China yesterday confirmed commitment to not use exchange rates as a tool in escalating trade dispute, thereby somewhat easing fears that the trade wars were set to morph into currency wars. Nevertheless, the US has labelled China as a currency manipulator and announced plans to engage with IMF to eliminate the unfair competitive advantage created by CNY’s latest plunge. Trump also increased pressure on the Federal Reserve to act to counter the Chinese action. Futures implied probability of a 50bps rate cut at the Fed’s September meeting increased from 16% to 37% overnight.

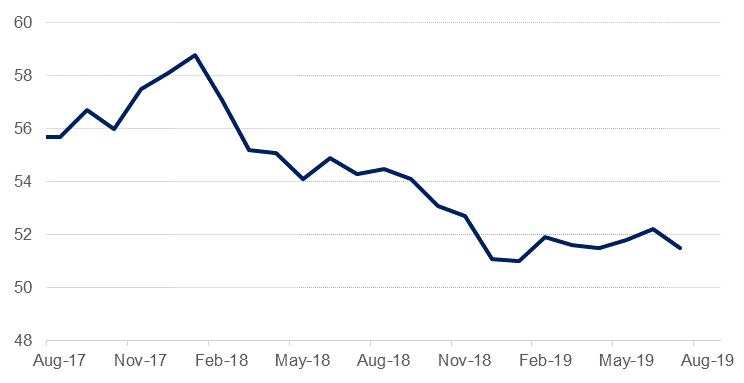

Key PMI data was released in several jurisdictions yesterday, clearly showing the impact of slowing global growth. Australia’s July Composite PMI fell to 52.1 from 52.8 in the earlier month, showing the impact of slowing Chinese growth on manufacturing even as services remained strong at 52.3 vs 51.9 in June. Nevertheless, RBA at its meeting this morning, is likely to keep the cash rate target unchanged at 1.00%. Ongoing rate cuts appear to have helped the composite PMI in India where the July index rebounded to 53.8 from 49.6 in June, its highest reading since Nov 2018, though still lower than 54.1 an year ago. The growth came from increase in new orders as well as employment gains. The RBI is expected to cut rates by another 25bps at its meeting later this week. The composite PMI Index in the Eurozone dropped to 51.5 in July with goods output falling for a sixth month and by the greatest extent since 2013. The services sector continued to sustain the expansion of the overall Eurozone economy, registering at 53.2 in July vs 53.3 in June. The PMI data also confirmed that Italy and Germany remain the weak spots with German composite PMI falling to 50.9 from 51.4 in June and indicating a level consistent with GDP contracting. In the US, the ISM non-manufacturing PMI fell to 53.7 vs expectations of 55.5 and last months reading of 55.1.

Turkish CPI inflation rose to 16.7% y/y in July, from 15.7% the previous month, as the expiration of tax cuts on white goods and autos took effect. The inflation print was broadly in line with expectations, and shouldn't change expectations for further rate cutting in Turkey over 2019 following the 425 bps cut seen in July. This is especially the case given last week's downgrade to the central bank's year-end price growth target, and continued support for lower rates from President Recep Tayyip Erdogan.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

US treasury yields fell further as the US-China trade conflict intensified and appeared set to morph into currency wars. Yields on 2yr, 5yr, 10yr and 30yrs USTs closed at 1.57% (-14bps, w/w), 1.52% (-14bps), 1.71% (-14bps) and 2.25% (-12bps) respectively. However, sovereign bonds in Europe were mixed with yield on 10 yr Gilts declining 4bps to 0.51% and those on 10yr Bunds declining 2bps to -0.52% while those on Italian bonds increased 2bps to 1.56%.

Increased volaitility in financial markets saw material increase in credit protection costs and widening of credit spreads. CDS spread on US IG rose 6bps to 63bps and that on Euro Main increased 4bps to 58bps.

Despite falling benchmark yields, average yield on Barclays Bloomberg GCC bond index increased 3bps to 3.41% as credit spreads widened by 13bps to 174bps.

The dollar had another day of weakening as President Trump increased pressure on the Fed to cut rates. The Dollar Index (DXY) closed at 97.52 vs 98.07 the day before.

Though JPY softened a touch against the dollar at 106.14, EUR rose 0.2% to trade at 1.1229. CNY, the most watched currency at present, rose 0.2% to 7.0866 per dollar, still well below the critical level of 7. GBP remained under pressure, closing slightly weaker at 1.2143.

Despite expectations of no rate cut by the RBA at its meeting today, AUD weakened to 0.6756 in response to the fear of material slowing of Chinese economic growth ahead.

Global equities fell across the board as investors had heavy profit taking bias in the face of escalating trade wars and weakening global PMIs. S&P 500 fell nearly 3% followed by FTSE 100 closing down by 2.47% and Euro Stoxx in the red by 1.93%. Asian equities are continuing to fall with Nikkei and Hang Seng down 2.03% and 1.47% respectively in early morning trades today.

GCC equities were not spared the pain. Dubai index fell 2.3% and Abu Dhabi was down by 1.87% with losses felt mainly in property shares. Tadawul All Share Index fell for the fourth day, closing 1% down led by circa 3% fall in Saudi Basic Industries Corp’s shares.

Oil markets sagged overnight as the US-China trade war escalated. The depreciation of the RMB past the 7 handle shook financial markets generally and Brent prices fell by more than 3.3% to close below USD 60/b for the first time since mid-June. WTI gave up 1.7% to end trading at USD 54.69/b. Geopolitical tension in the Strait of Hormuz region is having a minimal impact on oil prices even as Iranian forces seized another tanker and the UK has joined a US mission to keep the Strait clear.

Gold continues to be propelled higher by the trade war uncertainty hammering risk-markets and gained 1.6% overnight. Gold futures priced in INR, the biggest consumer market, has hit a record high level of INR 36,250/10 g while demand is starting to look shakier in the nation. Imports in July fell 55% y/y in July in volume terms as higher prices and the impact of a higher import tariff have an impact.

Major industrial metals sold off in sympathy with oil. LME aluminium fell by 0.4% while copper was down almost 0.8% as doubts about the health of China’s economy in the face of significant trade pressure creep into markets. Iron ore has moved back closer to USD 100/tonne on fears of a sharper slowdown in China’s manufacturing sector.