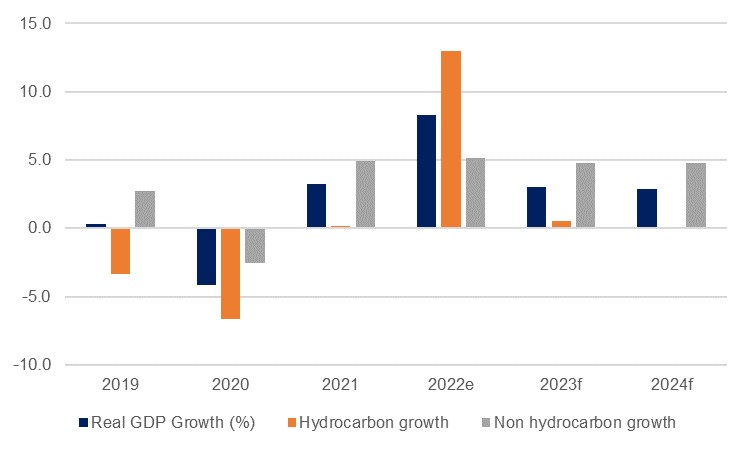

We estimate that Saudi Arabia recorded real GDP growth of 8.3% last year, which would have made it one of the strongest-performing economies in the world. Much of this was driven by robust oil production growth, with oil output averaging 10.5mn b/d according to Bloomberg estimates, representing a y/y gain of 15.5%. In the latest available print, Q3 GDP growth was at 8.8% y/y and 2.1% q/q. The oil sector remained the primary driver of growth as it expanded 14.2% y/y, while non-oil growth was at 6.0% and government activities at 2.5%. This data informs our estimate of 13.0% real growth in hydrocarbon GDP in 2022. However, it was not only the oil economy that performed strongly, with non-oil GDP expanding 5.1% over the year according to our estimates, backed up by a PMI survey that averaged 56.5, compared with 55.8 in 2021. The November PMI survey was a seven year high for the index.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

This year, we expect that the dynamics of growth will be reversed, with the non-oil sector taking the lead as oil production gains are expected to be lesser as compared with those seen in 2021. We forecast that Saudi Arabian oil production will be broadly unchanged from 2022 levels as the year begins with OPEC+ production curbs in place once more. On the back of this we forecast that Saudi oil GDP will slow to 0.5% growth this year, and remain flat in 2024. Non-oil GDP growth meanwhile is expected to remain strong, albeit coming slightly off 2022’s levels; we forecast an expansion of 4.8% this year and next.

This growth in the non-oil sector will be underpinned by ongoing government investment and spending as the authorities continue to develop their giga projects and broader infrastructure targets as related to the Vision 2030 development and diversification programme. Capital spending in the budget rose by nearly 30% in 2022, and the 2023 budget provisions for a further 4% increase, which is in addition to the investment spending off the budget by the Public Investment Fund and other government related entities; PIF has committed to spending USD 40bn a year in Saudi Arabia through 2025. In this environment, private sector firms retain a high level of business confidence according to the PMI survey and have been hiring at the fastest rate in years.

Saudi Arabia has significant fiscal firepower with which to continue investing heavily in the domestic economy; while oil prices have receded in recent months on the back of recession fears, we maintain our view that prices will average higher this year than last, with a forecast USD 105/b for Brent futures, driven by market tightness in the second half. We estimate that Saudi oil exports rose 166% to USD 323.8bn in 2022, and that they will remain high at USD 343.4bn in 2023.

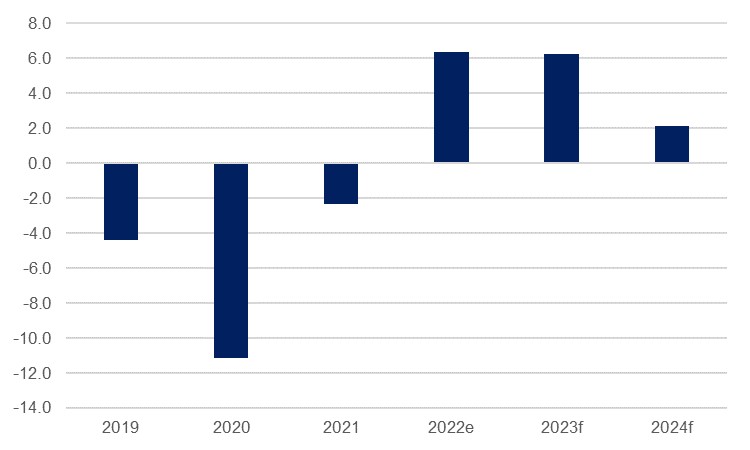

Strong oil exports will continue to boost government coffers, and we see budget revenues at 35.1% of GDP this year, down just modestly from 35.8% last year. This compares to an average 27.7% over 2015-2021. Last year we estimate that Saudi Arabia posted its first budget surplus since 2013 at 6.4% of GDP, and we expect the surplus to be similar this year at 6.2% before narrowing, but remaining positive, at 2.1% in 2024.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

