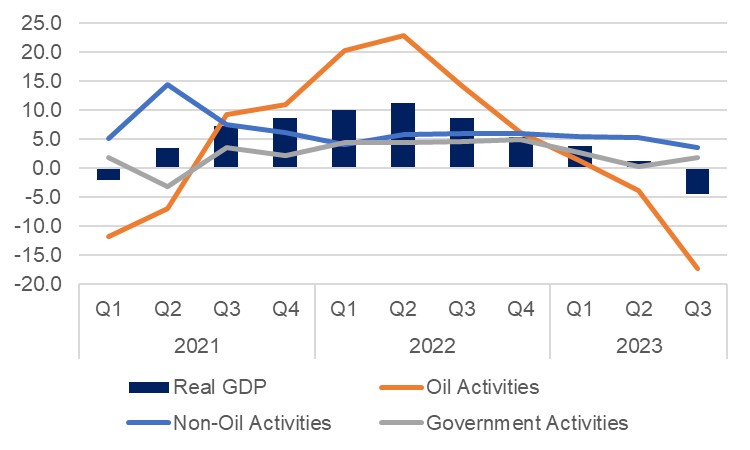

Preliminary data show that Saudi Arabia recorded a real GDP contraction of 4.5% y/y in the third quarter, compared with a 1.2% expansion in Q2. This marks the first decline in GDP since Q1 2021 but was entirely driven by the oil sector which contracted 17.3% y/y as voluntary production curbs by Saudi Arabia saw oil output average 9.0mn b/d in Q3 2023, compared with 10.9mn b/d in the corresponding period last year, a drop of 21.1%.

Source: General Authority for Statistics, Emirates NBD Research

Source: General Authority for Statistics, Emirates NBD ResearchSaudi Arabia has confirmed that it will maintain its additional 1mn b/d of cuts to keep output steady at 9.0mn b/d through the end of the year at least. This means that the oil sector will remain a drag on the economy in the fourth quarter, with crude oil production set to be 18.9% lower than it was in Q4 last year.

By contrast, the non-oil sector still looks fairly robust as it expanded 3.6% y/y, albeit somewhat weaker than in the first two quarters of the year which both saw growth of 5.3%. This is consistent with the PMI for KSA, which averaged 57.2 in Q3, down from 58.9 in Q1 and 59.2 in Q2, but still indicative of a solid expansion in the non-oil private sector.

Government services activity accelerated to 1.9% y/y in Q3, from 0.3% in Q2.

Overall, we maintain our forecast for headline GDP growth of -0.5% in 2023, reflecting the drag from the oil & gas sector. We expect that ongoing structural reforms and heavy investment into Vision 2030 projects will maintain a robust pace of growth in the non-oil economy over the coming quarters and years.

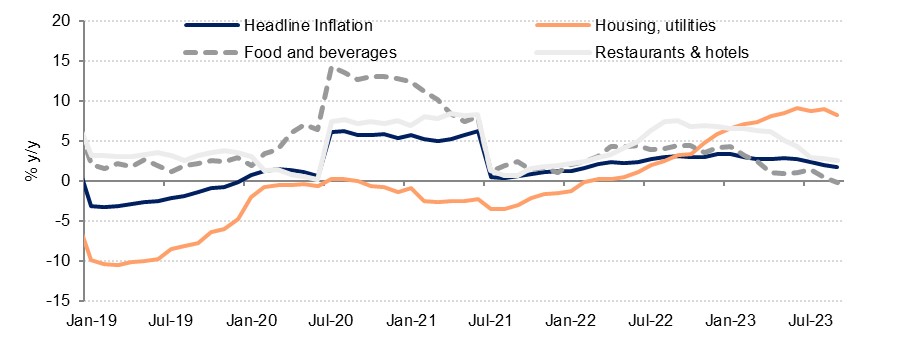

CPI inflation in Saudi Arabia slowed to 1.7% y/y in September, down from 2.0% the previous month. The fall in the headline figure was on the back of a 0.2% drop in food & beverage prices, and bigger annual declines in the price of furnishings & household equipment (down 2.8% y/y) and clothing and footwear (down 3.6%). However, house price pressures, which have been the primary driver of inflation over the past year, remained to the fore with annual housing & utilities inflation at 8.1% y/y in September and having averaged 8.0% ytd. Rents were up 9.8% y/y in September with apartment rents up 19.8%. Saudi Arabia has been facing a housing shortage, especially in Riyadh as the population expands rapidly, which has put upwards pressure on prices despite sizeable government homebuilding projects. Annual inflation has averaged 2.6% ytd, in line with our full year forecast for 2.5%.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research