signed a USD 1.3trn spending bill despite warning Congress that he would veto the bill as it did not explicitly lay out spending for a wall on the Mexican border. The White House’s relationship with Congress could come under closer scrutiny if president Trump fires his chief of staff, John Kelly, as media speculation grows he could be the latest official to leave the administration.

The Bank of England voted to keep interest rates on hold at its latest MPC meeting on Thursday. However, the breakdown of the vote did see two voters out of nine support hiking at the meeting. A 25bps hike at the May meeting is being increasingly priced in as the BoE grapples with elevated inflation levels and improving conditions for a deal between the UK and its partners in the EU ahead of the country leaving the bloc. Sterling has pushed solidly back above GBPUSD 1.40 and appears set for further gains as the US enters into trade disputes with China and other major economies.

Overall messaging from the Fed las week was not as troubling as expected and although sentiment remains fickle, it provided some short-term support to the bond market. Yields on 2yr, 5yr, 10yr and 30yr treasuries closed the week lower at 2.25% (-5bps w/w), 2.60% (-6bps w/w), 2.81% (-4bps w/w) and 3.06% (-3bps w/w) respectively. Consequently, corporate bond portfolios did well with yields on US Aggregate Index and Euro Aggregate Index tightening marginally to 3.17% and 0.59% respectively.

Despite a 6% increase in oil prices and tightening benchmark yield curve, the GCC bond market suffered from pressures exerted by a) large new supply; b) fears of trade wars being more negative for EM markets than the DM markets, c) fears of capital outflow from EM bonds as yields rise in the DM world; and d) negative rating trend. During the week, yield on Barclays Bloomberg GCC bond index rose 8bps to 4.29% as credit spreads widened 9bps to 170bps. However, the current level still remains below the 172bps reached in June last year. Although the current level is higher than the five year average of 162bps, we do not expect material tightening in credit spreads given rating downgrades in the last two years.

Primary market remained active with ADCB raising $750 million via a 5yr bond at MS+130bps, taking the year to-date new issuance from the region to over $21.6 billion. Looking ahead, Kingdome of Bahrain has mandated banks for possible 7yr, 12yr and 30yr tranches. Also Qatar is believed to have met fixed-income investors in Asia to test their appetite for a potential bond sale in the next few weeks. Dubai Government which we expected to require capital market support, chose to obtain $2.45 billion financing for Metro Rail Extension in the loan market.

Dollar weakness characterized currency markets last week. New tariffs introduced by US president Donald Trump on Chinese imports have created worries about a looming trade war with China who has pledged to defend its economic interests. GBP was a strong performers, pushing comfortably back above the 1.40 handle thanks to an improving tone in the negotiations between the UK and its EU partners over Brexit while JPY pushed to new lows against the dollar as markets sought a flight to safety.

Increasing risk of trade wars weighed on equities across the globe last week. S&P 500 and Dow Jones were down by circa 2% on Friday and Euro Stoxx closed lower by 1.7%. Export oriented economies suffered more with Nikkei and Hang Seng closing down by 4.51% and 2.45% respectively and continues to trail lower this morning.

Regional bourses generally followed suit with their western counterparts, barring Abu Dhabi exchange that climbed +0.82% on the back of strength in energy and banks shares yesterday. Bahrain was another favoured exchange that close marginally up, while DFM (-1.09%), Tadawul (-0.04%) and Qatar (-0.83%) all closed down.

Oil markets had their strongest gains since July last week. Brent futures closed more than 6% higher and ended Friday above USD 70/b while WTI gained 5.7% to at USD 65.88/b. Commentary from Saudi Arabia’s energy minister, Khalid al Falih, that OPEC was considering extending its production cuts into 2019 along with the appointment of John Bolton as the new US national security adviser helped catalyse the rally in crude. Investors moved back into crude positions in a big way last week with net long positions in WTI and Brent both increasing.

The backwardation in both the Brent and WTI curve jumped sharply at the end of last week with the Brent spreads erasing all of the compression they had seen year to date. WTI has also moved more firmly out of the contango it tested last week as the market prices political risk into futures in a large way.

Click here to Download Full article