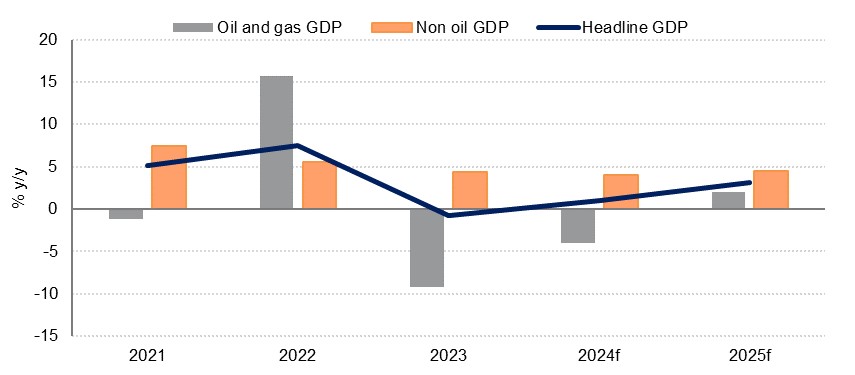

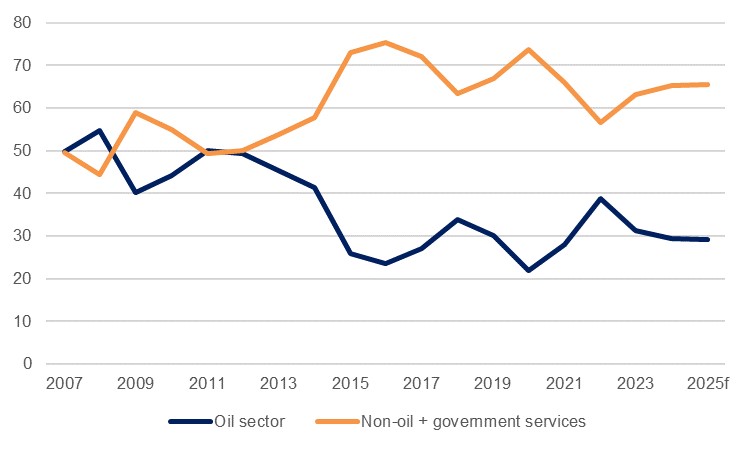

Saudi Arabia recorded a real GDP contraction of 4.3% y/y in Q4, contributing to the full-year growth figure of -0.8% on the final print, a modest adjustment from the -0.9% initially posted and down from 7.5% in 2023. The decline in output last year was driven wholly by the oil sector which saw a decrease of 9.0%, in contrast to the 15.0% expansion logged in 2023. The fall last year was on the back of oil production curbs implemented as part of the OPEC+ strategy to shore up prices, and oil output fell to an average 9.6mn b/d in 2023, compared with 10.5mn b/d in 2022. More positively, government services expanded 2.1% last year while the non-oil sector recorded growth of 4.4%, compared with 5.6% the previous year.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

While growth in the non-oil sector slowed in 2023, it remained comparatively buoyant when looking at the global backdrop and the various external challenges last year, and almost all sectors of the economy outside of oil saw growth (manufacturing excluding petroleum refining was a non-oil outlier as it contracted 0.7%). Community, social & personal services saw the highest pace of growth at 10.8%, followed by transport, storage & communication (7.3%) and wholesale & retail trade, restaurants & hotels (6.8%). The growth in the latter sector is especially interesting as it is the third-largest component of GDP after the oil sector and government services and its rapid expansion is testament to the changes wrought to Saudi Arabia’s retail and entertainment landscape over the past several years.

New methodology

The Q4 and full-year 2023 figures were the first released after the General Authority for Statistics revised its data methodology to the chain-linked method. Rather than calculating the real rate of growth for the economy using the sector weights from one specified base year, the chain-linked method continuously updates from the weights and prices of the previous comparison year, and so can more accurately reflect the ongoing changes in the structure of an economy.

Source: Haver Analytics, Emirates NDB Research

Source: Haver Analytics, Emirates NDB Research

The methodology revision has led to our headline real GDP growth forecast for 2024 rising from 0.7% previously to 1.0%, even as our underlying sector growth projections remain unchanged. On March 3, Saudi Arabia confirmed what we had expected would happen, as it extended its 1mn b/d of production cuts until the end of Q2. In light of this we still expect Saudi Arabia’s oil production to fall to an average 9.2mn b/d in 2024, down from 9.6mn b/d in 2023, and so we forecast a contraction of 4.0% in oil & gas GDP this year. Some support could still come from the investment side even as ARAMCO has in January abandoned its plan to expand oil production capacity to 13mn b/d (from 12mn presently). In announcing its 2023 results, the company stated that capital investments this year would be ‘approximately USD 48 to USD 58bn’, compared with USD 49.7bn in 2023 (itself up 28%).

For the non-oil sector meanwhile, we maintain our projection of 4.0% growth, which would represent a moderate slowdown on last year but still denote a strong performance given slower global growth and an ongoing high interest rate environment. The PMI surveys for the first two months of the year have been somewhat mixed, with a decline in January followed by a marked recovery in February, but both readings were well above the neutral 50.0 level and continue to indicate a robust expansion in the non-oil private sector.

Moreover, we expect that high levels of investment will continue to feed through into a range of sectors, further encouraging growth through the remainder of the year. The Saudi government remains committed to ‘funding and supporting the implementation of programs, initiatives, and economic transformation projects in line with Saudi Vision 2030’, according to its budget for 2024, while MEED data also shows a significant pipeline of private sector cash flow.

Robust growth in private consumption will also continue to power growth, in part supported by an expanding population. After consumer spending (card spend plus cash withdrawal and e-commerce spending) rose 6.7% in 2023, outpacing the 2.3% average CPI inflation rate by some margin and thereby denoting real growth, in January there was an 8.6% expansion while inflation was just 1.8%.