In the US, House Speaker Nancy Pelosi walked back on her Tuesday deadline for a new fiscal stimulus deal to be reached with the White House administration, and there were cautious notes of optimism struck by both sides. Pelosi said that she was ‘optimistic’ that a deal could be reached, while White House Chief of Staff Mark Meadows said that ‘everyone was working hard’, and that the administration’s offer had been raised to USD 1.88tn. President Donald Trump meanwhile told the media that he could go even larger than the USD 2.2tn package the Democrats are seeking. However, it is not just the size, but the shape of the package that remains in contention. Further, the White House is looking increasingly at odds not only with the Democrats, but also with the Republican Senate, with words of warning reportedly struck by Majority Leader Mitch McConnell.

US new housing starts disappointed in September, rising only 1.9% m/m, compared to expectations of 3.5% growth. Meanwhile the August contraction was revised down to -6.7%, from -5.1% previously. New building permits were stronger, rising 5.2%, beating consensus expectations of 3.0% growth.

The likelihood of greater stimulus monetary stimulus, and even the potential for negative interest rates, in the UK has risen after a speech by BoE MPC member Gertjan Vlieghe yesterday. Vlieghe spoke about the potential long-term and structural damage wrought on the UK economy by the pandemic crisis, and concluded with his thoughts on what the next steps could be. He said: ‘in my view, the outlook for monetary policy is skewed towards adding further stimulus’, and that ‘the risk that negative rates end up being counterproductive to the aims of monetary policy is low.’

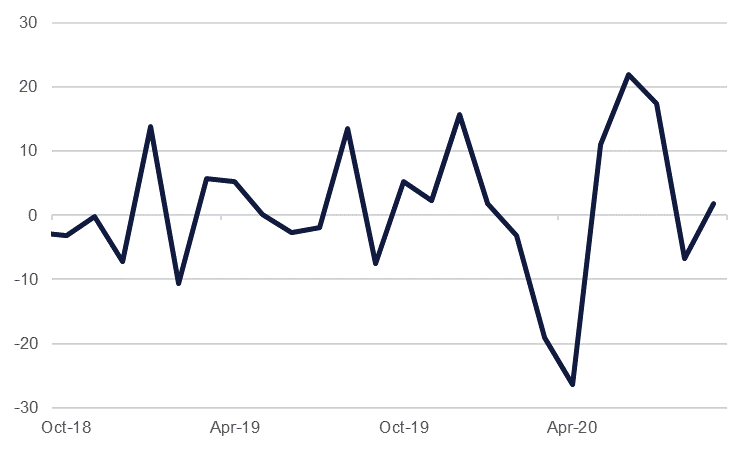

Source: Emirates NBD Research

Source: Emirates NBD Research

Congressional Democrats and the Trump administration appeared to be getting closer to a new stimulus deal with the White Houser offering up to USD 1.88trn, far greater than what Senate Republicans have endorsed. Treasury markets at the long end of the curve sold off in anticipation of an inflationary boost to the economy. Yields on 10yr USTs have now pushed above 80bps for the first time since June while the 2s10s curve has steepened to almost 67bps.

Emerging markets bonds fell overnight as investors are likely paring positions ahead of the November 3rd US presidential election.

The EUR advanced to its highest level in a month on Tuesday off renewed optimism on a US fiscal stimulus package, shrugging off concerns about new European Covid-19 cases and imposed restrictions. The currency climbed to highs of 1.1844 and remains steady around this level this morning, an increase of 0.61%, rising above the 50-day moving average of 1.1797. The GBP ended the day unchanged but has earned some modest gains this morning and trades at 1.2975.

The USD remains on the defensive as risk appetite strengthened. The DXY index recorded further declines, falling by -0.40% overnight and is testing lower 92.93. USDJPY rebounded from highs of 105.75 and is little changed from Monday's closing price at 105.40. The AUD weakened after comments from an RBA official on short term rates falling below zero, but the currency staged a resurgence in the evening and is largely unchanged at 0.7075. The same can be said for the NZD which trades at 0.6610.

US equity indices largely shrugged off the pressures on the tech sector, as Netflix results disappointed and the DoJ launched an antitrust case against Google. Even the tech-heavy NASDAQ secure gains of 0.3%, while the Dow Jones and the S&P 500 were a little stronger, adding 0.4% and 0.5% respectively as hopes for stimulus remained.

Elsewhere, the day was more mixed. In Asia, the Shanghai Composite closed up 0.5%, recovering from a brief dip after GDP growth figures disappointed on Monday. In Japan, however, the Nikkei lost -0.4% on the day. These fortunes are reversed this morning, with the Shanghai Composite currently trading down -0.6%, and the Nikkei up 0.5%. In Europe, the DAX closed down -0.9%, while the FTSE 100 gained 0.1%.

Oil prices were higher overnight with Brent futures settling at USD 43.16/b, up 1.3%, and WTI gaining 1.5% to close at USD 41.46/b. Oil markets are likely responding in kind to a risk on rally in hope of a new fiscal deal in the US. The API reported a build in US crude inventories of around 600k bbl last week. Official data will be out later this evening.