SAMA’s net foreign assets rose by USD 7.8bn to USD 444.6bn in March, likely buoyed by the proceeds of the EUR 1.5nm Eurobond issue in late February and higher oil export revenues, which is mirrored in the USD 7.7bn rise in government deposits at the central bank in March. However, for the whole of Q1 21, net foreign assets at the central bank declined -USD 4.5bn.

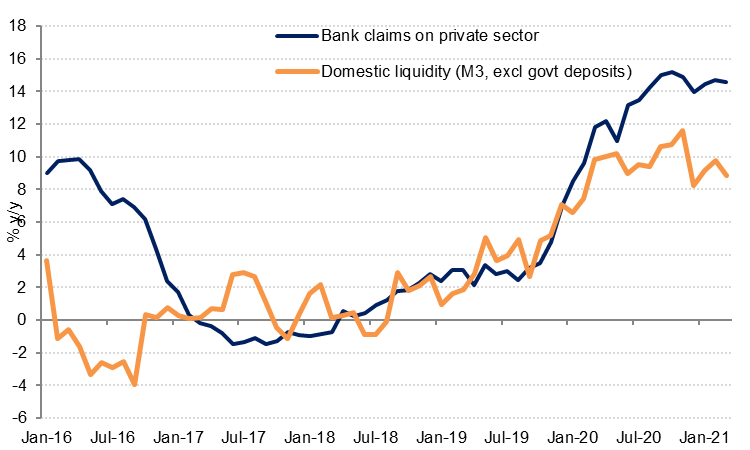

Money supply growth slowed to 1.2% m/m and 8.9% y/y in March, the slowest annual growth rate since February 2020. We expect M3 growth to continue to slow in Q2 21 off a high annual base, as central banks pumped liquidity into the financial system during the peak of the pandemic lockdowns in Q2 20.

Private sector credit growth has remained remarkably steady in recent months, reaching 14.6% y/y in March compared with 14.7% y/y in February and 14.4% in January. Public sector borrowing slowed sharply to 9.8% y/y in March, from 11.5% y/y in February and 17.8% y/y in January. Consumer loan growth has accelerated since H2 2020 and stood at 13.1% y/y at the end of the first quarter, the fastest growth since 2013. However, credit card spending was down -12.5% y/y in Q1 21 to the lowest level since mid-2019.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

Point of sale (POS) transactions rose sharply in March after declining m/m in January and February. The value of POS grew almost 65% y/y in March. The annual growth rate will likely be even higher in April as the kingdom was in lockdown during April 2020 and POS transactions fell by a third. When ATM withdrawals are added to the value of POS transactions, it appears as if consumer spending grew 25% m/m and almost 17% y/y in March. While this is a volatile series, average growth in consumer spending in Q1 was just over 2% y/y.

Overall, the Q1 money and banking indicators point to an improvement in the kingdom’s external accounts and strong domestic demand.