US equity markets gave up early gains in yesterday’s session after Bloomberg reported that US-China trade talks may be going less well than previously thought. China is reportedly pushing back on some intellectual property and data protection concessions that it had previously agreed to, as it hasn’t received assurances that US tariffs on their exports would be lifted. However, when asked at a press conference about how the trade talks were going, President Trump said they were going “very well”. The US trade delegation is scheduled to travel to Beijing next week for further talks, and Chinese VP Liu He is expected to visit the US some time after that. Separately, US factory orders grew by a lower than expected 0.1% in January, while durable goods orders in January were also weaker than the preliminary report had indicated. The main event today is the Fed’s rate decision and commentary on their outlook for the US economy and monetary policy.

The UK’s labour market isn’t yet showing signs of weakness, despite weaker GDP growth and increased uncertainty around Brexit. Employment rose by 22k in the three months to January, with most of the job growth in the services sector. The unemployment rate eased to 3.9%, the lowest since 1975. At the same time, annual wage growth remains solid at 3.4%. February inflation data is due to be released today, with the market expecting the headline rate to remain unchanged at 1.8%.

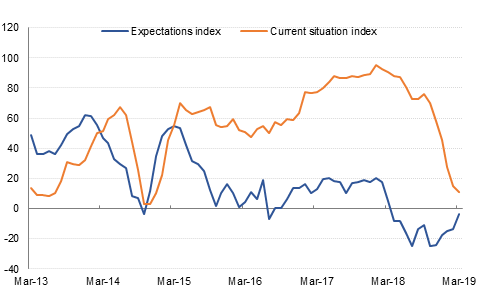

In the Eurozone, the German ZEW survey showed financial analysts were less pessimistic about the outlook than they had been in February, with the expectations index improving to -3.6 from -13.4 in February. However, the current conditions index fell to 11.0, signalling a less favourable assessment of the current situation. Both the current situation and expectations indices were below consensus forecasts.

Treasuries remained steady ahead of the Fed policy announcement later today. Though the Fed is widely expected to keep rates on hold, the focus will be on the dot plot projections for rate hikes in 2019 and also on comments from Fed Chair Powell at the press conference. Yields on the 2y UST, 5y UST and 10y UST closed at 2.46%, 2.42% and 2.61% respectively.

Regional bonds closed largely unchanged. The YTW on Bloomberg Barclays GCC Credit and High Yield index remained at 4.20% while credit spreads hovered around 168 bps.

The primary issuance pipeline continues to look healthy. RAK Bank is considering selling bonds to refinance existing debt.

The Dollar Index (DXY) is trading 0.10% firmer this morning at 96.48. In the build up to the FOMC monetary policy announcement and release of the revised economic forecasts and DOT plot, most of the major USD crosses remain near key technical levels. The EURUSD currently stands at 1.1346 (close to the 200-week moving average of 1.1338) while USDJPY is currently trading at 111.60 (just above the 200-day moving average of 111.45). For a clear direction to be given, the market awaits the outcome of the monetary policy meeting. While the central bank is expected to keep interest rates unchanged, policy makers have recently become more cautious about the pace of additional rate hikes. Should this be reflected in their economic outlook, the dollar is likely to find itself under pressure.

Developed market equities closed mixed following reports that US and Chinese negotiators remain at odds over certain aspects of trade talks. The S&P 500 index closed flat while the Euro Stoxx 50 index added +0.6%.

It was a mixed day of trading for regional equities. Abdullah Abdul Mohsin Al Khodari Sons gained +10% after shareholders voted against the dissolution of the company. Elsewhere, the EGX 30 index dropped -1.8% on the back of weakness in Commercial International Bank (-1.8%) and Global Telecom (-5.8%).

Oil markets saw little change overnight with few fundamental catalysts to push the market one way or the other. Brent is flat this morning at USD 67/b while WTI is trading slightly below USD 59/b. Data from the API showed a drop in US crude stocks of 2.1m bbl, larger than market expectations, with drops also in gasoline and distillates.

Palladium has broken above USD 1,600/oz, its highest on record. Market anxiety over Brexit and the US-China trade talks helped spur precious metals higher, barring silver.