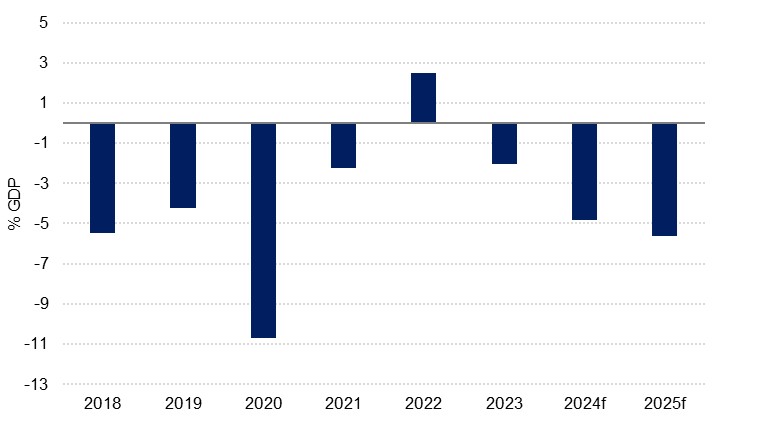

Saudi Arabia’s ministry of finance has issued its pre-budget statement for 2025, with revised estimates and forecasts for both next year and the current fiscal year. The Saudi authorities anticipate that the budget will remain in deficit for the next several years, a stance adopted in October 2023, as the kingdom commits to achieving the diversification goals of the Vision 2030 development plan. The pre-budget ‘highlights the Kingdom’s commitment to accelerate the regulatory and structural reforms, as well as the development of policies.’ However, with a projected budget deficit equivalent to just 2.3% of GDP next year its projections are somewhat more bullish than our recently revised forecasts.

| 2023 | Budget 2024 | Estimates 2024 | 2025f | 2026f | 2027f | |

|---|---|---|---|---|---|---|

|

Total revenues |

1,212 | 1,172 | 1,237 | 1,184 | 1,198 | 1,289 |

| Total expenditures | 1,293 | 1,251 | 1,355 | 1,285 | 1,328 | 1,429 |

| Budget balance | -81 | -79 | -118 | -101 | -130 | -140 |

| % GDP | -2.0 | -1.9 | -2.9 | -2.3 | -2.9 | -3.0 |

*SAR bn unless noted otherwise. Source: Saudi Arabia Ministry of Finance, Emirates NBD Research

Our recent downward revision to our oil price forecast (see Oil outlook 2025: dimming), sees us forecast an average Brent crude price of USD 73.0/b next year, which would mark an 8.8% decrease on our expected average of USD 80.0/b in 2024. While we have for the time being left our oil production forecasts for Saudi Arabia unchanged, and these may well move higher, as it stands this sees our total revenue forecast for 2025 at SAR 1,118bn, which is far closer to Saudi Arabia’s low scenario (SAR 1,121bn) than its high (SAR 1,241bn) or even baseline (SAR 1,184bn) scenarios (Saudi Arabia does not give an oil price expectation in the pre-budget statement). The Saudi baseline forecast for next year projects a 4.3% decrease on the projected revenues in 2024, with the statement putting some of that down to a ‘cautious approach’ to forecasting designed to ‘account for potential developments in the domestic and global economy.’

With questions over oil demand growth to the fore, the outside risk of a disorderly end to the OPEC+ production management agreement, and non-oil private sector activity growth slowing according to PMI surveys, we remain comparatively conservative on revenue growth. However, there are upside risks to our revenue forecasts, whether that is through higher oil revenues if production comes back online more swiftly than we currently envisage (and there isn’t a parallel slide in prices), or through a stronger rise in non-oil revenue. The diversification of the economy has seen other income streams rise in importance, and y/y growth in non-oil revenues in the budget was 6.2% over the first half of 2024, following an 11.1% expansion in 2023.

Source: Haver Analytics, Emirates NBD Research

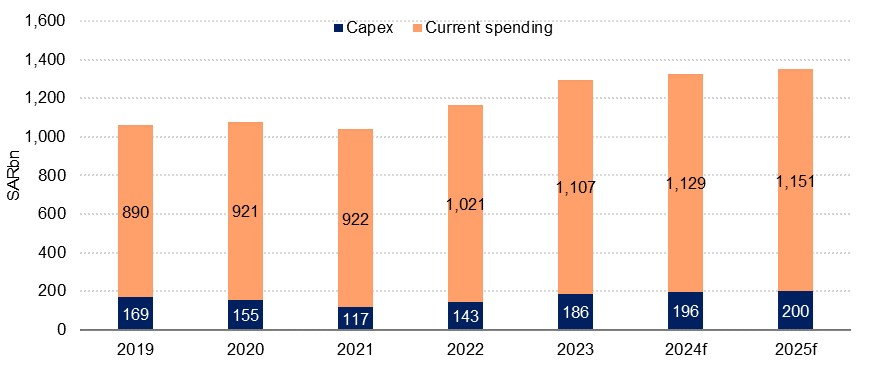

Source: Haver Analytics, Emirates NBD ResearchOn the other side of the budget equation, the pre-budget report forecasts that total spending in 2025 will be SAR 1,285bn. This would mark a 5.2% decline on the official revised projection of SAR 1,355bn this year. By contrast, we forecast a 2.0% expansion in expenditure next year, which on top of our projected spend of SAR 1,324bn this year would see an outlay of SAR 1,351bn in 2025, some degree higher than the official projection. While this might seem especially bullish on the spending front, it is worth noting that the original 2024 budget saw expenditure at SAR 1,251bn, and this looks set to be significantly exceeded.

Meanwhile, there is nothing in the pre-budget statement just released that suggests retrenchment by the Saudi authorities beyond the phrases ‘spending efficiency’ and the ‘periodic review of project timelines.’ The commitment to ‘transformative spending’, including ‘sectoral and regional strategies, giga projects, [and] Saudi Vision 2030 programs’ remains intact. And while there have been recent headlines around the scaling down or pushing back of some projects, the commitment to hold major international events such as the Asian Winter Games in 2029 or Riyadh Expo in 2030 will necessitate significant spending in the near term. As our forecasts stand, we see a budget deficit equivalent to 5.6% in Saudi Arabia next year, significantly wider than the official projection.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

We anticipate that the budget shortfall will be financed primarily by public borrowing once more next year. In 2023, government debt rose by SAR 60.2bn, representing 74.4% of the budget shortfall, while Saudi Arabia has been active in 2024 as well, issuing USD 12bn in bonds in January and a series of sukuks since, alongside borrowing from PIF and ARAMCO. The government has also raised funds from a secondary ARAMCO share sale. The pre-budget document states that ‘the government aims to utilize sovereign and development funds for capital investment while empowering both the private and non-profit sectors to foster growth and prosperity.’