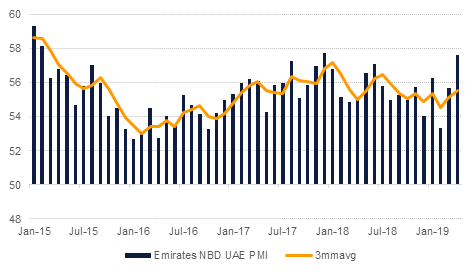

The UAE’s central bank has cut its 2019 GDP growth forecast to 2% from a 3.5% projection as recently as March. The central bank expects non-oil GDP growth to accelerate to 1.8% from 1.3% in 2018 and for the oil sector to see roughly level growth at around 2.7%. Oil production in the UAE has so far averaged around 7% higher year/year despite the UAE adhering to OPEC+ cuts. Even though there will be a high base effect in H2 2019 we still expect that oil production will contribute positively to growth this year. The Emirates NBD Purchasing Managers’ Index does suggest that non-oil growth has accelerated so far in 2019 although it remains beset by weak job growth and wage figures. The reasonably soft labour market conditions will be weighing on consumption, worsening a trend of private consumption declining as a share of total GDP. In an effort to spur growth, the government will waive fees for more than 1,500 services although a full list of which fees will be cancelled has yet to be published.

Economic confidence in the Eurozone improved in May after 10 consecutive monthly declines. Consumer confidence rose to -6.5 from a revised lower 7.3 while industry and services sectors also saw improvements. While sentiment on aggregate across the bloc improved, consumer confidence in Germany actually slowed heading into June as the GfK indicators moved to 10.1 from 10.2 a month earlier. Lower growth forecasts for the Eurozone bloc and only a temporary halt to trade tension between the EU and US may ebb away at consumer sentiment over the next few months. Elsewhere, consumer confidence in the US improved in May, rising nearly 5pts to 134.1. Positive conditions in the labour market appear to be supporting consumer sentiment even as economic data has recently taken a soft turn. Short-term expectations for consumers also improved. At a consumer level, the high level dispute between China and the US does not look to be creating concern over the direction of the economy.

Turkey’s economic confidence index fell 8.5% m/m to 77.5 in May, from 84.7 in April. The decline was across the board, with falls in consumer, real sector, services, retail trade and construction confidence. The deterioration is reflective of the challenging business conditions in Turkey, with high interest rates, a weakening currency, and substantial political risk all weighing on sentiment.

Source: Haver, Emirates NBD Research

Source: Haver, Emirates NBD Research

Treasuries continued their positive run as investors remain cautious in light of concerns over global growth. Yields on the 2y UST, 5y UST and 10y UST closed at 2.12% (-4 bps), 2.06% (-6 bps) and 2.26% (-6 bps) respectively.

Regional bonds saw a bit of an uplift. The YTW on Bloomberg Barclays GCC Credit and High Yield index dropped 2 bps to 3.93% while credit spreads rose 3 bps to 174 bps.

This morning the dollar is mostly unchanged against the major currencies, the Dollar Index trading 0.03% lower at 97.921. Analysis of the daily candle chart shows that the daily uptrend that has been in effect since 10th January 2019 remains intact and while the price remains above the 50-day moving average (97.430), further gains seem likely in the short term.

Developed market equities closed lower as investors remained cautious. The S&P 500 index and the Euro Stoxx 600 index lost -0.8% and -0.2%.

Regional equities closed higher. The focus remained on Saudi equities with the Tadawul jumping +2.0% on significantly higher volumes before stocks became part of the MSCI EM index. It was worth noting that low liquidity MSCI names saw the biggest gains. On the DFM, Emaar-related names continue to do well with Emaar Properties jumping +4.2%.

Oil markets were little changed overnight but have started to sell-off in early trading this morning. With few market catalysts to move off of, oil is responding to persistent anxiety over the trade conflict between the US and China and what it will mean for growth and demand this year. Brent futures lingered around USD 70/b for much of yesterday and have moved below that handle this morning while WTI is solidly back below USD 60/b at USD 58.51/b today.