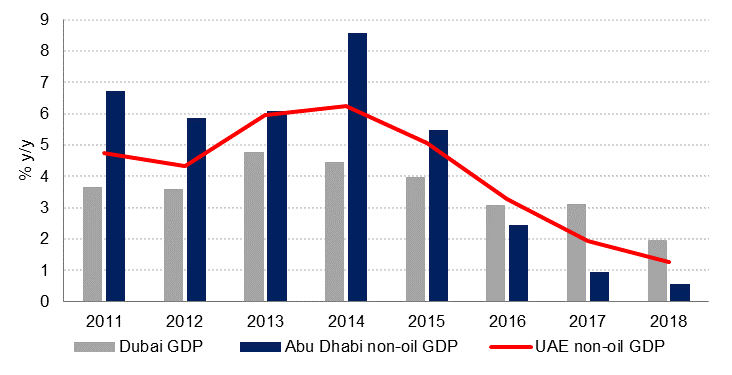

Official estimates show the UAE’s non-oil GDP growth slowed to just 1.3% last year, the weakest growth since at least 2011 (official GDP by industry data only goes back to 2010). This was somewhat surprising for us in the context of higher oil prices – which usually lead to more government spending - and sustained investment in infrastructure in preparation for Expo 2020.

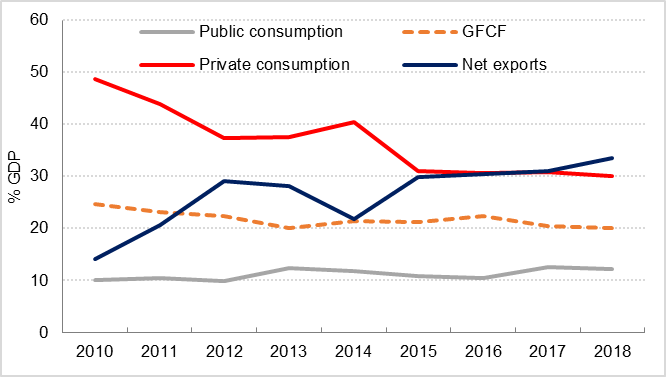

Our analysis suggests that the weakness in private consumption has been the primary drag on non-oil sector growth in the UAE over the last few years, and recent trends in employment and wage growth suggest that this is likely to remain the case in 2019.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

Chart 2 shows that private consumption used to account for nearly half of the UAE’s real GDP in 2010, but that this had declined to just 30.1% in 2018. Public consumption has increased slightly over this period, from 10% of total GDP in 2010 to 12.2% in 2018, but that has been insufficient to offset the impact of softer household spending.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

Another indicator confirming weaker consumption growth in the UAE is the slower growth of the wholesale & retail trade sector, which accounts for around 17% of the UAE’s non-oil economy. Growth in this sector averaged just 0.3% p.a. in 2017-2018, compared with nearly 5% growth p.a. in 2010-2015.

There are likely several factors that have contributed to the slowdown in household consumption over the last few years, including slower private sector job growth, lack of private sector wage growth and the rise in consumption and other taxes as part of broader budget reform in 2016-2018.

Source: Haver Analytics, IHS Markit, Emirates NBD Research

Source: Haver Analytics, IHS Markit, Emirates NBD Research

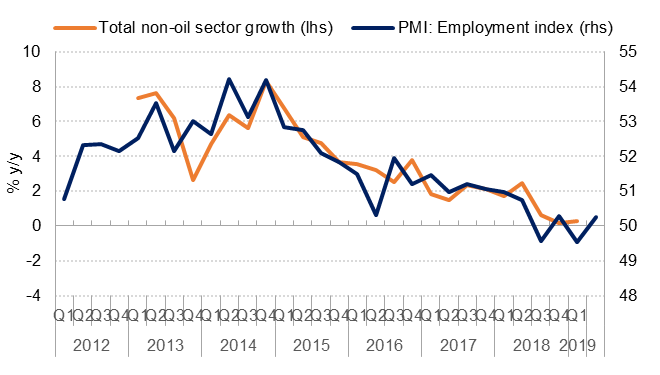

The correlation between the employment component of the PMI (measuring the change in private sector employment) and the growth of the UAE’s non-oil sectors is high (Chart 3 above). Official employment data published by the central bank confirms the trend of weak private sector job growth this year, as well as declining salaries across all job categories. Neither the employment component of the PMI survey, nor the official private sector jobs and salary data published by the UAE central bank point to a recovery in private consumption this year.

While stagnant wages and fewer job opportunities have likely been a key factor in determining household spending, higher taxes have probably not helped. Excise taxes were introduced in October 2017 while 5% VAT was introduced in 2018. Abu Dhabi introduced road tolls in 2019 and raised housing fees on expatriates in 2018

Higher oil prices fed through to higher petrol prices in 2018, further contributing to the cost of living. However, declining fuel prices have contributed to deflation in the UAE this year, providing some relief for consumers.

Although rents and housing costs have declined significantly over the last 3 years, in practice this has not always resulted in lower housing costs for households. Many tenants have chosen to upsize rather than reduce costs, and for others the cost of moving has offset gains from moving to a lower priced property.

