Continued bid for safe haven assets amid increasing trade tensions fuelled demand for US treasuries, thereby causing yield on longer dated USTs to fall last month while the shorter dated yields increased in response to the Federal Reserve raising its target rate by 25bps to the 1.75% to 2.00% range last month. Yields on 2yr, 5yr, 10yr and 30yr treasuries closed the month of June at 2.53% (+6bps m/m), 2.74% (-1bp m/m), 2.86% (-4bps m/m) and 2.99% (-6bps m/m) respectively. Falling benchmark yields provided a constructive platform for USD denominated bonds and sukuk portfolios, however widening credit spreads were a head wind.

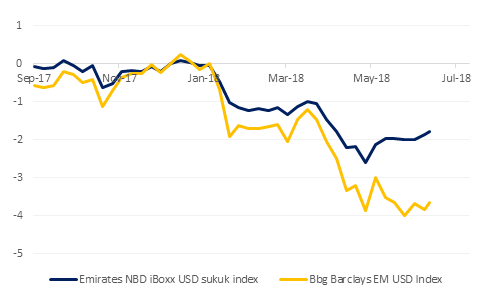

Against this backdrop, year-to-date return on global sukuk portfolio was better than that on conventional bonds while volatility was relatively lower. Even though global sukuk have not remained unscathed amid general sell off in EM securities in the recent weeks, they have noticeably outperformed their conventional bond counterparts. Total return on Emirates NBD Markit iBoxx sukuk index was a small gain of +0.1% last month compared with a loss of -0.34% on EM bond index.

Click here to Download Full article