Saudi Arabia’s headline Purchasing Managers’ Index (PMI) rose to 57.3 in May from 56.8 in April, and the highest reading since December 2017. The gradual rise in the headline PMI this year suggests that growth in the kingdom’s non-oil private sector is recovering after a relatively soft 2018. Other indicators, such as an improvement in private sector credit growth and rising point of sale transactions in the first four months of this year are consistent with a modest rebound in private sector activity.

Both output and new orders rose at a faster rate in May, with firms citing “stronger underlying demand conditions”. While this is largely due to domestic demand improving, new export orders have also recovered in Q2 2019 after a weak start to the year, with the May new export order index reaching the highest level since February 2017.

Selling prices rose in May for the first time in seven months, albeit modestly, although input costs also increased slightly last month. The employment index increased to 50.5 in May, but remains low by historical standards despite the strong rise in output and new work. However, firms did increase both their quantity of purchases and their stocks of inventory in May. Both these indices were at the highest level since last summer. Firms also remained very optimistic about their expected output in 12 months’ time, although the degree of optimism was slightly lower than in April.

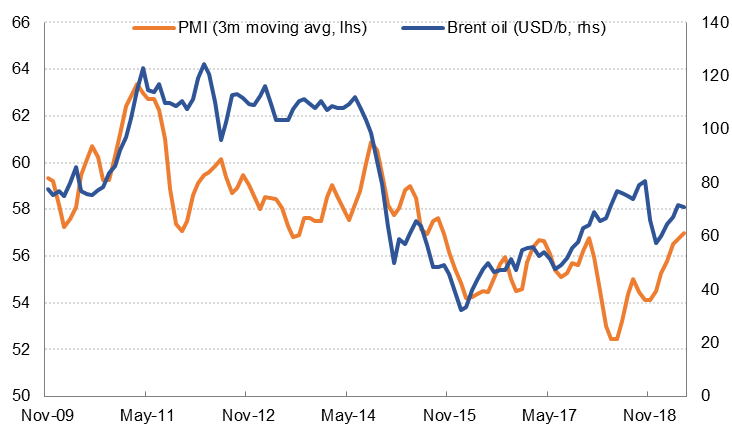

Last year, we noted that there was something of a disconnect between higher oil prices - Brent oil prices rose 30% in 2018 – and subdued activity in the private sector, reflected in the weakest average PMI on record. However, the rebound in the headline PMI this year suggests that the private sector is starting to benefit from higher oil prices and the resulting improvement in the government’s fiscal position.

Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research