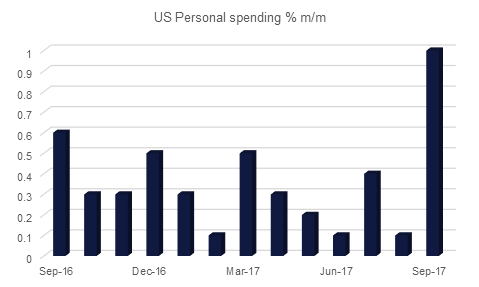

September saw strong personal income and consumption data in the United States, corobarating the message from the Q3 GDP report that showed a positive contribution to growth coming from consumption. Personal spending surged by 1.0% during the last month of the quarter, while personal incomes rose by 0.4% up from 0.2% previously. However, with the price deflator also rising by 0.4%, real incomes were flat causing the savings rate to decline to 3.1% from 3.6%. Some of the improvement in spending was probably caused by the hurricanes during the month, but the underlying picture augurs for a strong start to Q4.

Other data released yesterday showed that economic sentiment in the Eurozone rose to its highest level since 2001, demonstrating that political turmoil in Spain was barely registering in terms of expectations for the economy. In fact data released in Spain yesterday showed that GDP there grew by a strong 0.8% q/q in Q3, with Spain’s own Economic Sentiment index reaching a 22-month high despite the backdrop of uncertainty in Catalonia. The news this morning that the leader of Catalonia has fled from Spain to Belgium will add to the sense that the crisis there is coming to an end, at least for the time being, which should help to reverse some of the negative sentiment in Eurozone financial markets.

The BOJ left its main monetary policy tools unchanged this morning following its two-day meeting, with the policy balance rate kept at -0.1% and its 10-year JGB yield target also left at about 0.0%, with its asset purchases also maintained. However, with the BOJ lowering its inflation forecasts for this year and next, the Bank effectively acknowledged that monetary policy will probably remain expansionary for some time longer than in the case of other major central banks, which are currently either in the process of normalizing interest reates or mulling how and when they will do it. Such divergence in monetary policy is expected to weigh on the JPY exchange rate over time.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

US Treasuries received a boost from reports that the cuts to the US corporate tax would be phased over several years. The long-end of the curve was also supported by comments from Treasury Secretary Steven Mnuchin that he does not see much demand for ultra-long issuance. Yields on the 2y USTs dropped 1 bps to 1.57%, on 5y USTs by 3 bps to 1.99% and on 10y USTs by 4 bps to 2.36%.

Regional bonds followed the lead set by benchmark yields. The YTW on the Bloomberg Barclays GCC Credit and High Yield index dropped 3 bps to 3.58% while credit spreads widened by 2 bps to 154 bps.

The USD is mostly lower after yesterday’s political news in Washington which has created uncertainty about where the investigation into President Trump’s ties with Russia will go next. The EUR is also benefiting mildly from events in Spain with the leader of the Catalonia Independence Party Carles Puigdemont having fled to Belgium in fear of arrest. As we go to print, the Dollar Index trades at 94.573, remaining above the 23.6% one year Fibonacci retracement for a fourth consecutive trading day. While the index remains above this level, further gains can be expected, a risk enhanced by the greenbacks tendancy to appreciate in Q4.

Of note is the USDJPY which despite falling for a second consecutive day, remains in an daily uptrend. USDJPY fell in line with 10 year treasury yields which went below 2.40% on concerns that President Trump’s tax cuts will only be introduced gradually. While it continues to trade above the 112 key level, our bias for USDJPY remains bullish.

Developed market equities closed mixed amid speculation that the proposed cuts to corporate taxes would occur in phases over several years. The S&P 500 index dropped -0.3% while the Euro Stoxx 600 index added +0.1%.

The Qatar Exchange (+0.8%) was a notable outperformer in what was a weak day of trading for regional equities. The DFM index and the Tadawul dropped -0.3% and -0.2% respectively.

Sabic gained +0.4% after the company reported a strong set of earnings for Q3 2017. Dar Al Arkan gained +2.7% to close above the SAR 8.00 level for the first time in two years. However, there is no news driving the move.

Oil prices extended their gains at the start of the week, sending Brent futures within a hair of USD 61/b and pushing WTI up over USD 54/b. Positive expectations about OPEC extending its cuts, and complying with them, are keeping the crude markets buoyant despite news that Iraq has raised exports from its southern fields to replace the shortfall in barrels from the north.

The UAE’s energy minister, Suhail al Mazroui, said the country would keep cutting oil production to adhere to its targeted production as part of the OPEC production cut agreement. The UAE has so far overshot its production, achieving average compliance of 52% in January to September, according to the IEA.

Click here to Download Full article