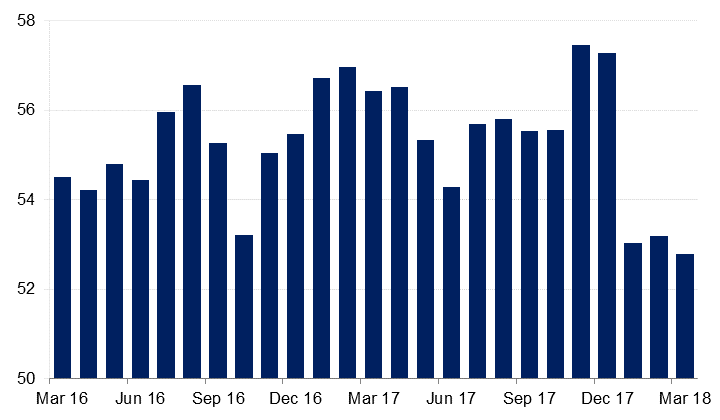

The Emirates NBD Saudi Arabia Purchasing Managers’ Index (PMI) stood at 52.8 in March, down from a reading of 53.2 the previous month. This marks a record low on the index, implying that Saudi Arabia’s non-oil private sector is expanding at the slowest pace in nine years. New orders in particular weighed on the headline figure, standing at just 50.5, while new export orders fell to 49.8, below the neutral 50.0 level which delineates contraction and expansion. The non-oil private sector’s expansion rate has been slowing over the past several months, as the effects of a pre-VAT boost seen at the close of 2017 (VAT of 5.0% was introduced in Saudi Arabia in January) dissipates, and the new tax weighs on activity. A number of respondent firms cited VAT as dampening consumer demand last month.

More positively, growth in output picked up in March, rising from 56.9 in February to 58.6. While below historical averages, it was nevertheless the strongest reading so far in 2018, with 27.7% of respondents reporting greater output than the previous month.

Despite the sluggish growth at present, business optimism at 71.0 remains far above the 12-month average of 61.4. In line with our views, respondents anticipate an economic upturn, and also expect new project wins. We maintain our assessment that the slowdown over the past several months is in part a response to the surge in activity in Q4 2017, and that an expansionary fiscal policy and higher oil prices should support wider non-oil economic activity as liquidity in the banking sector rises.

The fall in the pace of expansion will prompt firms to continue price discounting in a bid to galvanise demand over the coming months; output prices were below the neutral 50.0 level for the second month running in March. Despite the pressures on private sector firms, job creation remains positive at 51.5, compared to a 12-month average of 51.2. Easing input prices will enable firms to continue this discounting strategy without overly squeezing their margins; both purchase costs and staff costs stood at 50.7 in March, below 12-month averages.