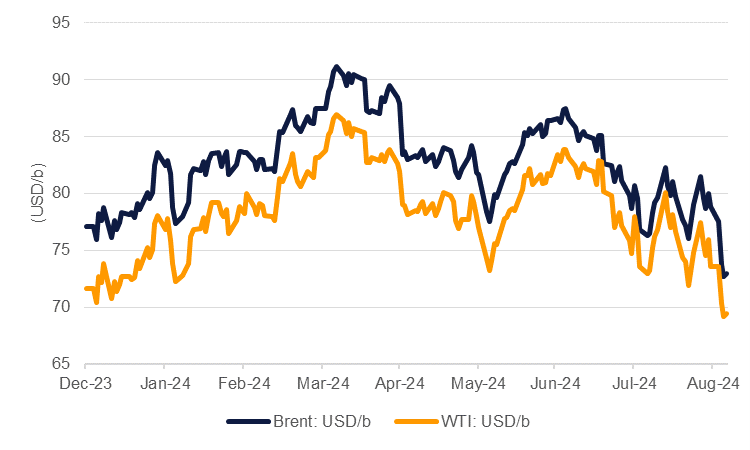

Oil markets are pushing OPEC+ into a difficult choice on whether to stick with its planned production increase in Q4 or postpone it later into 2025. Benchmark prices have fallen to year-to-date lows—Brent futures below USD 73/b and WTI below USD 70/b—and there look to be few barriers in the short term to oil testing new low levels for the year.

The next joint ministerial monitoring committee for OPEC+ countries meets on October 2 and will provide an oil market assessment to OPEC+ ministers. At the August 2 JMMC, OPEC+ gave itself room to adapt its planned production increase, saying that the “gradual phase-out…could be paused or reversed, depending on prevailing market conditions.” Since the August JMMC, Brent prices have dropped by about 5% and have entrenched year-to-date losses of roughly the same amount. What conditions could trigger an OPEC+ strategy change are unknown but economic data look as though they would strongly support OPEC+ changing tack.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

Confidence on the macro narrative for oil demand is dissipating. The slump in prices this week looks to have been sparked by weaker Chinese data. China’s manufacturing PMIs for August dropped to 49.1, holding below the neutral 50 level for the last four months. Elsewhere, expectations of weaker labour market conditions in the US—with non-farm payrolls data to be released later this week—will reinforce fears of a pending recession in the US economy even after a solid Q2 GDP print.

The next major risk for oil this month comes from the Federal Reserve and the scale of interest rate cut it delivers at the September 17-18 FOMC. A 50bps cut may be what markets are hoping for but if that scale of cut is accompanied with weaker projections for GDP activity this year or a higher unemployment forecast it is unlikely to restore much confidence that conditions for oil demand will be positive in the final months of the year or into early 2025. Conversely, if the Fed sticks with a 25bps cut markets will be disappointed and price in expectations of a recession in the US economy caused by overly-tight monetary policy, likely to also take oil prices lower.

Given the worsening backdrop for oil prices and its own caveats on strategy, we expect that OPEC+ will announce it will suspend its planned production increases for the rest of 2024 and phase production back in during 2025 at an even more gradual pace. But as ever with OPEC+ decisions there is a gap between plans and production. Compliance with current output targets has been fairly good though it has waned in the last few months thanks to over production from countries like Iraq, Kazakhstan, the UAE and Russia. Extending production restrictions risks embedding more frustration within OPEC+ with the possibility of a disorderly unwind of production controls.

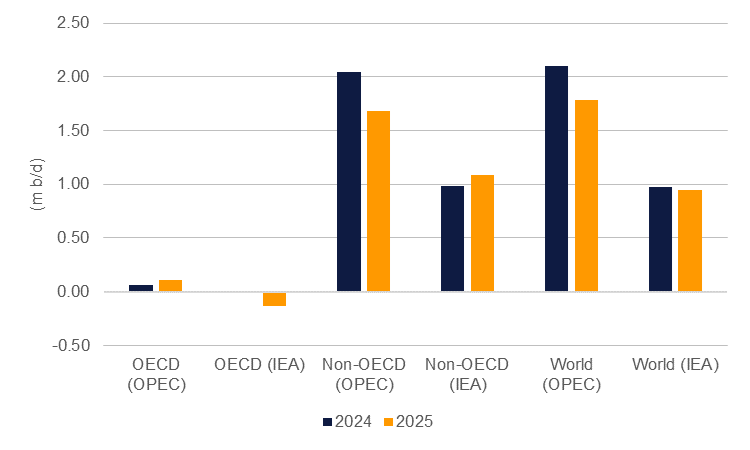

Should OPEC+ signal it plans to delay its planned production increase then it should be accompanied by a revision to OPEC’s robust demand forecasts for 2024 and 2025. OPEC has stood out among other major forecasters like the IEA or EIA in the strength of its demand forecast, expecting oil consumption growth of more than 2m b/d this year and 1.8m b/d next year. The IEA, by contrast is projecting less than 1m b/d of demand growth in both years. The next OPEC monthly oil market report is due out September 10 and may give more of a signal that OPEC+ is planning to delay its production increases until later into 2025.

Source: IEA, OPEC, Emirates NBD Research.

Source: IEA, OPEC, Emirates NBD Research.