Saudi Arabia announced that it will cut exports by 500k/d day next month as it seeks to shore up oil prices. The announcement was made on the sidelines of an OPEC meeting in Abu Dhabi. While there is no indication that there will be a multilateral change in direction for the time being, the group’s statement highlighted the mounting risks, stating: ‘2019 prospects point to higher supply growth than global requirements, taking into account current uncertainties’…that ‘may require new strategies.’ This raises the possibility of a change in policy following the major meeting to be held in Vienna in December.

The FOMC unanimously voted to hold the federal funds rate at 2.0%-2.25% on Thursday, as had been widely anticipated. One notable takeaway was the committee’s observation that the ‘growth of business fixed investment has moderated from its rapid pace earlier in the year’ – it offered no explanation of this, but concerns over trade wars is a likely cause. Nevertheless, no mention was made of recent weaker housing data or market volatility, and there was little change in tone to suggest that the Fed’s dot plot would change from predicting three hikes next year. A December hike carries a 93% market probability, but 2019 looks more uncertain, with the market predicting two hikes next year.

UK GDP expanded by 0.6% q/q in Q3, the fastest pace since 2016. On an annualised basis, the expansion rate was 1.5%. While these growth figures are positive, they belie somewhat the underlying health of the UK economy given that much of the growth was driven by short-term and one-off boosts.

Saudi Arabia announced that it will cut exports by 500k/d day next month as it seeks to shore up oil prices. The announcement was made on the sidelines of an OPEC meeting in Abu Dhabi. While there is no indication that there will be a multilateral change in direction for the time being, the group’s statement highlighted the mounting risks, stating: ‘2019 prospects point to higher supply growth than global requirements, taking into account current uncertainties’…that ‘may require new strategies.’ This raises the possibility of a change in policy following the major meeting to be held in Vienna in December.

Inflation ticked up once more in Egypt in October, with headline CPI rising from 16.0% y/y in September to 17.7%, and core inflation from 8.55% to 8.86%. Subsidy cuts enacted at the start of the fiscal year have driven up prices, even as the currency has remained stable. The faster-than-expected price growth raises problems for the central bank prior to its MPC meeting next week. While continued rate-cutting was already likely off the cards for the remainder of the year, resurgent inflation, coupled with an ongoing decline in portfolio inflows, raises questions over whether they should renew hiking.

UST yield curve flattened as the outcome of the US mid term election with Republicans losing control of the house raised prospect of more checks and balances in place in the US politics. Yield on 2yr, 5yr and 10yr closed the week at 2.92% (+2bps w/w), 3.03% (+1bp, w/w) and 3.18%(-2bps, w/w) respectively. Yields in Europe were generally down with 10yr Gilt yields closing down a bp to 1.49% in the face of Brexit stalemate.

Global credit spreads were largely range bound with CDS levels on US IG closing marginally higher at 67bps and that on Euro Main closing down a bp to 70bps.

Despite the bearish oil market, CDS spreads on local GCC sovereigns were stable with Saudi Arabia and Abu Dhabi 5yr CDS levels closing the week mostly unchanged at 93bps and 66bps respectively. Credit spreads on bonds also remained mostly unchanged with average OAS on GCC bond index remaining at 1.67% and yield at circa 4.68% through out the week.

Catalysed by policy makers at the Federal Reserve paving the way for a December rate hike, the dollar recovered from its earlier declines in the week to finish higher against most of the other major currencies. Over the last five trading days, the Dollar Index closed 0.38% higher at 96.905, closing above the 200-week moving average for a third consecutive week. Of note is that this is key level (95.846) acted as a support earlier in the week and prevented further declines. While the price stays above this level, a retest of the one year high of 97.200 remains a possibility. A break and daily close above may lead to further gains for the index, approaching the 76.4% five year Fibonacci retracement of 97.940.

Global stocks are facing pressure again, from China and worries that the most recent earnings season could prove to be a peak. Global equity bourses staged a mixed performance last week. US Indices were generally in the red while shares are registering modest gains in Japan, Hong Kong and China and little changed in Australia and South Korea this morning.

Bearish oil prices are affecting the sentiment on regional equities. Tadawul was down 0.4% followed by DFM in the red by -0.3%.

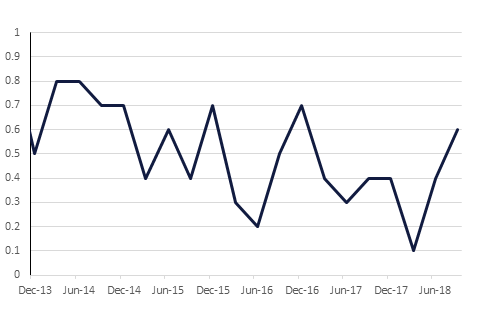

Brent futures fell to USD 70.18/b at the close of the week, a 3.6% w/w fall and the lowest level since April, as the market adjusted to the news that waivers on Iranian oil imports would be greater than anticipated, and concerns rose over future demand growth. Meanwhile, WTI fell 4.7% over the same period to USD 60.19/b, also a multi-month low, as we saw record production of 11.6mn b/d, and stockpiles rose to 5.8mn b/d. Ongoing transport constraints in the US have kept the spread between the two benchmarks wide.