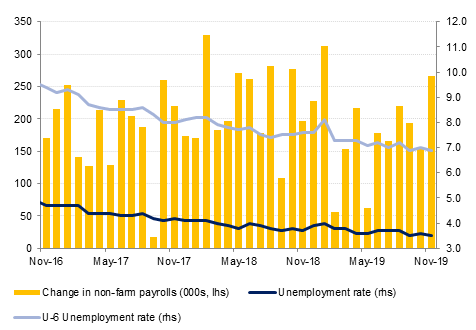

Strong payroll figures for November capped off a mixed week which started with renewed gloom over trade. A week before the next US tariffs are set to be introduced on China, we are still none the wiser about whether they will in fact go ahead, or whether a ‘phase 1’ trade deal will be reached just in time. The jobs data offered some respite from the uncertainty however, with payrolls rising by 266,000 last month and bringing the unemployment rate down to 3.5% from 3.6% previously. Wages were also underpinned at 3.1%. The data goes someway to countering the need for a further cut in US interest rates, although with the outlook over trade still unclear another move cannot be taken completely off the table just yet. The importance of a trade deal for China was shown by data that showed total exports in November dropped 1.1% from a year ago, with shipments to the U.S. plunging 23%.

The UK will be a focal point in the coming week with the December 12 election. According to the latest opinion polls Boris Johnson seems set to win the election with a solid majority, but there is still the chance that the polls could narrow causing a hung parliament. The pound rallied strongly last week, up around 1.66% against the USD, on the presumption that Johnson will get his majority, which would offer greater certainty over Brexit as well as fostering a more business friendly environment. However, even if the Withdrawal Agreement passes before the January 31st deadline, uncertainty over the future trading relationship with the EU will remain.

Other events this week revolve around the FOMC and ECB meetings. No changes are expected from either meeting, but the press conference by President Lagarde will be of interest as it is her first meeting in charge, as will the comments be of Fed Chair Powell. Whatever they say, however, the chances are that it will be eclipsed by the news around trade as the 15th December deadline draws near.

Source: Emirates NBD Research, Bloomberg

Source: Emirates NBD Research, Bloomberg

It was a week of two halves for treasuries. While news of delay in Phase 1 trade deal between US and China drove yields lower, a blowout non-farm payrolls data helped yields recover all of its early-week losses. Yields on the 2y UST and 10y UST ended the week at 1.61% (flat w-o-w) and 1.83% (+6 bps w-o-w).

Following the jobs data, expectations of an interest rate cut moved deep into 2020. A full 25 bps rate cut is now only priced in December 2020.

Regional bonds tracked moves in benchmark yields but remained in a very tight range. The YTW on Bloomberg Barclays GCC Credit and High Yield index dropped -1 bp w-o-w to 3.24% while credit spreads tightened 5 bps w-o-w to 147 bps.

Last week’s gains of 0.38% resulted in EURUSD closing the week at 1.1060, the first gain in three weeks. Despite breaking above the 100-day moving average (1.1067) earlier in the week, the cross was unable to hold onto these gains closed below this key level as a result of Friday’s firm NFP headlines. Over the next week, a break and daily close below 1.1050, not far from the 50-day moving average of 1.1052, is likely to trigger further losses towards the 1.10 level.

GBPUSD climbed for a second consecutive week, with a 1.66% gain taking the price to 1.3140, the highest weekly close since May. Over the course of the week, the price was able to sustain its break above the 76.4% one-year Fibonacci retracement (1.3045) which is technically bullish for the price. Analysis of the 14-day Relative Strength Index (RSI) shows that at 70.66, GBPUSD is currently in overbought territory and as such, the price may see limited short term declines as investors lock in profits on long positions. However, despite this, further gains are likely in the medium term and a retest of the 1.33 level cannot be ruled out before the end of the year.

A decline of 0.84% last week cancelled out the previous week’s gains and resulted in USDJPY falling back to 108.57. At its present levels, USDJPY sits just above the 50-day moving average (108.54) and remains resisted by the 200-day moving average (108.87). A break below the 50-day moving average is likely to be followed in quick succession by a tumble towards the 38.2% one-year Fibonacci retracement (107.99). Should this level fail to hold, then further declines towards the 107 level are possible.

The Tadawul was a notable outperformer in what was otherwise a sluggish day of trading for regional equities. It is likely that the cash released from the Saudi Aramco IPO found its way back into the market. On the IPO front, Saudi Aramco priced its IPO at the top end of the range and is scheduled to start trading on 11 December 2019.

Elsewhere, Arabtec rose +14.4% amid a surge in volumes. There was no specific news or reports from the company which could be the trigger for such a move.

OPEC+ agreed to deepen their current round of production cuts by 500k b/d for the first quarter of 2020 in an effort to limit the oil market surplus from blowing out early next year. The share of the deeper cuts will be borne most heavily by Saudi Arabia, the UAE, and Kuwait among OPEC producers while Russia, Kazakhstan and Mexico are due to take most of the burden for non-OPEC producers. In addition to the official cuts endorsed by OPEC+, Saudi Arabia has effectively made its over-compliance official, pledging an additional 400k b/d of output restraint.

Oil prices rose in response to the news that OPEC+ agreed on deeper cuts but remain bound in the USD 60-65/b range where they have spent much of the past month. Longer-dated pricing is anchored at lower levels. Brent December 2020 contracts have been holding a little under USD 60/b for most of the second half of 2019 with WTI contracts for the same month around USD 55/b. Brent futures settled the week up 3.1% at USD 64.39/b and WTI up 7.3% at USD 59.20/b.