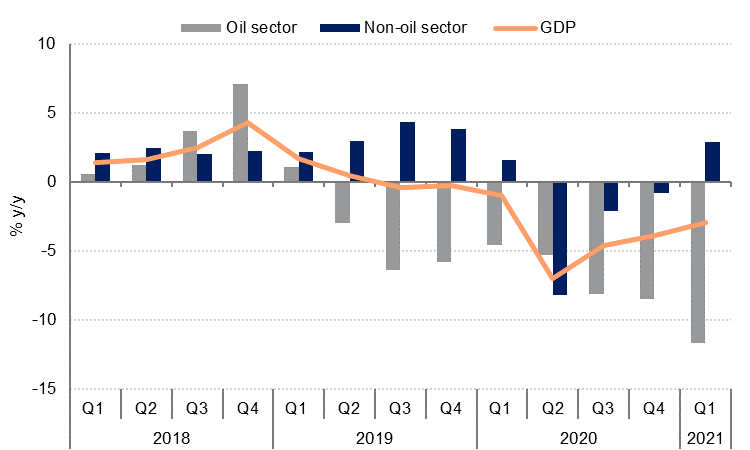

Saudi Arabia’s non-oil sectors grew just 0.1% q/q and 2.9% y/y in Q1 2020, according to preliminary data. Manufacturing grew almost 12% off last year’s low base, although this was partly due to strong growth in oil-related manufacturing. Utilities, trade & hospitality and financial services all posted solid y/y growth in the first quarter of this year, but the q/q metrics were weaker, likely due to tighter Covid-related restrictions that were re-imposed in February.

PMI data had pointed to a recovery in the non-oil sectors in Q1 21 and the surveys for April and May suggest that the pace of growth accelerated in Q2. We expect non-oil GDP growth to accelerate at a double-digit rate this quarter off the low annual base (recall the kingdom was in lockdown in Q2 2020) before moderating in H2 2021. At this stage we retain our 4.0% non-oil growth estimate for 2021, but we recognise that the risks to our forecast are skewed to the upside.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

The oil sector contracted -8.8% q/q and -11.7% y/y in Q1 2021 as the kingdom made additional production cuts in February. Consequently, headline GDP contracted -3.6% q/q and -3.0% y/y in the first quarter of this year. While these cuts are being gradually unwound, OPEC+ appears to be taking a conservative stance on output, and as a result we expect the oil sector to be drag on headline GDP growth through 2021. We retain our forecast of 0.7% real GDP growth in Saudi Arabia this year and expect growth to accelerate to over 6% in 2022 on higher oil production and a faster non-oil sector growth.