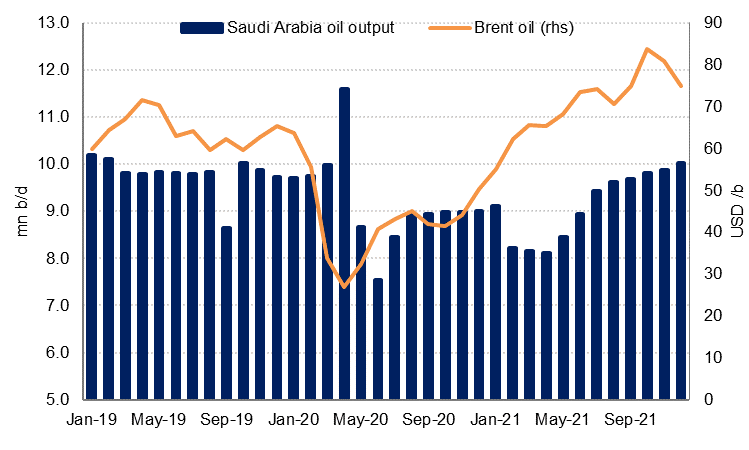

Saudi Arabia’s oil production increased to 9.0mn b/d in June according to Bloomberg data, up 490k b/d from May as the kingdom started to unwind the extra production cuts from February. Oil production in H1 21 averaged just 8.5mn b/d however, around -7.7% lower than average 2020 production. Production is likely to have increased again in July in line with what OPEC+ had agreed in May, but the current failure of OPEC+ to agree on further production increases from August means that oil production in 2021 is likely to remain below the 2020 average of 9.2mn b/d. Oil sector growth is thus likely to be a drag on Saudi Arabia’s GDP growth this year, but to a smaller extent than we had anticipated a few months ago.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

The risks to non-oil sector growth appear skewed to the upside of our 4% forecast. Non-oil GDP grew 2.9% y/y in Q1 2021 and the low annual base for Q2 points to a stronger reading in Q2 2021. The PMI survey for Q2 2021 averaged 56.0, the highest quarterly reading since Q4 2019. Output and new order growth have been strong and employment in the private sector has started to recover as well. Data for Q1 show the unemployment rate for Saudi nationals fell to 11.7% from a Covid-peak of 15.4% in Q2 2020, and the employment component of the June PMI survey rose to 51.1, the highest reading since November 2019.

We have revised our oil sector growth forecast up to -2.5% from -4.0% previously, following the sharp rise in oil production in June-July, taking headline GDP growth in 2021 to 1.3% from 0.7% previously. If OPEC+ does reach an agreement to boost production from August, then headline GDP growth could be higher still.

Inflation in the kingdom remains high, accelerating to 5.7% y/y in May. However this is still largely due to tax hikes in June and July 2020 which will fall into the base over the next two months. Consequently, we expect to see headline inflation slow sharply in H2 21. Within the CPI basket, transport costs have increased at the fastest rate, almost 20% y/y in May on the back of higher oil prices this year. The government has announced that it has set a ceiling on domestic petrol prices at the June level, and will absorb any further increase after June. Housing costs, which account for 20% of the CPI, have declined on an annual basis since October 2020, and food price inflation is slowing as well. We expect average inflation at 3.0% this year from 3.4% in 2020.

The current account surplus widened in Q1 2021 to USD 8.7bn or 4.6% of GDP from 1.2% in Q4 2020. However, this was offset by outflows on the financial account of around USD 15bn. Inward FDI to Saudi Arabia reached USD 1.8bn in Q1 2021, slightly less than in Q4 2020, but this was dwarfed by FDI abroad of over USD 11bn, more than double what was invested abroad in the whole of 2020. Net portfolio investment (abroad) increased to USD 11bn in Q1 21, up 49% y/y. Net foreign assets at the central bank declined further in April and May, even as the current account surplus likely increased, indicating that Saudi entities continued to invest abroad in Q2 2021.

Source: Haver Analytics., Emirates NBD Research

Source: Haver Analytics., Emirates NBD Research