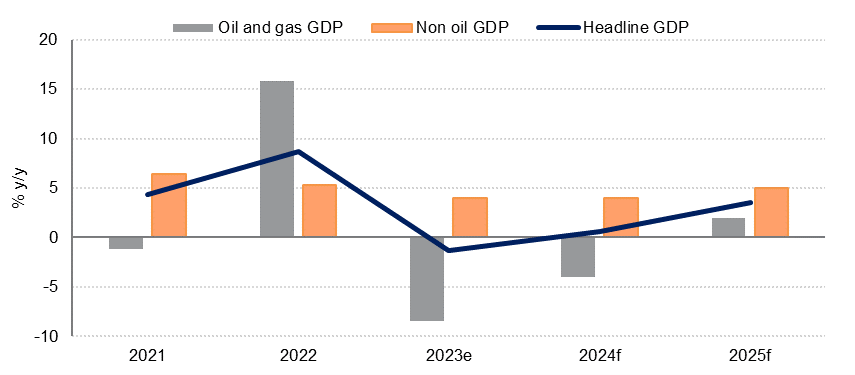

GDP growth in Saudi Arabia slowed sharply in the first three quarters of 2023 to just 0.2% y/y, down from 10.0% y/y in the same period 2022. This was largely due to a -6.5% y/y contraction in hydrocarbon GDP on the back of oil production cuts, but non-oil GDP growth also slowed to average 3.5% in January -September. Trade and hospitality, and transport and storage sectors saw the fastest growth in the first three quarters of 2023, along with construction and social and personal services. For the year as a whole, we estimate non-oil growth of 4.0%, which was likely offset by a -8.5% contraction in oil and gas GDP, resulting in headline GDP contracting by around -1.3% in 2023.

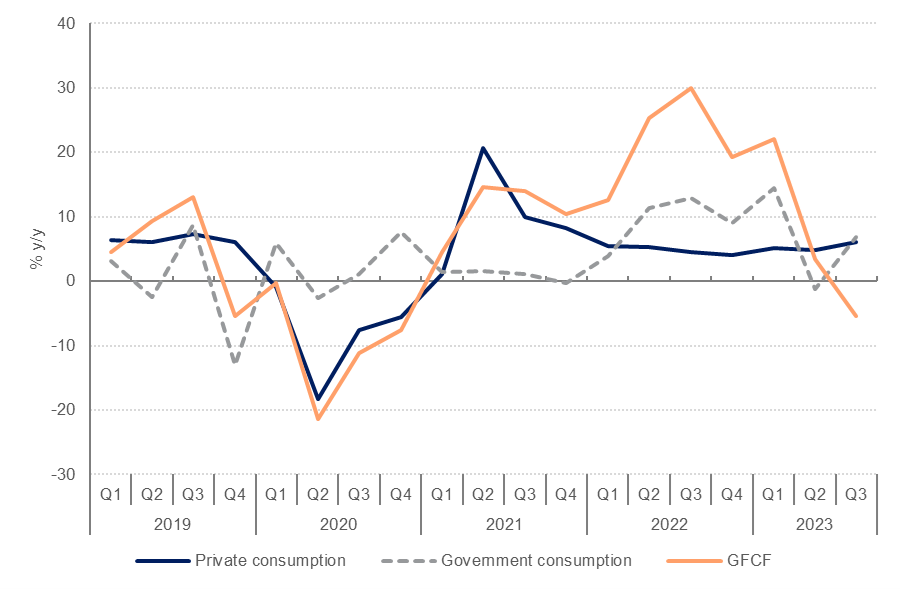

The expenditure breakdown of GDP shows private consumption spending grew 5.3% y/y in the first three quarters of 2023, slightly stronger than in the same period the previous year, while government consumption spending grew 6.3% y/y over the same period. Investment was also a key driver of non-oil growth with GFCF up 6.2% y/y in Jan-Sep, although this was much slower than investment growth over the same period in 2022. Net exports were the main drag on GDP last year, as exports contracted -5.5% while imports grew 7.8%.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

In 2024, we expect private consumption to remain supported by continued migration to the kingdom as well as relatively low inflation. We expect government spending (both consumption and investment) to increase at a slower pace in 2024 than the 9.5% growth in 2023 budget spending. However, we don’t expect a tightening in fiscal policy as the ambitious diversification targets will require significant further investment in the coming years.

Estimates from MEED projects at the start of 2024 show a significant increase in expected cash flow disbursed for both government and private sector on projects in the kingdom this year and a further increase in 2025, which we expect to support non-oil GDP growth this year and next.

