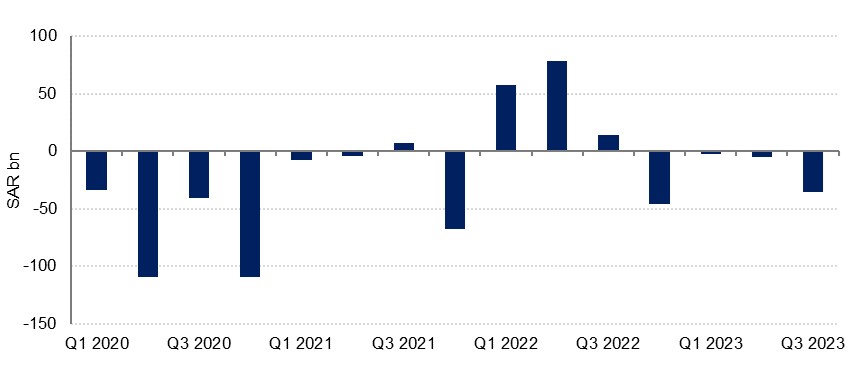

Saudi Arabia’s budget deficit widened sharply in the third quarter, posting a shortfall of -SAR 35.8bn (USD 9.5bn), compared with a deficit of -SAR 8.2bn over the first half. This leaves the deficit over the first three quarters of the year at -SAR 44.0bn, compared with a surplus of SAR 149.5bn over the corresponding period in 2022.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

Total revenue for the first nine months of the year was down 10.1%, driven entirely by a 23.8% y/y decline in oil revenues as Brent crude prices averaged 20.1% lower than last year and Saudi oil production fell 6.3% y/y. This was particularly apparent in the third quarter budget figures as oil income was down 35.8% y/y and 18.2% q/q.

In contrast, non-oil revenue expanded 21.5% y/y over the three-quarter period with strong gains from taxes on income, profit and capital gains tax in particular. However, while Q3 non-oil income was up 53.1% y/y it was actually down 17.4% on Q2. Looking at the subcomponents of non-oil income this slowdown was driven by the seasonal fall in zakat income (down 86.1% q/q) following the Eid al-Fitr holiday which fell in the second quarter.

On the expenditure side, total expenditure was up 12.2% y/y over January to September, with gains in capital expenditure (21.2%) continuing to outpace growth in current spending (11.0%). On a quarterly basis, capital spending actually declined -5.3%, but this followed an outsize 67.4% gain in Q2 and it was still up 1.8% y/y. Saudi Arabia’s ambitious Vision 2030 plans necessitate significant investment expenditure to be realised and this continues apace.

We maintain our expectation that oil prices will average higher through the rest of the year on the back of mounting market tightness, while geopolitical tensions will also likely keep a risk premium on prices for some of this period. Saudi Arabia has also confirmed that its voluntary additional 1mn b/d of production cuts will be maintained through the end of the year, while budget expenses tend to rise more rapidly in the final quarter of the year. As such, we hold to our forecast for a budget deficit equivalent to 1.9% of GDP this year, compared to a surplus of 2.5% last year (which was the first since 2014). In 2024 we expect that the budget deficit will narrow to 1.3% of GDP. At the close of September, the Saudi Ministry of Finance released its pre-budget statement for next year, envisaging a deficit of 1.9% of GDP, followed by 1.6% in 2025 and 2.3% in 2026. This stands in contrast to previous expectations of budget surpluses.

