.jpg?h=457&w=800&la=en&hash=942CE0F4BC2401A05DAB408BF1DD6C8A)

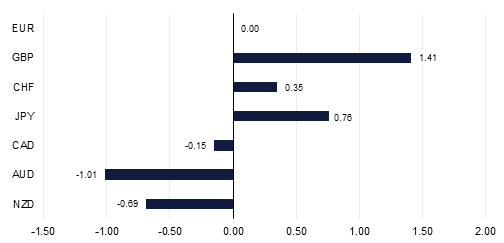

Trade talks have returned into the spotlight after Donald Trump upped the ante by threatening China with steeper tariffs ahead of the resumption of trade negotiations this week, causing China to threaten to pull out of the talks in response. Trump said on Sunday that he would increase tariffs on USD 200bn of Chinese imports to 25% from 10% on Friday this week and he also raised the possibility of putting a 25% duty on another USD 325bn of imports. The latest round of brinkmanship comes after markets had more or less assumed that a trade deal was a done deal, causing recent positive sentiment to evaporate and risk aversion to return, with the JPY strengthening sharply and the CNY weakening as a result. USDJPY remains vulnerable to further losses as global equities unwind recent strength.

The intrusion of renewed trade threats has disturbed the mood of optimism stemming from increasing signs of stabilization in the world economy. April’s US non-farm payroll report showed the U.S. unemployment rate dropping to a forty-nine year low of 3.6%, while there was a 263k gain in non-farm payrolls after 16k in upward revisions to March. A soft average work week and average hourly earnings growth remaining at 3.2% y/y also gave the report a more goldilocks flavour of being not too hot and not too cold, and keeping USD gains largely intact.

The Eurozone also surprised positively last week with a 0.4% Q1 GDP growth rate, up from 0.3% q/q in the previous quarter, while UK monthly GDP was also better than expected at 0.3% in the three months to February, and looks on course to deliver a growth rate of close to 0.5% q/q for the first quarter when it is released later in the week. The Bank of England voted unanimously to leave interest rates unchanged at 0.75% last week, but Governor Mark Carney warned markets that should growth match the BOE’s forecasts, “more, and more frequent interest-rate increases than the market expects”, would occur. This might seem positive for GBP, but with Brexit talks now resuming the pound could once again face negative Brexit headlines and concerns.

Source: Emirates NBD Research, Bloomberg

Source: Emirates NBD Research, Bloomberg