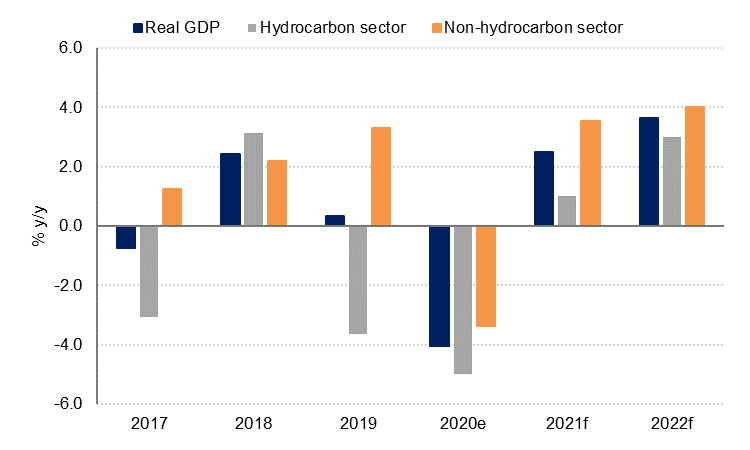

Saudi Arabia’s GDP data for Q3 2020 was stronger than we had expected, with the non-oil sectors rebounding 8.8% q/q after contracting -12.7% q/q in Q2 2020. On an annual basis however, non-oil GDP was still down -2.1% y/y. Survey data suggests that non-oil sector growth in Saudi Arabia accelerated in Q4, with the PMI averaging 54.2, the highest quarterly average since Q4 2019. As a result, we have revised up our 2020 full year GDP estimate to -4.0% from -5.2% previously.

However, Saudi Arabia’s decision to take a unilateral 1mn b/d cut in oil production in February and March means that oil sector growth in 2021 is not going to be as fast as we had expected at the end of 2020. We now estimate just 1.0% growth in the hydrocarbons sector in 2021 compared with 3.0% previously. We expect the non-oil sectors to grow 3.6% this year, yielding headline real GDP growth of 2.5%, only fractionally lower than the IMF’s latest forecast of 2.6%.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

The budget for 2021 makes provision for SAR 990bn in government spending, down -7.3% y/y from estimated 2020 spending, with current spending down -4.5% y/y mainly on cuts to subsidies, grants, social benefits and “other expenses”.

Capital spending in the budget will decline by more than -26% in 2021, or SAR 36bn (USD 9.6bn), but this will be more than offset by increased domestic investment by the Public Investment Fund (PIF). PIF will invest USD 40bn (SAR 150bn) per year over the next five years in the infrastructure and other projects in the kingdom to boost growth and create jobs. In 2020, PIF had planned to invest SAR 96bn (USD 25.6bn) domestically, so this is a significant increase. PIF’s recently approved five-year plan estimated it would create 1.8mn direct and indirect jobs by 2025 and contribute USD 320bn to non-oil GDP.

Based on the estimates for domestic investment by PIF, and assuming the plans are fully executed, total public sector investment spending (the government budget plus PIF) could be almost 8% higher y/y in 2021, providing a solid boost to domestic demand despite the headline cut in budget spending.

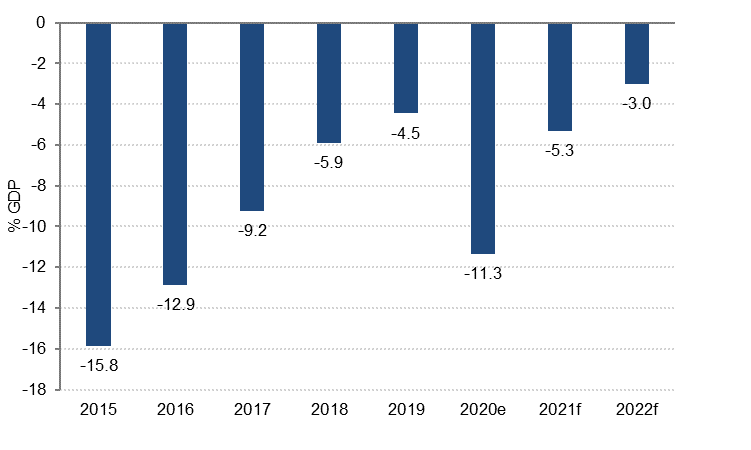

Overall, we expect a budget deficit of SAR 150.3bn (-5.3% of GDP) in 2021, slightly higher than the official forecast of SAR 141bn (-4.9% of GDP). The budget statement indicates that around 60% of the deficit will be financed by debt (both domestic and international), which equates to SAR 90bn or USD 24bn on our forecast. If we assume that 40% of this debt is raised on international capital markets, that would imply total external debt issuance this year of around USD 10bn. Saudi Arabia raised USD 5bn in bonds earlier this week. However in addition to deficit financing, the kingdom as a USD 5.5bn bond maturing on 26 October 2021, which suggests the kingdom could tap capital markets again this year for at least another USD 10bn.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

Headline inflation surged to 6.1% y/y in July and August on the back of higher customs duties and VAT, after averaging just 1% in H1 2020. Average CPI for 2020 was likely 3.5%, up from -2.1% in 2019.

With the tax increases now in the base, we expect the headline rate to slow sharply in H2 2021 but remain in positive territory. We expect inflation to average 2.0% this year.