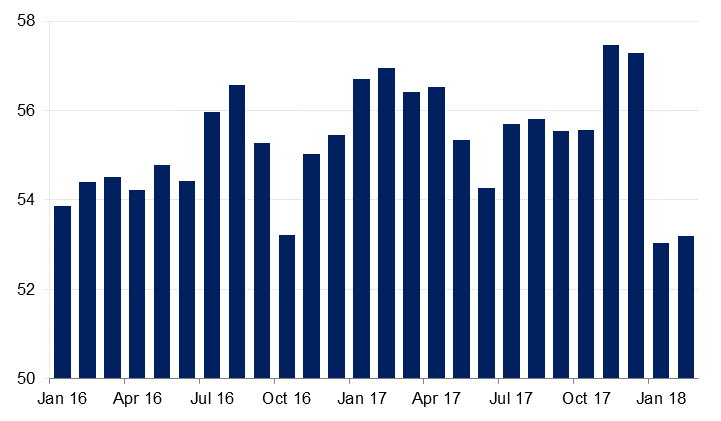

The Emirates NBD Saudi Arabia Purchasing Managers’ Index (PMI) stood at 53.2 in February, only marginally higher than the January reading of 53.0. The index signals a modest rate of growth in the non-oil private sector last month, at a similar rate to January. Output increased at a slightly faster pace in February, but new order growth slowed sharply, with this index at the lowest level in the survey history (52.9). This was partly due to weaker external demand as new export orders declined slightly on average last month; however softer domestic demand likely also contributed to the slower growth in new orders in February.

Source: IHS Markit, Emirates NBD Research

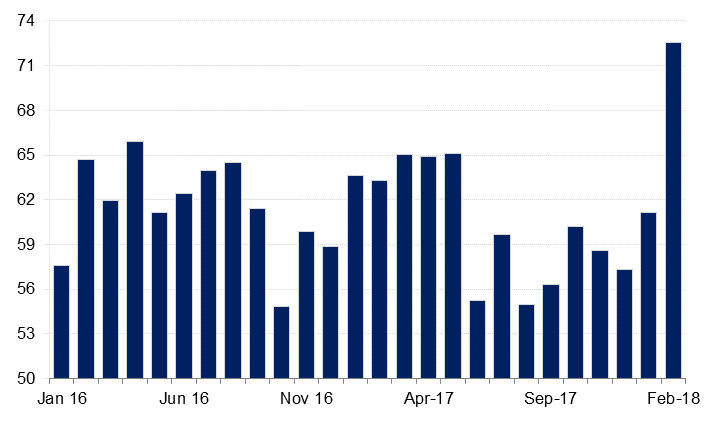

Source: IHS Markit, Emirates NBD Research

Employment increased at a slightly slower rate than in January. Purchasing activity continued to slow after surging in Q4 2017 before the VAT came into effect. Stocks of inventories increased at a solid rate in February however, likely reflecting slower new order growth. Input cost inflation moderated in February as the impact of VAT was reflected in the January readings. Nevertheless, both purchase costs and staff costs increased last month relative to January, with staff costs rising at the fastest rate since September 2016. Output prices declined sharply in February, with this index declining to 47.6, the lowest level on record as firms cut prices to try and stimulate demand.

Despite the slowdown in new order growth and evidence of softer domestic and external demand, firms were the most optimistic about future output than they have been since April 2014. Respondents cited an expected upturn in the economy and new projects as reasons for their optimism over the coming 12 months.

Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research

The lower PMI readings in the first months of this year are likely a response to the surge in activity and purchasing in Q4 2017, as firms and consumers brought forward purchases ahead of the introduction of VAT. We expect this to be a temporary phenomenon and we expect the PMIs to recover over the next couple of months. Overall, we are more optimistic about non-oil growth in the Kingdom in 2018 as fiscal policy is likely to be more expansionary and higher oil prices should support liquidity in the domestic banking system, despite higher nominal US rates.