Trade developments will remain at the forefront this week, especially in regard to escalating US-China trade tensions. However, other destabilizing cross currents are also brewing in Europe and to some extent in the Middle East, keeping risk appetite low and safe havens like the USD underpinned.

On the positive side President Trump at least followed his deferral of a decision on tariffs on EU and Japanese autos with an agreement with Canada and Mexico regarding tariffs on steel and aluminium imposed last year, showing that he does not want to fight trade battles on multiple fronts. While this is welcome, it also suggests he may be prepared to double-down on China where signs of progress are not much in evidence after the ratcheting up of tariffs announced in the last fortnight, and the specific targeting of Huwei.

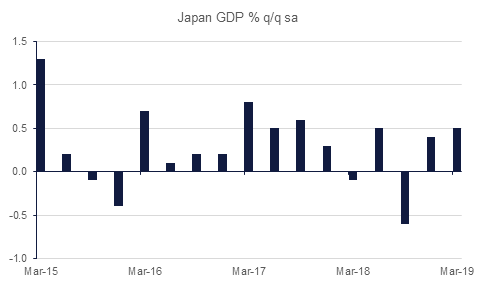

Japan’s Q1 GDP data was released this morning and shows that growth was much stronger than expected rising by 0.5% q/q, against expectations for a fall of -0.1%. This puts the annualized growth rate at 2.1%. However, the details of the report were less encouraging, with private consumption falling by -0.1% and business spending declining by -0.3%, with weaker imports being the principal factor behind a rise in net exports.

On the back of exit polls that have just been released in India markets are becoming optimistic that PM Modi will be returned to power when results are formally announced on Thursday. Modi’s victory would probably mean continuity of existing policies, which will be welcomed by markets even though the track record of the last few years has not been as impressive from a reform perspective as in the first few years of his tenure.

Egypt has been granted staff-level approval for the completion of the fifth and final review of its IMF programme, begun in late 2016. Upon sign-off by the executive board, USD 2bn will be released, taking the total granted to Egypt over the course of the programme to USD 12bn. The Fund recognised Egypt’s achievements in correcting ‘significant external and domestic imbalances’ and promoting ‘inclusive growth and job creation.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Treasuries gained further last week amid mixed economic data and lack of progress on the US-China trade deal. Although some progress was made over trade deal with other countries, the market participants continued to remain cautious. Yields on the 2y UST, 5y UST and 10y UST ended the week at 2.19% (-7 bps w-o-w), 2.17% (-9 bps w-o-w) and 2.39% (-7 bps w-o-w) respectively.

Regional bonds drifted lower amid worries over fallout of ongoing regional geopolitical tensions. The YTW on Bloomberg Barclays GCC Credit and High Yield index rose 4 bps w-o-w to 3.99% and credit spreads widened 9 bps to 170 bps.

The AUD has rebounded after the weekend election saw the Liberal coalition returned to power against expectations that the Labour party would win. The victory of the Liberal’s is likely to be perceived as good for business at a time when there are renewed concerns about the economy with the labour market showing a rise in unemployment in April to 5.2%. The INR is also starting the week stronger following opinion polls showing PM Modi as favbourite to win the Indian election.

The USD more generally is strong having risen against most major currencies last week, with the exception of the CHF, which also benefited from safe-haven flows. The heating up of US/China trade rhetoric was the main source of safe-haven demand for the USD, but with tension over regional geopolitics and Brexit in the UK also partly responsible. GBP slid over 2% during the week versus the USD, falling close to 1.27 for the first time since January.

Developed market equities closed lower across the board on Friday. In the U.S., the S&P500 lost 0.58% while the Nasdaq declined by 1.04%. On the other side of the Atlantic, the results were similar, with the DAX losing 0.58%, Euro Stoxx posting a 0.38% loss. Regional markets had mixed results on Sunday and while the DFM lost 2.21% and the Tadawul fell 1.12%, the ADX was able to climb 0.30%.

This morning Asian equity markets have opened with mixed results and as we go to print, the Nikkei is trading 0.38% higher, while the Shanghai Composite is down 0.59%.

Oil markets snapped several weeks of losses last week as geopolitical tension and still strong compliance with the OPEC+ production cuts pushed prices higher. Brent ended the week up more than 2% at USD 72.21/b while WTI added 1.8% to close at USD 62.76/b. Brent forward curves moved higher, to as wide as USD 1/b on 1-2 month spreads while WTI time spreads remain weighed down by persistent increases in US crude stocks.

OPEC+ held a market monitoring meeting over the weekend in Saudi Arabia to assess whether markets needed an increase in production to compensate declining output from Iran and Venezuela, among other producers. Saudi Arabia’s energy minster indicated that he expects cuts to remain in place as inventories in the US are still increasing (up 30m bbl since the start of the year) but that the group will be flexible in meeting demand.