.jpg?h=457&w=800&la=en&hash=F307EF7312343753ED268FFAF4A8DFDD)

Rhetoric from official Chinese press agencies suggests the country is not prepared to back down on its trade dispute with the US. Domestic government-controlled media suggested the country could use its predominance in the supply of rare earth metals, used extensively in communications technology, to leverage the US into adopting a less confrontational stance on trade. China’s vice foreign minister said that while the country opposed a trade war it was not afraid of engaging in one. With no direct communication between senior Chinese or US leaders are the moment, markets will be left reeling in the wake of hostile headlines.

On the back of a softening in consumer sentiment, Germany’s labour market softened in May as the level of jobless rose by 60k that month. The headline unemployment rate rose to 5%. Weaker economic growth is contributing to the weaker jobs numbers in Europe’s biggest economy and the potential of a trade war spiraling out of control could threaten employment levels further, particularly in manufacturing.

The Bank of Canada left rates on hold at its latest meeting, citing rising risks to global trade and a momentary slowdown in the domestic economy. Base rates in Canada remain at 1.75% while the bank said China’s restrictions on trade in Canadian agricultural products having a “direct effect” on exports. The relatively cautious tone from the BoC saw the loonie weaken to above 1.35 against the USD but it has now stabilized around that level.

Source: EIKON, Emirates NBD Research

Source: EIKON, Emirates NBD Research

Fixed Income

Treasuries continued their positive run as investors remain cautious in light of concerns over global growth and lack of progress between the US and China on the trade front. The gains, however, were at the front end of the curve. Yields on the 2y UST, 5y UST and 10y UST closed at 2.10% (-2 bps), 2.06% (flat) and 2.26% (flat) respectively.

Regional bonds saw a bit of an uplift. The YTW on Bloomberg Barclays GCC Credit and High Yield index dropped 3 bps to 3.90% while credit spreads rose 1 bps to 175 bps.

FX

The dollar remains in demand, with safe haven buying the dominating factor, and with the JPY also benefiting on crosses. Trade and geopolitical concerns continue to erode investor confidence, while the risk of a no-deal Brexit and concerns about Italian budget responsibility are also high on the market’s mind. Yield differentials are having little influence on currency fluctuations in this environment, with the re-inversion of the U.S. yield curve causing worries about the likelihood of recession. Currently trading at 98.128, while the price of the Dollar Index remains above the 50-day moving average 97.467, further gains seem likely.

Equities

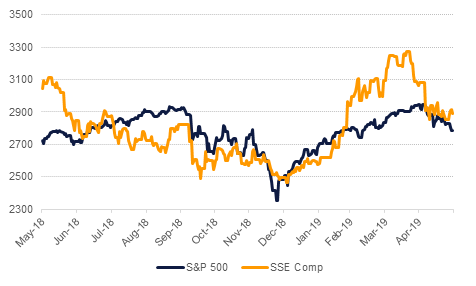

Developed market equities closed lower as the rhetoric between China and the US continued unabated. The S&P 500 index and the Euro Stoxx 600 index dropped -0.7% and -1.4% respectively.

Most regional markets closed higher. However, the Tadawul dropped -1.6% following the inclusion of Saudi stocks into the MSCI EM index. At the moment, it appears that local institutional investors are using the opportunity to pare some of their positions

Commodities

Oil markets are recouping some ground in early trade today after falling as much as 0.9% in Brent futures overnight. The API reported a drop in US inventories of 5.3m bbl last week, helping markets to recover. Official data from the EIA has been delayed thanks to the US public holiday at the start of the week.

Crude exports from Iran have reportedly fallen to just 400k b/d in May, an effective collapse as importers shun the country’s crude for fear of falling foul of US sanctions. Iran was exporting as much as 2.5m b/d as recently as April last year so the utter collapse in exports will help to keep a floor under crude prices as other producers have yet to step in to replace the scale of decline.