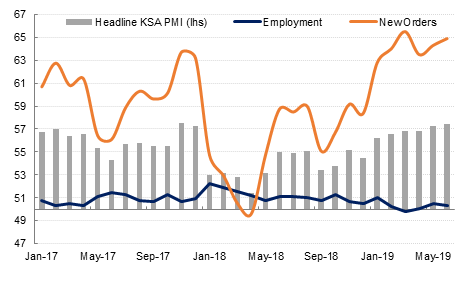

Saudi Arabia’s headline Purchasing Managers’ Index (PMI) was fractionally higher in June at 57.4 (57.3 in May) on the back of faster growth in new work, despite slightly softer growth in export orders. This suggests that domestic demand remains robust.

Output increased in June at a sharp rate, reflecting the growth in new work. However as we have seen in recent months, growth in output and new work has not boosted hiring in the private sector in a meaningful way. Where 41% of panellists reported increased new work in June, less than 0.5% reported higher payrolls. Wages were also flat last month.

The selling price index was marginally below the neutral 50.0 level in June, for the seventh time in eight months. The extent of price discounting was slight on a seasonally adjusted basis, and input cost inflation was relatively low as well, reflecting the lack of inflationary pressure more broadly in the Saudi economy.

Businesses remain optimistic about the coming year, with around 49% of firms expecting their output to be higher in June 2020. However, the degree of optimism was the weakest in ten months. This may reflect concerns about slower global growth – and the negative implications for oil prices – as well as heightened regional geopolitical tensions in the region. We retain our 2.0% GDP growth forecast for Saudi Arabia this year.

Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research