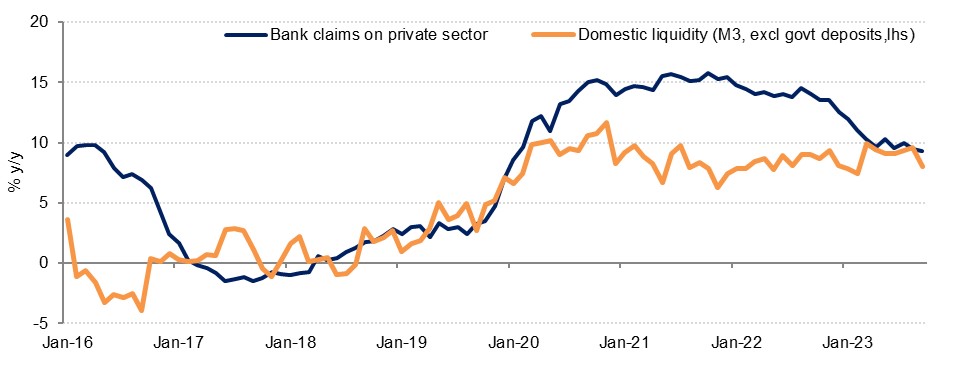

Private sector credit growth slowed slightly to 9.3% y/y in September, from 9.5% the previous month and 10.0% in July. The September figure marks the slowest pace of expansion since January 2020, as higher borrowing costs weigh on demand for credit. On a monthly basis the pace of growth was steady at 0.9%.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

Personal loans still account for the biggest share of banks’ loan books at 48.2%, but this has slipped slightly from 49.6% at the close of last year. A notable gainer has been real estate which now accounts for 9.5% of the total, from 8.9% in December 2022, while utilities now makes up 5.2%, from 4.7% previously. In terms of lending growth, information & communication logged the strongest q/q expansion at 17.2%, with finance & insurance and utilities both also registering a robust pace. Annually, education was the fastest growing sector, followed by utilities, and professional, science, technology activities.

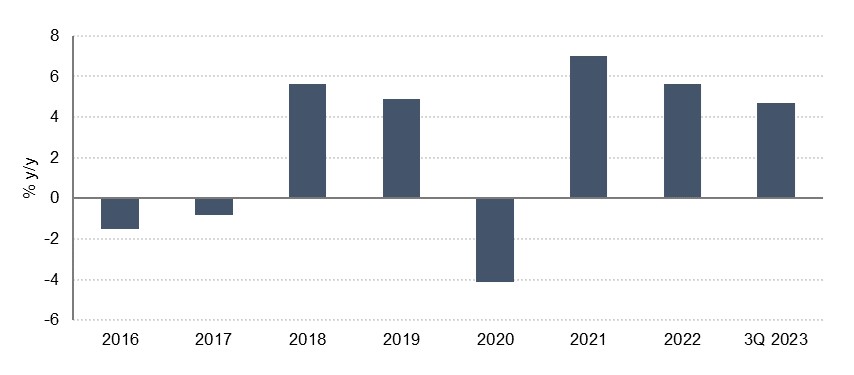

Consumer loans registered q/q growth of 0.1% in Q3 but were actually down 0.8% on the previous year. All categories of consumer loans declined y/y in Q3 except for education (16% y/y) and tourism and travel (14% y/y). Credit card loan growth has been steady at around 20% y/y since the start of this year. Consumer spending (estimated by ATM cash withdrawals and point of sales payments) was up 4.7% y/y over January to September. This outpaced annual CPI inflation which averaged 2.7% over the period, indicating real growth in household consumption over the first three quarters of the year.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

Annual credit growth outpaced broad money supply growth which slowed to 8.0% y/y in September, after the two were broadly in line in August. On a monthly basis, money supply contracted 0.4% m/m in September, the first decline since May. Narrow money (M1) increased 0.7% m/m in September after contracting the two previous months, and the decline in broad money was driven by a 6.9% m/m fall in FX deposits and other quasi monetary deposits.

Total bank deposits were up 8.3% y/y in September but registered a 0.4% decline from August’s levels. The growth continues to be driven by government entities, both in demand deposits and time and savings deposits. Higher interest rates are encouraging strong growth in time and savings deposits which are up 49.4% y/y in September, compared with an average annual growth rate of 7.8% over the three years to December. Demand deposits fell 4.8% y/y as they continue to be drawn down by business and individuals (down 6.9% y/y) while government entities’ demand deposits were up 7.7%.

Government deposits at SAMA rose SAR 60.7bn in September compared with August, likely boosted by the ARAMCO dividend payment on September 10. They were still down 30.2% y/y, however, with Saudi Arabia having reported a USD 16.6bn balance of payments deficit in the first half.

Net foreign assets at SAMA rose USD 12.8bn in September to USD 420.3bn, a three-month high. This was still down 6.0% y/y, however. On the other hand, net foreign assets at commercial banks declined by USD 5.3bn in September but were still up 17.2% y/y, leaving total net foreign assets in the banking system down 6.0% y/y at USD 432.8bn.