Net exports are likely to remain a drag on growth in 2024 however, with oil exports expected to decline further on weaker global growth, and import demand forecast to remain strong with ongoing domestic investment. We have pencilled in non-oil GDP growth of 4% again in 2024, partially offset by at -4% contraction in oil and gas GDP, yielding headline GDP growth of 0.7% in 2024.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

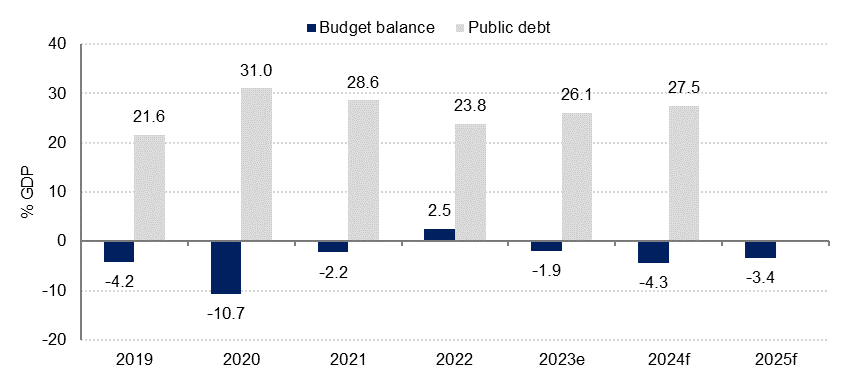

Official estimates put the 2023 budget balance at -2.0% of GDP, broadly in line with our own forecast of -1.9% of GDP. Revenues declined by an estimated -5.5% last year on lower oil prices and production, while expenditure grew by almost 10% y/y, largely driven by a 41% increase in capital (investment) spending in the budget.

For 2024, we expect oil prices to average USD 82.5/b, similar to 2023. However with Saudi Arabia now extending its 1mn b/d voluntary production cut at least through March 2024 and only gradually recovering thereafter, we expect the volume of oil sold to decline by around -4% from average 2023 levels, weighing on budget revenue. While the published budget shows a forecast -1.8% decline budget revenue in 2023, our estimate is for a steeper -6.4% decline in topline revenue this year. At the same time, we forecast 2.0% growth in total expenditure, compared with a -1.9% decline in the official budget. Consequently, we expect the budget deficit to widen to -4.3% of GDP this year, versus the official estimate of -1.9% of GDP.

The 2024 budget document is not explicit about the breakdown of oil and non-oil revenues, nor the assumed level of oil production. Based on our expectations for lower oil production this year relative to 2023, we estimate the break-even oil price for the budget at approximately USD 104/b, up from around USD 87/b in 2022 and USD 97/b in 2023.

The stock of public debt rose to SAR 1,024bn in 2023 according to the 2024 budget statement, or 26.1% of GDP, up from 23.8% of GDP in 2022. Public debt remains relatively low and there is scope for additional borrowing to finance the budget deficit in 2024. Indeed the government has already issued USD 12bn in bonds in January as yields have fallen to levels last seen in summer 2023.

Source: Haver Analytics, Ministry of Finance, Emirates NBD Research

Source: Haver Analytics, Ministry of Finance, Emirates NBD Research

CPI inflation in the kingdom slowed to 1.7% y/y in November from 3.3% in December 2022. CPI averaged 2.4% in the year to November 2023, only slightly lower than the 2.5% average in 2022. The main driver was higher housing costs, up 8% y/y in 2023, while most other categories saw inflation slow relative to 2022.

We expect housing to remain the key source of inflation in 2024 also, along with services prices such as for hospitality and recreation. We retain a 2.5% forecast for average inflation in 2024.

Private sector credit growth continued to exceed money supply growth in November 2023, although the difference is not as large as it was for most of 2021 and 2022. Private sector credit grew 9.8% y/y in November, up from 9.4% in October, while broad money supply grew 7.4% y/y, down from 8.8% in October. Money supply growth has been driven by quasi money (mainly longer-term SAR deposits), which have grown almost 30% on average in 2023, while M1 contracted by -2.3% y/y.

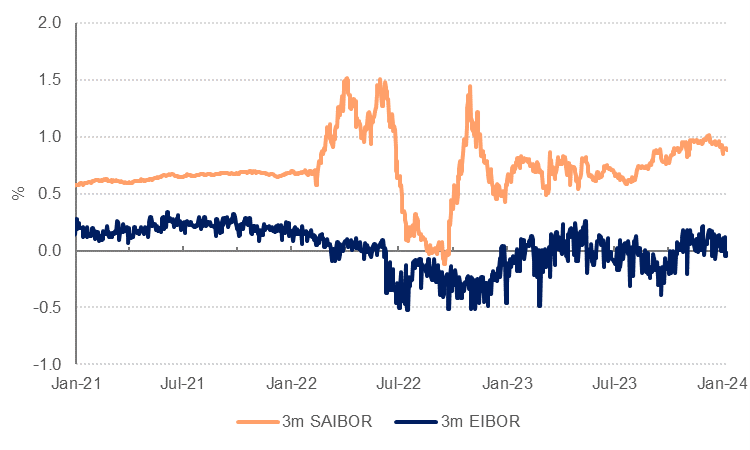

The relatively tight liquidity conditions in the Saudi financial system are reflected in the widening of the 3m SAIBOR spread over SOFR, which ended the year at around 100bp. Spreads have tightened a bit since the start of this year but remain wider than the average since 2018.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

To the extent that we expect investment in strategic sectors and mega-projects to continue in 2024, demand for credit is likely to remain strong. With oil-related liquidity likely to remain constrained, overall banking sector liquidity is expected to remain tight.

Net foreign assets at SAMA declined modestly last year, reaching USD 418bn at the end of November, down from USD 441bn at the end of 2022. This was largely matched by a decline in government and related deposits at the central bank over the same period. We expect the budget deficit in 2024 to be financed by debt issuance rather than drawing down reserves.

Click here to download forecast table