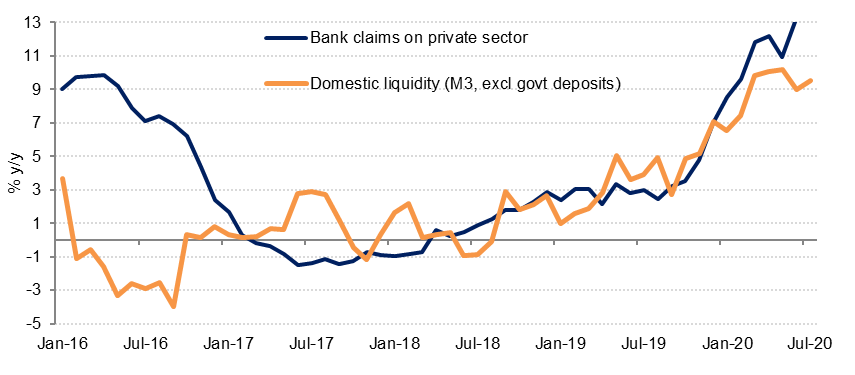

Broad money supply growth in Saudi Arabia accelerated to 9.5% y/y in July from 9.0% y/y in June, although on a m/m basis M3 contracted for the second month in a row. Private sector credit growth also accelerated last month, rising 0.8% m/m and 13.5% y/y, the fastest rate of annual growth since October 2014.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

Total public sector borrowing grew 19.0% y/y in July, slightly slower than in June. Much of this was due to increased government bond issuance to finance the budget deficit. Bank claims on government grew 20.8% y/y in July, in line with the average growth seen this year. SAMA’s balance sheet also shows a -SAR 12bn (USD3.2bn) decline in the government’s current account in July, although the government reserve account increased slightly (SAR 2bn).

Net foreign assets at SAMA increased by USD 429mn to USD 443.4bn in July, around USD 50bn lower than at the end of 2019.

The value of point of sales (POS) transactions declined -15% m/m in July even as the VAT rate increased to 15% from 5% on 1 July. On an annual basis however, POS transaction values were one-third higher than in July 2019 despite the increase in consumption taxes and customs duties in recent months. However, to some extent this growth may reflect a shift from cash to card spending as consumers increasingly shop online.