The first US rate cut in a decade

In a much anticipated move, the US Federal Reserve cut the target interest rate by 25bps to be between the 2.00% - 2.25% range, citing potential negative implications of global developments for the US economic outlook as well as muted inflation pressure in the country as the reasons to lower rates. The IOER (interest on excess reserve) rate was also reduced by 25bps to 2.10%.

The Fed also opted to end its balance sheet runoff effective beginning of August, rather than the end of September this year as originally planned. Until now the Fed was normalizing the balance sheet at the rate of USD15bn/month with the intention of keeping the size of the balance sheet constant from September. We think this move will have only a marginal impact on markets.

Will the Fed cut rates again in September?

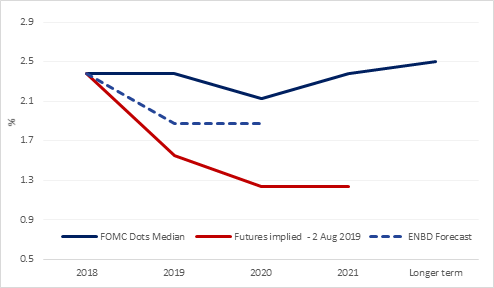

The Fed is citing this cut as an insurance against recession and a mid-cycle adjustment to ensure continued expansion, however, pricing action in the markets reflect that investors don’t really believe that the insurance cut will work, particularly given the lack of progress in the US-China trade negotiations. While the Fed’s dot plot remained unchanged, Fed fund futures implied probability of rate cut in September now stands at over 90% for 25bps and 10% for a 50bp cut.

Federal Reserve officials seem to be looking at history for prior examples of “mid-cycle adjustments” tacitly signaling their view that the current environment may be similar to the 1995 and 1998 episodes, when the Fed cut rates 75bps each time. However, we think the current situation, whereby global economic growth is under threat from trade wars and negative rates are prevailing in most of the developed world, the current cycle is unlikely to behave like the ones that occurred two decades ago.

Though economic growth in the US remains in very healthy territory, residential investment – the most interest rate sensitive component of GDP – has been falling for few quarters now. This coupled with weaker trend in manufacturing and slowing job growth indicates increasing possibility of GDP growth slowing substantially and therefore the chances of the Fed’s so called mid-cycle adjustment morphing into a full-blown cutting cycle are reasonably high.

Source: Emirates NBD Research

Source: Emirates NBD Research

Click here to Download Full article