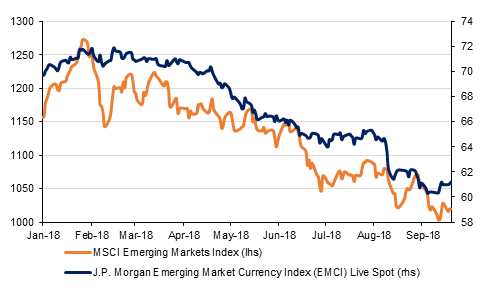

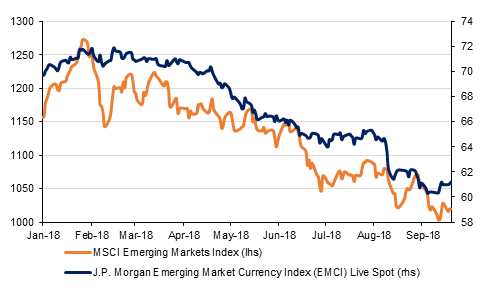

The passage of summer has seen no let up in the pressure on emerging markets with monetary policy normalization in the US and trade war rhetoric exposing fragilities in many parts of the world. In this context the GCC is holding up somewhat better and we are becoming slightly more constructive about the near term outlook.

- Global macro: Since our last edition the U.S. economy has been very strong, while the rest of the world appears to be facing a greater array of challenges and risks. From trade tariffs and protectionism, to monetary policy normalization, these are casting a cloud over the prospects for 2019 as well as exposing EM vulnerabilities.

- GCC macro: We are slightly more constructive on the GCC as we head into the final quarter of the year, largely on the back of increased oil production since the June OPEC meeting.

- MENA macro: Tightening global monetary conditions and increasing EM aversion will lead to higher debt servicing costs for MENA oil importers given persistent high debt loads and fiscal deficits.

- EM Focus: India

- Interest rates: The UST yield curve is being pushed higher as a result of a) higher than expected budget deficit in the US; b) rising trade war fears; c) QE unwinding, and d) the Fed’s commitment to continue raising rates.

- Credit: Despite rising benchmark yields and the recent pick up in new issues, GCC bonds held up well on the back of credit spread tightening.

- Currencies: The dollar has fallen from its 2018 highs against the other major currencies despite the prospect of more monetary policy tightening from the Fed.

- Equities: Since the start of Q3 2018, the weakness in global equities along with performance differential has intensified as multiple factors plaguing investor sentiment emerged.

- Commodities: We outline our view for oil prices in 2019. The market will have to adjust to supply risks as output from Iran declines sharply while demand is at risk from the escalating trade war between the US and China.

Emerging markets in the spotlight

Source: Emirates NBD Research, Bloomberg

Source: Emirates NBD Research, Bloomberg

Click here to Download Full article

Source: Emirates NBD Research, Bloomberg

Source: Emirates NBD Research, Bloomberg