Events at the end of last week took a turn for the worse, with Canada and the US failing to meet the weekend deadline to strike a trade deal following a US-Mexico agreement reached earlier in the week. This does not yet imply the end of negotiations, as the two sides can continue to negotiate for another 30 days. If they cannot agree to new terms, however, President Trump has said that he will scrap NAFTA and stick with the bilateral deal made with just Mexico. Trump also threatened to withdraw from the WTO and renewed his threats against the EU over autos. Overshadowing all of this is the stand-off between the US and China, with the US threatening to impose tariffs on another USD200bn of Chinese imports.

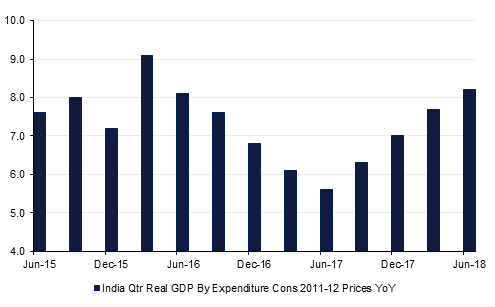

Indeed it seems quite possible that this could happen as early as Friday when the deadline for public comments on the issue lapses. Progress between the two economic superpowers may in fact not be seen until after the mid-term elections in November, with the chances of a deal before then low as Trump continues to ramp up trade war rhetoric to fire up his political base. US politics may well now become another significant theme for markets to follow as the mid-terms draw nearer, being only 63 days away. EM pressures are also continuing as one of the main themes, as the firmer dollar, rising US rates and global protectionism hurt sentiment. This culminated at the end of last week with Argentina raising interest rates to 60% after pleading with the IMF to accelerate the disbursement of its USD50bn bailout. Other EM currencies suffered fallout including India where the INR fell to a record low of 71 last week, despite strong GDP growth data of 8.2%.

The coming week will begin slowly with US labour day holidays today, but with meaningful economic data due out over the rest of the week, including non-farm payrolls on Friday. In terms of policy announcements the Bank of Canada is expected to hold rates steady on Wednesday in view of the uncertain trade backdrop, while the RBA is also expected to stay on hold this week.

Continuation of strong economic data out of the US kept the case for a rate hike in September well intact. Despite concerns on the trade front, treasury yield edged slightly higher last week. Yields on the 2y UST, 5y UST and 10y UST closed at 2.62% (+1 bp w-o-w), 2.73% (+2 bps w-o-w) and 2.86% (+5 bps w-o-w) respectively.

Regional bonds followed the broad move in USTs. The YTW on the Bloomberg Barclays GCC Credit and High Yield index rose +2 bps w-o-w to 4.43% and credit spreads widened 1 bp to 174 bps.

Following the Eid break, activity in primary market seems to be picking up. Aldar Properties, Abu Dhabi Islamic Bank and Al Hilal Bank are meeting investors for potential issuances.

GBP has slipped at the start of the week, unwinding last week’s gains, as UK PM May ruled out a second Brexit referendum in an article in a Sunday newspaper.

The dollar remained almost unchanged last week, the Dollar Index closing 0.04% lower at 95.11 on Friday. Of note is that despite declines earlier in the week, the index was able to pare the majority of these losses and close back above the 50-day moving average (95.02).

While the price remains above this level and the 76.4% one year Fibonacci retracement, a retest of the one-year high of 96.98 remains a possibility. A weekly close above this level could catalyse further gains towards the 76.4% five-year Fibonacci retracement of 97.94, a level last seen in June 2017.

The INR continued its sharp decline to close at record lows of 71.0. The USDINR has now dropped -10.0% ytd. Along with the overhang of broad emerging market pressure, high oil prices and widening trade and current deficit also appear to be weighing on the currency. While a strong Q1 FY 2019 GDP print of 8.2% could help alleviate some concern, the pair is likely to follow broad emerging market trend in the immediate future.

Regional equities started the week on a negative note with the ADX index and the Qatar Exchange losing -0.9% and -0.2% respectively. The ADX index was led lower by weakness in market heavyweights Etisalat (-1.0%) and First Abu Dhabi Bank (-1.5%).

Oil markets managed to eke out some gains over the week despite an uncertain outlook for trade talks between Canada and the US and further deterioration in some major emerging market assets. October Brent futures expired at the week up 2% at USD 77.42/b and 4.3% over the month. WTI added 1.6% over the five days to close slightly below USD 70/b. Benchmark prices are caught between the supportive factor of pending US sanctions on Iran and the negative risks that a trade war blow-out could pose to commodity demand.

Market surveys of OPEC production show total August output at 32.8m b/d, its highest level so far this year. Production has risen three months running since the end of May with large increases in August coming from Iraq and Libya while Saudi Arabia showed a marginal increase and other GCC producers stayed flat. Critically, Iranian production is already showing signs of decline, falling by 150k b/d last month. US sanctions on Iranian oil exports come into effect in November but importers of Iranian barrels will already be moving away from taking shipments.

Forward curves are beginning to price in more and more of that anticipated disruption to supply. The Brent curve has moved back into backwardation after a persistent contango formed on the front-end since the start of Q3. The deterioration in Iranian output in August will add more conviction to a tightening story over the remainder of the year and into 2019, making long calendar spreads attractive again. In WTI, the backwardation levelled off last week at a little below USD 0.5/b.

Click here to Download Full article