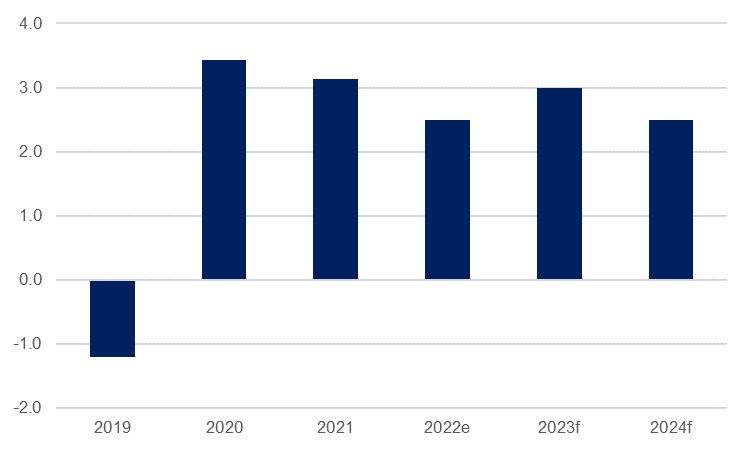

We forecast that inflation will average 3.0% in 2023, which would mark a slight acceleration over 2022, when price growth averaged 2.4% over January to November. Our expectation is that strong domestic demand as the non-oil sector enjoys investment growth will drive an uptick in headline inflation this year, before slowing to 2.5% once more in 2024. Recent PMI surveys have shown an increase in staff costs in Saudi Arabia. Nevertheless, this inflation rate is more favourable than seen in much of the rest of the world, where CPI baskets have been far more susceptible to the spikes in global commodity prices. In Saudi Arabia the fuel price cap will continue to soften any energy related inflation drivers even as we expect oil prices to tick up once more through the course of the year.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

While the oil economy will remain hugely important for Saudi Arabia over the next several years, we do not expect that it will be the dominant growth driver as it was in 2022. Rather, we expect that the key growth sectors will be related to Saudi Arabia’s Vision 2030 diversification programme, and in particular, construction, tourism, and entertainment & hospitality.

For construction, growth will be supported by significant government investment, both through the budget and through PIF and other government related entities. There are five giga projects underway in Saudi Arabia, not least the Neom development, in addition to the Diriyah, Qiddiya, Red Sea and Roshn developments. According to the Riyad Bank PMI survey, firms in the sector have been ramping up hiring as they look to deliver on these and other smaller developments: it is not only the headline-grabbing projects underway in KSA, but the Kingdom is also aiming to build 300,000 new homes over the course of four years from March 2022, boosting home ownership by its citizens to 70%. According to the US-Saudi Business Council, the value of contracts awarded over the first three quarters of 2022 totaled USD 31.9bn, representing y/y growth of 67%. Construction averaged y/y real GDP growth of 4.6% over Q1-Q3 last year, compared to 1.5% over the corresponding period in 2021.

Tourism will be a key growth sector in Saudi Arabia as the wider industry (as apart from religious tourism) develops from a very low base following the country’s opening up to tourists several years ago, especially if ambitious government visitor targets are reached. Respondents to the Riyad Bank PMI survey have cited higher tourism levels as helping to drive growth in their new orders which will sustain growth through the coming years. High profile advertising slots around the world during the course of the FIFA World Cup at the close of 2022 will have helped generate further interest, while ongoing regulatory reform will help make it an increasingly attractive destination: Saudi Arabia has announced that it is launching its own short-stay rental platform.

International airlines are adding new routes to Saudi Arabia, while hosting major sporting events will further boost numbers, and publicity. Meanwhile, with the pandemic crisis receding, Hajj numbers are set to return to pre-Covid levels, which will provide a further shot in the arm to the sector this year. The trade, restaurants & hotels component of GDP maintained a strong pace of growth in 2022, averaging 9.2% over the first three quarters, compared with 10.7% in 2021.

Related to the tourism sector, we also expect that entertainment and hospitality will be a key sector to watch in the coming years, as it will also enjoy a significant boost from domestic demand. The relaxation of social restrictions has seen a boom in the range of entertainment and hospitality venues available to Saudi Arabian citizens, leading them to increasingly spend their money at home rather than abroad. Coffee shops, restaurants, theme parks, and cinemas are all proliferating, offering substantial employment opportunities and likely to support construction growth in the coming years. Aside from building new cinemas, Saudi Arabia is also increasingly moving into film production.

Saudi Arabia launched a new industrial strategy in October 2022 in a bid to boost investment in the manufacturing sector and create jobs in the kingdom. The National Industry Strategy aims to triple industrial output and raise the value of industrial exports to USD 149bn by 2030. The number of factories in the kingdom is expected to triple by 2035 and additional investment in the sector could reach USD 345.9bn.