.jpg?h=4000&w=6000&la=en&hash=505534C8127096E3FF3B73C674420981)

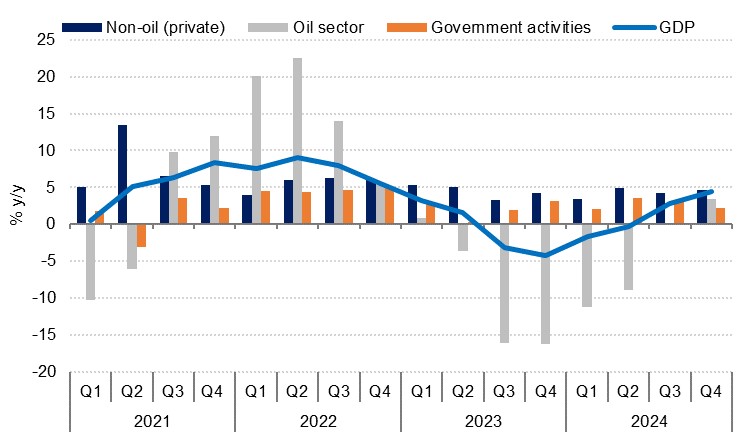

Saudi Arabia recorded real GDP growth of 1.3% in 2024 according to the flash estimate from the General Authority for Statistics. With oil production curbs still firmly in place through 2024, growth was driven by a 4.3% expansion in non-oil activity (beating our predicted 4.0%) while oil GDP shrank by 4.5% (greater than our forecast of a 4.0% contraction). Government activities recorded 2.6% growth. In 2025 we forecast headline GDP growth of 3.3% with both the oil and non-oil sectors driving the expansion.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

There was positive momentum through the end of the year as Q4 GDP growth hit 4.4% y/y, the strongest pace of growth since Q4 2022. A major contributing factor to this was the return of oil GDP to growth for the first time since Q1 2023 as it expanded 3.4% y/y (Q3 growth was flat). There were no additional OPEC+ oil production curbs implemented through the period, meaning that those introduced 12 months earlier started to pass through into the base and no longer exert a drag on headline output. While oil production in Q4 was down by a moderate 0.6% y/y at 8.95mn b/d in Q4, from 9.00m b/d in Q4 2023, other activity related to hydrocarbons likely provided the positive growth. Condensates and natural gas production is not covered by the OPEC+ agreement, while investment in the hydrocarbons sector is also likely powering growth.

In 2025 we forecast that oil GDP will return to growth at 2.5% as oil production curbs start to be eased later in the year. We forecast oil production to average 9.2m b/d in 2025. Investment in the hydrocarbons sector will likely also underpin activity, for instance the development of the Jafurah Gas Field which is expected to come online in full in 2027 and will further boost natural gas production in the kingdom thereafter.

Non-oil sector picking up speed

The non-oil sector also ended the year strongly, expanding 4.6% y/y in Q4. This is in keeping with the indication given by the Riyad Bank PMI survey for Saudi Arabia, which strengthened to 58.1 in the final quarter, from 55.2 in the previous three-month period. Respondents to the PMI surveys have cited a strong flow of new pipeline work that supported new activity and we expect this to remain the case through 2025: our forecast non-oil GDP growth stands at 4.5%. There are more than USD 421bn worth of projects currently underway in Saudi Arabia with a total USD 146bn awarded in 2024. Private household consumption will also remain a growth driver through the year as a growing population, rising employment, and lower interest rates should all prove supportive. Over January to November 2024, monthly consumer spending in Saudi Arabia averaged y/y growth of 7.1%, far outpacing the average inflation rate over the same period (1.7% y/y) and indicative of robust real growth.