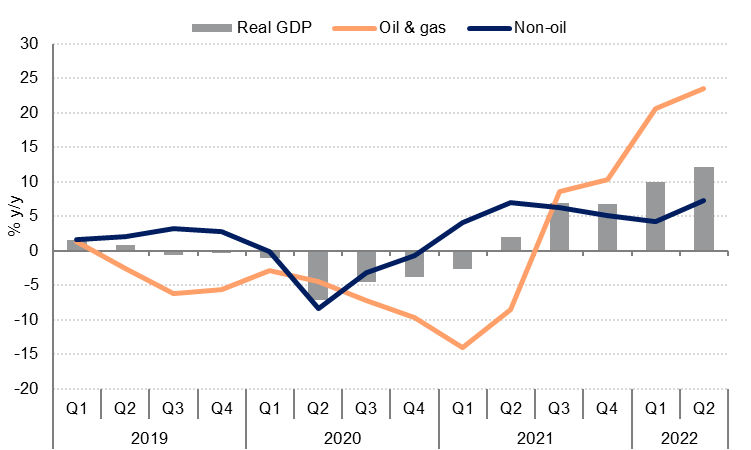

Saudi Arabia’s economy grew at a faster than expected 7.3% y/y in Q2 2022, following a 4.2% y/y expansion in Q1. While most of this was due to the 23% y/y growth in oil and gas GDP, the non-oil sectors (both private and public) grew 6.8% y/y last quarter even off last year’s high base. The fastest growth in the non-oil sector was for trade, restaurants and hotels (16.4% y/y) followed by non-oil manufacturing (12.1% y/y), construction (8.8% y/y) and transport, storage & communication (7.7% y/y).

The PMI data for July and August suggests that private non-oil sector growth has remained robust in Q3, despite higher interest rates. An expected budget surplus this year means that public sector infrastructure projects and other (off-budget) investment will likely continue even as borrowing costs keep rising into 2023 – we expect the Fed to raise rates to 4.25% by December with another 50bp pencilled in for H1 2023.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

Saudi consumers also appear to be in relatively good shape. While point of sales data show a slowdown in spending to 4.4% in the year to July, this still implies real spending growth of around 2%. Inflation in the kingdom has been relatively low by global standards so far this year, averaging 2.2% in the year to August. However, the annual inflation rate has accelerated in recent months, reaching 3.0% y/y in August from 1.2% at the start of the year. This has been due to rising housing costs over the last three months, as well as increasing transport costs. Services inflation has also accelerated in recent months particularly for hospitality and recreational/ leisure services.

Overall, we retain our forecast for real GDP at 7.7% in 2022, slowing to 3.5% in 2023 as oil production growth is expected to slow sharply next year. Non-oil sector growth should continue to be underpinned by investment. There is some downside risk to our 2023 growth forecast if OPEC+ intervenes to reduce output in the face of weakening oil demand next year, and as higher borrowing costs could weigh on consumption.

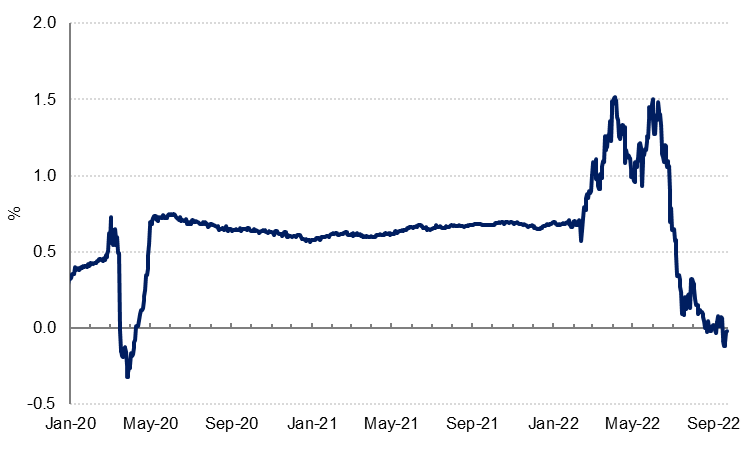

Liquidity conditions in the Saudi interbank market have improved significantly since the central bank started to intervene in June through open market operations. The 3m SAIBOR spread over 3m USD LIBOR is now slightly negative, after reaching a peak of 150bp at the end of May.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Money supply growth slowed slightly to 8.1% y/y in July and was still outpaced by private sector credit growth of 13.8% y/y. Claims on public sector entities grew 25.6% y/y in July after slowing in Q2. Net foreign assets stood at USD 446.3bn at the end of July, just USD 8.1bn higher than at end 2021, despite a sizeable budget surplus of over USD 36bn in H1 2022. Saudi Arabia has likely deployed some of the H1 surplus to support oil importing countries in the MENA region with central bank deposits, import guarantees and through foreign direct investment. The kingdom has also likely transferred some of the budget surplus to the Public Investment Fund to invest both abroad and domestically.

With oil production reaching almost 11mn b/d in August according to Bloomberg estimates, we expect a sizeable budget surplus in H2 even as oil prices have eased from their June 2022 highs. We retain our forecast for a budget surplus of 10.4% of GDP in 2022, narrowing to 7.3% in 2023.