Brexit will continue to dominate the headlines this week, as a third vote is scheduled on Tuesday to approve the deal PM May has negotiated with the EU. The second vote failed spectacularly last week, after which parliament voted to delay leaving the EU for an unspecified period of time. The PM believes that the prospect of an extended delay to Brexit will encourage many conservatives who have opposed the deal up to now to vote in favour this week. Following this vote, Theresa May is expected to join other European leaders at an EU summit on Thursday, where she would need to explain why the UK is asking for a delay in leaving the EU, and how long an extension is requested. All 27 EU states would have to agree to delay Brexit beyond 29 March. Uncertainty remains high, and although the risk of a no-deal Brexit on 29 March has receded somewhat, the pound is likely to remain volatile. In addition to the Brexit drama this week, the Bank of England meets on Thursday to discuss monetary policy; the policy rate is expected to be kept unchanged.

The Bank of Japan left monetary policy unchanged on Friday, as expected, but highlighted recent softness in exports and production. Governor Kuroda is still targeting 2% inflation, although the current inflation rate is just 0.8%. However, few analysts expect any easing in monetary policy in the near-term.

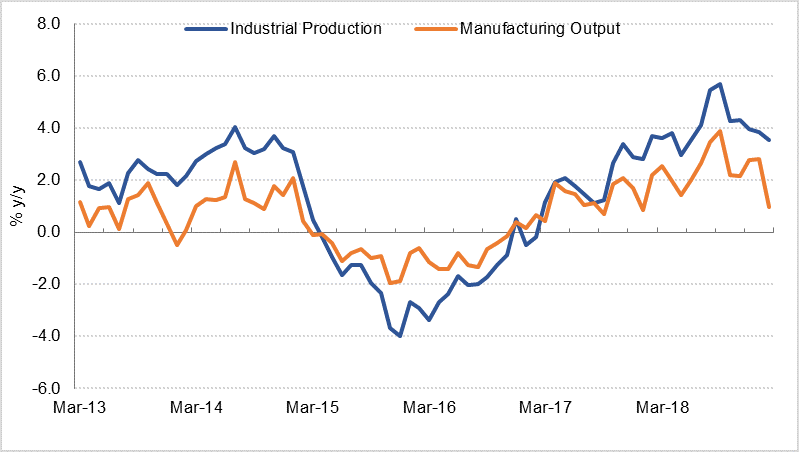

Manufacturing and industrial production data in the US, released on Friday, was disappointing. IP rose just 0.1% m/m in February (below consensus forecasts of 0.4%), while manufacturing declined -0.4% m/m. The Empire Manufacturing index declined to 3.7 in March from 8.8 in February, also well below forecasts. However, consumer sentiment as measured by the University of Michigan Sentiment Index rebounded in March to 97.8. The main event in the US this week is the FOMC meeting, which concludes on Wednesday, and where the Fed could revise the “dot” plot to reflect more gradual rate hikes, and possibly signal when it might end balance sheet unwinding.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Fixed Income

Treasuries closed higher following weaker than expected economic data from the US along with soft inflation data. Yields on the 2y UST, 5y UST and 10y UST closed at 2.43% (-3bps w-o-w), 2.39% (-4bps w-o-w) and 2.58% (-4 bps w-o-w) respectively. The decline in yields last week has taken them closer to the lows of the year seen in first week of January.

The focus this week will be on the Federal Reserve meeting where the central bank is expected to keep rates on hold. Investors will also keep an eye on the change in dot plot projections for the number of rate hikes in 2019.

Regional bonds benefitted from moves in benchmark yields. The YTW on Bloomberg Barclays GCC Credit and High Yield index dropped 10 bps to 4.22% and credit spreads tightened 7 bps to 173 bps.

In terms of ratings, Fitch affirmed the ratings of Ahli Bank, Al Khalij Commercial Bank and Qatar International Islamic Bank at A with stable outlooks.

FX

A rise of 0.81% took EURUSD to 1.1326 last week. The price had risen as high as 1.1344, before encountering resistance at this level (near the 200-week moving average of 1.1338). This weekly close below the 200-week moving average leaves the price technically vulnerable to further declines in the short term and as a result a decline towards the one year low of 1.1177 cannot be ruled out. However, in the week ahead, we favour the fundamentals which point towards a stronger euro.

Last week’s 0.28% gain took USDJPY to 111.48 and back above the 100-day and 200-day moving averages (111.31 and 111.44 respectively). This move is technically significant as the 200-day moving average is currently providing support to the price. While the price continues to realize daily closes above this level, a retest of the 76.4% one-year Fibonacci retracement is likely in the medium term.

GBPUSD rose 2.12% last week, closing at 1.3290, the highest weekly close since July 2018. Over the week, the price had risen as high as 1.3381 before profit taking on overbought conditions pared some of these gains. Of technical significance is that the formerly resistive 50-week (1.3118) and 100-week (1.3217) moving averages were broken and closed above. This is technically bullish for the price in the short term.

Equities

It was a mixed day of trading for regional equities. The DFM index added +0.1% while the Qatar Exchange lost -1.1%. The DFM index was supported by market heavyweights with Emaar Properties adding +0.4% and Dubai Islamic Bank gaining +0.9%. DP World (+0.8%) continued its positive run following better than expected corporate earnings.

Dana Gas rallied +2.7% after the company proposed to buy back 10% of its total share capital. The company added that it will seek shareholder’s approval in April to buy back about 690 million shares.

Commodities

Oil futures extended their year-to-date gains last week as fundamentals gave bullish signals to the market. Brent futures closed up 2.2% at USD 67.16/b and are now up 22.3% ytd while WTI gained 4.4% to end the week at USD 58.52/b, up almost 29% ytd.

OPEC held a meeting over the weekend in Azerbaijan and affirmed that production cuts will remain in place until at least June this year with indications they may be extending into H2. Messaging from oil ministers from major OPEC members has indicated as much: however, as the IEA noted in their latest assessment of near-term crude balances, the rapid decline in Venezuela’s production gives countries like Saudi Arabia or the UAE room to increase output but not breach the aggregate production cut target.