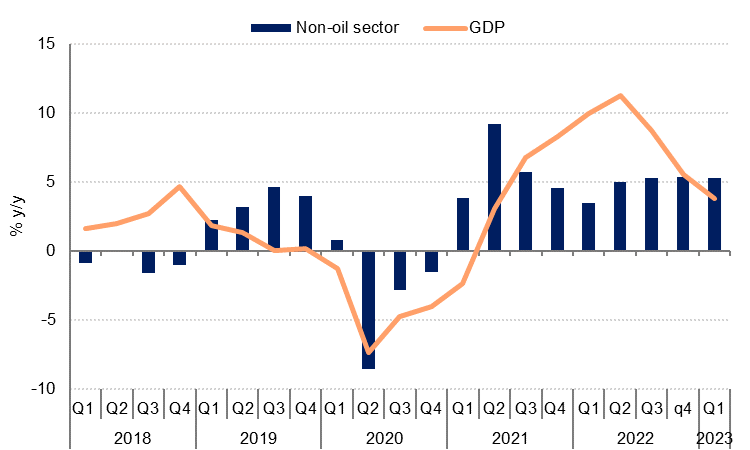

Saudi Arabia’s economy slowed to growth of 3.8% y/y in Q1 2023, slightly lower than the preliminary estimate of 3.9%. On a seasonally adjusted basis, real output contracted -1.4% q/q, largely on the back of declining crude oil and natural gas production.

Non-oil sector growth remained robust at 5.3% y/y in Q1 2023, unchanged from Q4 and Q3 2022. The transport, storage and communication sector grew 9.3% y/y, while trade, restaurants and hotels saw real output growth accelerate to 7.5% y/y. The construction sector also posted stronger growth in Q1 at 5.5% y/y. Finance, insurance and real estate growth slowed last quarter to 2.8% y/y from 3.9% in Q4 2022. Government services, which account for around 14% of total GDP, grew 4.9% y/y in Q1 – the fastest pace of growth in this sector since 2018.

On the expenditure side, consumption accelerated to 7.8% y/y from 4.5% in Q4 2022, driven by a surge in government consumption (16.2% y/y). Budget data for Q1 showed government spending on goods and services rose 70% y/y. Private consumption growth also picked up to 3.9% y/y but was weaker than in H1 2022.

Gross fixed capital formation has maintained its recent strong growth, although slowing slightly from Q4 at 17.6% y/y in Q1 2023. This reflects a sharp increase in investment spending in the kingdom since the start of 2022. Again, the budget data for Q1 shows a jump of 75% y/y for government investment spending, but private investment was likely a key contributor to fixed capital investment as well.

Net trade contributed positively to overall GDP growth in Q1 (reflecting a trade surplus). Export growth slowed to 2.0% y/y (likely reflecting weaker oil and gas exports) while import growth rose 11.2% y/y.

Although we have revised our forecasts for overall GDP growth lower to -0.5% in 2023, this is entirely due to the voluntary oil production cuts announced in April and which will be extended from July. We have assumed that the additional 1m b/d in production cuts from July will be extended through the end of the year; if these cuts are unwound in H2 then this would boost headline GDP growth in 2023.

We remain optimistic that non-oil sector growth will remain robust this year, as PMI surveys indicate strong domestic demand as well as robust external demand in the first five months of this year. The Riyadh Bank PMI averaged 59.0 through May, much higher than the 55.5 average in Jan-May 2022. There is likely upside risk to our 4.8% y/y non-oil sector growth this year, with the IMF recently indicating that growth in H1 2023 is tracking above 5%. Indeed, the Fund described the Saudi economy as “booming” after a recent staff visit to the kingdom.

Strong non-oil sector growth has been driven by significant structural reform in the kingdom over the last few years and an increase in investment post-pandemic. This is necessary to meet the Vision 2030 objectives as well as to create opportunities for young Saudis who will be entering the labour market in the coming years.

The latest census data (2022) puts the size of the population at 32.18mn in 2022, making it somewhere around the 40th largest in the world. This compares with 24.0mn when the census was last carried out in 2010, marking a 34.2% increase over the period and an annual growth rate of 2.5%. This makes Saudi Arabia the fastest growing population in the G20 by some margin in recent years. Of the gain in the population since the last census, 4.8mn were Saudis, contributing to the young age of the Saudi population with the median at just 22 years. Within the Saudi population, 63% are under the age of 30, meaning many citizens will be reaching working age in the coming years.

The Saudi government is well aware of this potential demographic pressure on the labour force, and this partly explains the economic shift undergone in recent years, where a host of new more labour-intensive industries such as hospitality and tourism have been encouraged to flourish and Saudis have been encouraged, through the Saudisation strategy, into jobs previously occupied by immigrant workers.

In December, the government launched the second phase of its Tawteen programme which earmarked 170,000 new jobs to be created, 30,000 of which will be in the tourism sector. The National Tourism Strategy aims at creating 1mn new jobs in the industry over the coming years as the sector develops. Faisal bin Fadel al-Ibrahim, minister of economy and planning, noted on the census’s release that ‘its outputs will be a key pillar for planning and decision making, developing economic and social policy, creating development plans for various sectors and services, and supporting the investment environment in the Kingdom and achieving the Vision 2030 goals.’

The split between Saudis and non-Saudis in the population stood at 58.4% to 41.6% in 2022, or 18.8mn to 13.4mn (this is down from a non-Saudi peak of 14.6mn in 2016). The bulk of these foreign inhabitants come from Bangladesh, India, Pakistan, Yemen, Egypt, Sudan, and Philippines. The division in the labour market remains quite different, however, with two thirds of the workforce in the country still non-Saudi. This skew towards a high proportion of foreign workers means that the median age of the non-Saudi population is far higher, at 34 years old, and 91.8% of non-Saudis are in the working age bracket of 15-64.

The high proportion of foreign workers also has implications for the gender balance in Saudi Arabia – while Saudi males and females are almost equal in number in the working age bracket, for non-Saudis there are 3.9 males for every female, leading to a headline division of 1.84 to 1.0. For the population as a whole, 61.2% are male and 38.8% female.

The ar-Riyadh region has the largest non-Saudi population, at 48.3% (compared with 25.9% in al-Bahah, the lowest), which is reflective of the capital district’s pre-eminence in the country’s economy – according to Invest Saudi, ar-Riyadh constitutes nearly 50% of Saudi Arabia’s non-oil GDP. It is the most populated area of the country also, accounting for 26.7% of the total, and 75.7% of the population are of working age, the highest rate in the country. Urbanisation is an ongoing trend in Saudi Arabia, albeit at a slower pace in recent decades. According to the census, 73.5% of the population now live in cities with greater than 100,000 inhabitants, with the United Nations putting the urban population at 85% in 2021, compared with 77% in 1991 and 67% in 1981.