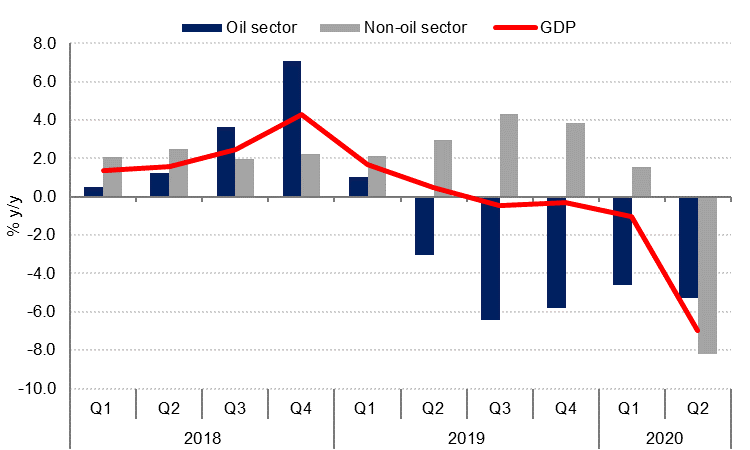

The Saudi economy contracted -8.9% q/q and -7.0% y/y in Q2 2020. Oil sector GDP contracted -5.3% y/y as the kingdom cut crude output in the face of weaker global demand due to the coronavirus. The non-oil sector contracted -8.2% y/y, with the private non-oil sector down -10.1% y/y.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

Trade, restaurants and hotels were the hardest hit in Q2 as borders were closed and lockdowns put in place to contain the spread of Covid19. This sector contracted -24.1% q/q and -18.3% y/y in Q2. Transport, storage & communication GDP declined -21.6% q/q and -16.3% y/y. Manufacturing GDP contracted -11.6% y/y. Surprisingly, government services also contracted-13.6% q/q and -1.3% y/y.

PMI survey data for July and August suggests there was no recovery in the non-oil private sector in Q3, although we do expect a modest rebound in Q4. As a result, we have downgraded our 2020 GDP growth forecast for KSA to -5.2% from -4.2% previously.