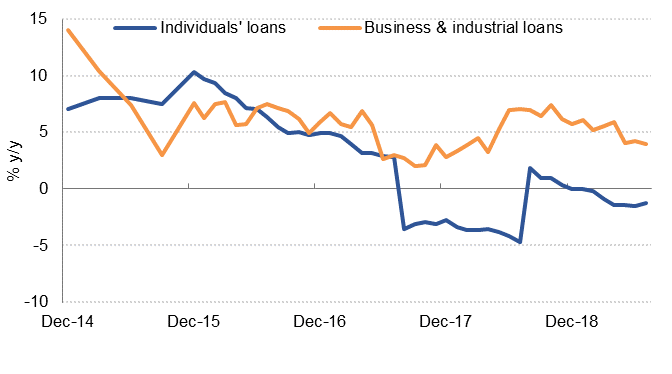

The US Federal Reserve has hiked interest rates 225bp since end-2015 (notwithstanding the recent rate cuts in July and September 2019), at a time when the UAE economy was already slowing. Higher borrowing costs would have weighed on both household consumption as well as business investment, contributing to more challenging macro-environment in recent years. Indeed, central bank data show a clear trend of consumer deleveraging since 2017.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

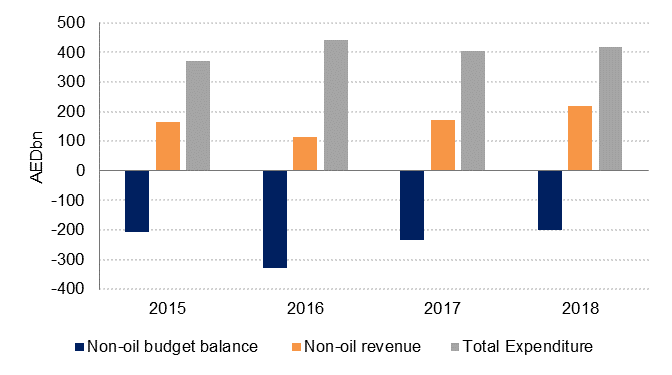

Ministry of Finance data shows that total government spending increased 3.5% y/y in 2018[1]. Total revenues rose 18.8% y/y. Non-oil revenues (which are more relevant in this analysis as they are raised through domestic taxes and fees), rose 26.8% in 2018. The non-oil budget deficit (non-oil revenue less total expenditure) has declined by nearly -40% since 2016, showing that the higher tax revenue raised in 2017 and 2018 has not been fully offset by increased spending. Effectively, this means reflects a tightening in the fiscal stance over the last 2 years, likely contributing to slower non-oil sector growth. When we look at the overall budget position, including oil revenues, the budget posted a surplus of nearly AED 60bn last year, compared with a deficit of -AED 89.1bn in 2015.

Source: UAE Ministry of Finance, Emirates NBD Research

Source: UAE Ministry of Finance, Emirates NBD Research

Data for H1 2019 shows that total revenue increased 10.3% y/y with non-oil revenue up 19% y/y. Total expenditure rose 9.7% y/y. Encouragingly, the non-oil budget deficit in H1 2019 was very slightly (-AED1.2bn) wider than in H1 2018, although the overall budget balance (including oil income) rose 16% y/y in H1 2019, suggesting that there is room for the government to further boost spending this year.

Official estimates show non-oil sector GDP growth of just 0.3% y/y in Q1 2019, only fractionally higher than in Q4 2018. The softness in non-oil sector growth appears to be concentrated in Abu Dhabi, with Q1 GDP data showing a contraction of -0.9% y/y in the non-oil sector, the third consecutive quarter of negative annual growth in the emirate. In fact, Abu Dhabi’s non-oil sector has expanded at a slower rate than Dubai’s since 2016.

While Dubai’s growth has also slowed over the last couple of years, it has been underpinned by infrastructure spending ahead of Expo 2020. Dubai’s 2018 budget made provision for a 20% rise in total spending and a 46% rise in infrastructure spending (budgeted figures, not actual spending). The emirate is planning to keep total spending broadly the same this year.

Overall, the data suggests that fiscal policy in the UAE has not been particularly supportive of economic growth over the last two years, although Dubai’s budgetary stance has likely been more expansionary than Abu Dhabi’s. Abu Dhabi announced an extra AED 50bn in spending over 2019-2021 in May last year, and it is possible that this will support faster growth in the emirates going forward, if the spending plans are effectively executed.

The main reason for the slowdown in non-oil sector growth in the UAE in recent years has been weaker consumption, particularly on the part of households and the private sector. Fewer employment opportunities, stagnant wages and higher taxes and borrowing costs have all contributed to lower private consumption.

However, tighter fiscal policy has also contributed to the slowdown in economic growth. The UAE’s budget position is among the strongest in the region, but the Ministry of Finance’s own data shows the budget recorded an overall budget surplus in 2018, even as non-oil sector growth weakened, and additional stimulus might have been warranted.

[1] For simplicity, we have included government capital spending in our analysis, not just consumption spend, as investment spending accounts for only around 10% of total expenditure.