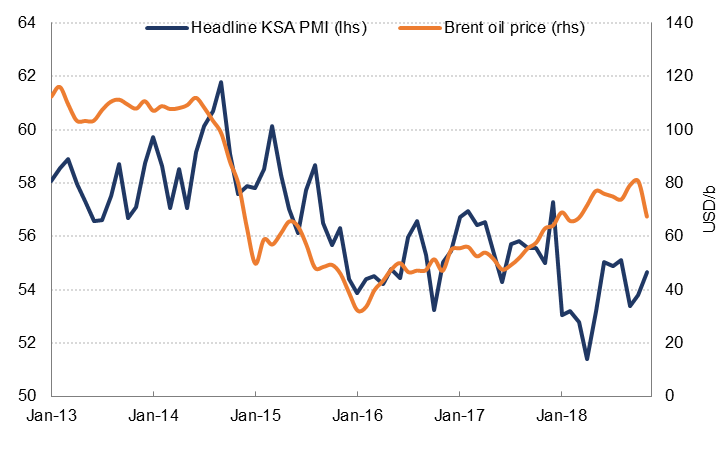

The headline Emirates NBD Saudi Arabia Purchasing Managers’ Index (PMI) rose to 55.2 in November from 53.8 in October, the highest reading this year. However, the PMI in November is still below the series average of 57.6, and the year-to-date average is lower than it was for Jan-Nov 2017, indicating a relatively soft rate of expansion in the non-oil private sector by historical standards.

Both output and new orders increased at a faster rate in November, and while new export order growth was firmer in November than it has been in recent months, it remained sluggish. The recovery in new orders thus likely reflects stronger domestic demand. However, some of the rebound in new order growth appears to be on the back of price discounting as well as increased marketing.

Many firms surveyed indicated that competition for new work was strong, and as a result, selling prices were marginally lower on average last month. Firms also indicated that they were increasingly focused on cost-savings. As a result, both employment and purchasing activity slowed in November, despite stronger new order growth. Input costs were broadly unchanged in November after declining slightly in October. There was little evidence of wage inflation, with the staff costs index at 50.2 in November.

Firms remained strongly optimistic about their output in the coming year, citing planned new products, increased marketing and more competitive prices; however, the ‘future output’ index slipped 2 points in November from the October peak.

We retain our 2018 GDP growth forecast of 2.0%, up from -0.7% in 2017. We will be reviewing the 2019 GDP growth forecast after OPEC’s December meeting.