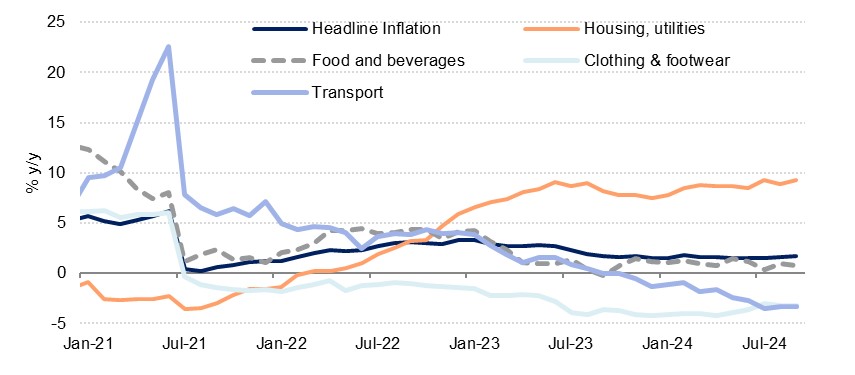

Headline CPI inflation in Saudi Arabia accelerated to 1.7% y/y in September, up from 1.6% the previous month. Annual price growth in the kingdom has been quite consistent through 2024 to date, averaging 1.6% over January to September within a range of 1.5% -1.8%. This marks a slowdown from the 2.6% averaged over the same period in 2023 with price pressures easing this year despite strong domestic demand. We now forecast an annual average of 1.7%, revised down from our previous projection of 2.0%, while next year we now forecast an average 2.0%, down from 2.5% previously.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

As has been the trend for several months, the housing sector in Saudi Arabia has been responsible for almost all the headline price growth in the CPI print. Accounting for 20% of the inflation basket (second only to food & beverages), housing & utilities saw annual price growth of 9.3% y/y in September, up 0.6% m/m. Annual housing inflation has averaged 8.7% ytd, up from 8.0% over the same period in 2023 and in sharp contrast to the long-run trend prior to last year when housing inflation was either low or negative. A rapidly growing and youthful population (the fastest growing in the G20 over the period between its last two censuses), a robust urbanisation trend, and ongoing growth in the number of expatriate workers are all contributing to strong demand for housing coming out of the pandemic, especially in Riyadh, and this is pushing up prices. There are a wide range of government and private sector projects and initiatives around boosting the supply of housing, including a government pledge to provide 300,000 new homes made in late 2023, though the impact of additional supply on housing inflation will be felt only in the medium term.

Other than the elevated inflation in housing, the rest of the Saudi CPI basket is seeing either low inflation or outright deflation. Food & beverages, 22% of the basket, was up 0.8% y/y in September and has recorded an average of 1.0% ytd. Out of the 12 components of the CPI basket, only three others aside from housing and food (education, restaurants & hotels, and miscellaneous goods & services) saw positive annual price growth in September. The rest all saw prices fall y/y, with furnishing down 3.7% y/y, clothing & footwear down 3.2%, and recreation & culture down 2.8%.

Source: Riyad Bank, Emirates NBD Research

Source: Riyad Bank, Emirates NBD Research

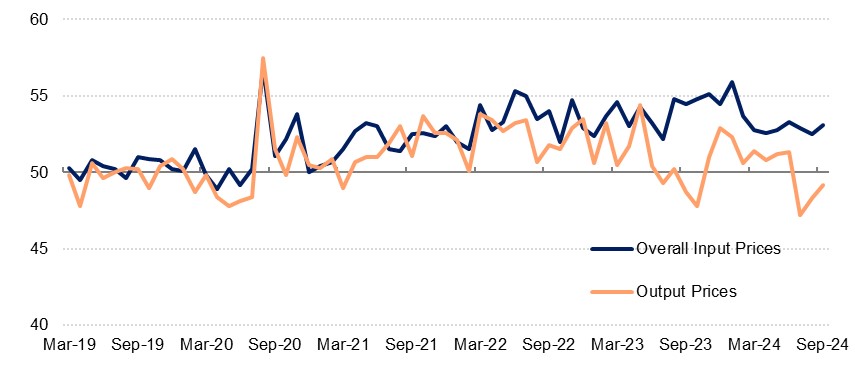

These falling prices tie in with what we have been seeing in the Riyad Bank PMI survey for Saudi Arabia, with businesses reporting cutting their output prices as they seek to remain competitive in an increasingly contested market. Firms lowered their prices charged to customers for the third month in a row in September, despite their input prices continuing to rise partly on higher shipping costs. This would go some way to explaining how headline price pressures in Saudi Arabia have remained benign even as the economy reports strong growth (we forecast non-oil growth of 4.0% this year) and rising domestic demand as various large infrastructure plans are implemented. We still expect moderately faster inflation next year compared with this year as the economy picks up (we forecast non-oil growth of 4.5% next year), but these trends will likely continue to cap how fast prices will rise.