The University of Michigan consumer confidence index in the US, increased to 99.9 in January reflecting boost to consumer sentiment from lower taxes. Also housing starts bounced back in January, rising 9.7% m/m after a sharp fall in December, taking the housing starts to 1.326m annualised, their highest level in 16 months. Solid confidence level augur well for spending to grow at a good rate over 2018 as a whole even if consumption growth slows in some months as alluded by the fall in January retail sales. While solid economic data in one month will not set off alarm bells at the Fed, the recent uptick in the core inflation should keep Fed officials steadfast in their rate hiking campaign. Beginning with a 25bps hike in March, we anticipate three hikes in 2018 with risk to the upside if benefits of tax cuts and spending plans eventuate faster than expected.

This morning, data released in Japan reported exports increasing by 12% and imports increasing by 8% in January, validating the continued expansion of the Japanese economy. The increase in imports resulted in the first monthly trade deficit since May 2017. Exports to China increased by 20% in a sign that Chinese economy may also be on strong footing.

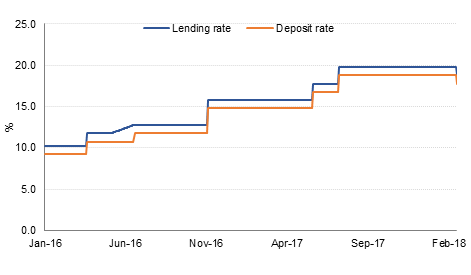

As was widely expected, the Central Bank of Egypt cut its key policy rates on Thursday, reducing its overnight lending rate and its overnight deposit rate by 100bps. This takes the benchmark rates to 18.75% and 17.75% respectively. The move marks the beginning of what we expect will be a modest easing over the coming year – we envisage a cumulative 400bps of cuts over 2018 following a period of very tight monetary policy previously.

Holiday in the US and China today make for a quiet start to the week which otherwise is filled with important data releases. The Fed will release minutes of its January meeting on Wednesday, though key questions relating to the Fed’s view on recent financial market volatility and the impact of proposed budget and spending plans on the US GDP and inflation will probably remain unanswered. New Fed Chair, Jerome Powell will present his first semi-annual testimony to the senate on 28th Feb. Also expected during the week are UK 4Q GDP, EU CPI data, EU PMI data, German IFO etc.

Stronger than expected housing start and consumer confidence data out of the US continued to depress US government bonds last week while strengthening the case for a rate hike in March. UST yields remained elevated with 2yr, 5yr, 10yr and 30yr closing the week at 2.19% (+11bps), 2.63% (+7bps), 2.87% (+1bps) and 3.13% (-1bp) respectively. That said, Friday saw some softening of the trend with 10yr yields declining 3bps to 2.87% after rising earlier in the week.

Stability in oil prices supported credit spread tightening with average OAS on Barclays GCC bond index closing the week one bp tighter to 154bps though yield rose 3bps to 4.13%. Barring Kuwait which is suffering from expectation of new debt, CDS levels on GCC sovereign generally had a tightening bias with KSA and Qatar 5yr CDS closing at 82bps and 87bps respectively.

Primary market saw, Bahrain based, AlBaraka Turk, raising $205 million of Tier 1 security with a call date in February 2023 at 10% yield.

The dollar declined last week, reversing the gains of the previous fortnight. Over the last week, the Dollar Index fell by 1.51% to 89.08, having hit a new 2018 low of 88.25 on Friday. Of note is that this move takes the dollar back below the supporting baseline that had held since September 2016 and leaves the index vulnerable to further declines. In the short term, there may be some reprieve as there was a decent reversal on Friday and the 14-day Relative Strength Index (currently at 39.13) looks bullish, however while the index remains below 90, the chance for further declines towards 85 cannot be ruled out.

EURUSD rose 1.27% last week to reach 1.2407 and reverse most of the previous week’s decline. Earlier on Friday, the price had even reached a new 2018 high of 1.2555, a level last seen in December 2014. Despite the EURO remaining in a daily uptrend, the test of 1.2555 was repelled by extreme selling pressure, retreating back towards 1.24.

Regional equities started the week on a mixed note. The DFM index lost -1.2% while the Qatar Exchange gained +0.6%. Volumes remained weak with the DFM trading AED 256mn compared with the 50-day average of AED 424mn.

Emaar Properties dropped -2.6% to close at its lowest level since November 2016. Shuaa Capital continued its downward slide with losses of -7.2%. Qatar National Bank plans to reduce its stake in QNB Alahly to 95% from 97.125% to comply with the rules of listing on the stock exchange. Al Rajhi Bank continued its positive run after the bank proposed a dividend of SAR 2.5 per share for H2 2017, higher than SAR 1.5 per share paid in H2 2016 and H1 2017.

Oil prices snapped their losing streak last week, gaining for the first time in February. WTI futures closed up 4.2% at USD 61.68/b while Brent added 3.3% over five days to settle at USD 64.84/b. A general recovery in risk assets over the week, and a weaker dollar, helped support oil prices along with commodity markets in general. Forward curves have begun noticeably flattening in February with the backwardation in Brent 1-2 month hovering around USD 0.3/b all month while in WTI the spread is only a little above USD 0.1/b.

Investors continued to unwind their positions in oil futures; net length in WTI and Brent fell by more than 62k contracts last week and there was a small build in short WTI positions. Long-short ratios still remain at high levels, suggesting there could be more selling if investors lose confidence that last week’s recovery is sustainable. In the US, oil and gas explorers continued to add drilling rigs, sending the total oil-focused count up by 7 last week and up more than 200k year on year.