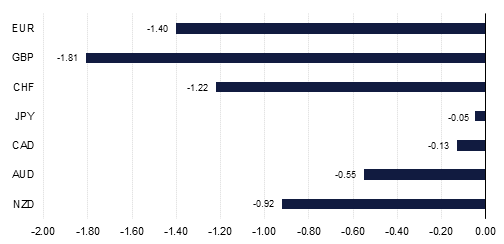

The dollar continued to strengthen against most major currencies last week, even though its rally stalled a little following the U.S. April employment report released on Friday. Non-farm payrolls were softer than expected at 164k, although March’s figures were revised up (to 135k from 103k) leaving the overall increase over the two months in line with expectations. The unemployment rate fell to 3.9% from 4.1%, but wage growth disappointed once again rising by just 0.1% m/m and 2.6% y/y. Accordingly the markets had little incentive to assume the Fed will tighten more aggressively this year than the two further hikes implied by its dots.

The coming week will provide another test of these assumption, with US price data for April likely to show that inflation pressures are building with both overall and core CPI and PPI measures continuing to exceed the 2% y/y pace. Following the FOMC meeting last week the markets are working on the assumption that a June rate hike is likely and commentary from Fed officials will now be watched closely to see if such an expectation is endorsed. Other influences on the dollar may include developments regarding trade policy. A senior US trade delegation met their Chinese counterparts at the end of last week but little progress was seen on outstanding differences between the two countries. NAFTA negotiations with Canada and Mexico are also ongoing and may provide fresh direction.

Source: Emirates NBD Research, Bloomberg

Source: Emirates NBD Research, Bloomberg

The dollar index rose for a third week, gaining 1.12% last week to reach 92.566 in a move with many key technical developments. The move has taken the index back above the 200 day moving average for the first time since May 2017. In addition, the former weekly downtrend that had been in effect since January 2017 appears to have been breached now with a second weekly close above the former capping resistive trend line. Indeed the index went as far as testing the 50 week moving average (92.730) and the 38.2% one year Fibonacci retracement (92.698) before advances were halted. In the week ahead, a daily close above these levels may trigger further gains towards 94.00.