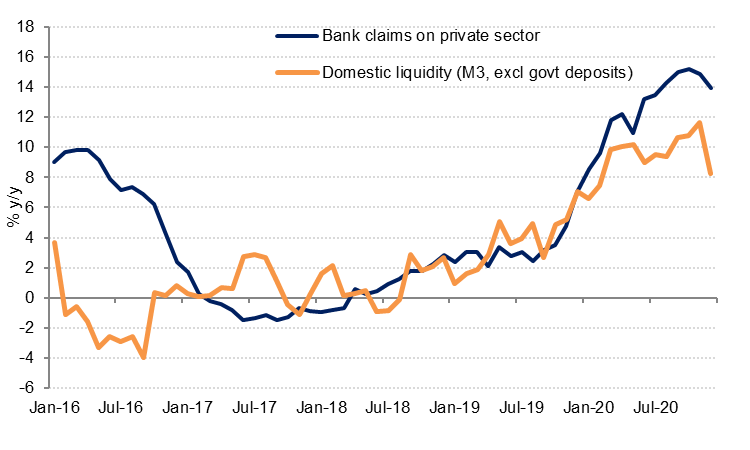

Broad money supply growth in Saudi Arabia slowed to 8.3% y/y in December, the slowest growth rate since February, despite rising 0.5% m/m. This is partly due to a high base in December 2019. However, quasi money growth declined -2.1% m/m and -5.2% y/y reflecting a decline in FX deposits and other quasi monetary deposits in December.

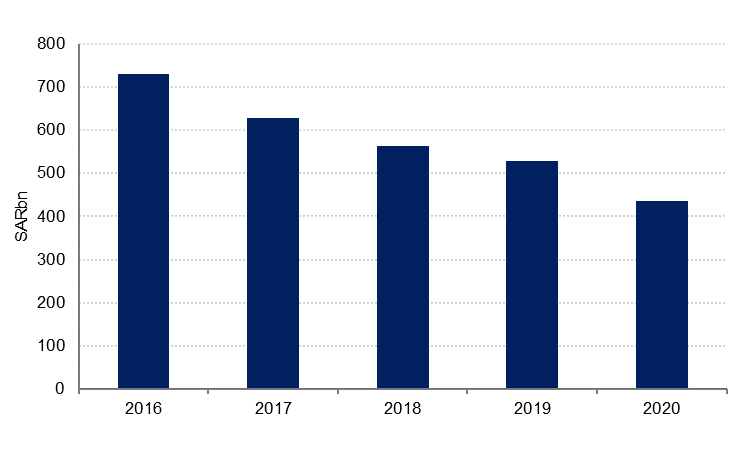

Government deposits (current account plus reserve account) at the central bank declined -8.1% m/m and -17.5% y/y to reach SAR 437bn in December. Government institutions’ deposits at SAMA also fell in December after rising sharply in November.

The steady decline in government deposits at the central bank over the last few years reflects both the drawing down of these deposits to finance budget deficits as well as the transferring of funds to the Public Investment Fund for investment, and other government institutions.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

Private sector credit growth also slowed in the last two months of 2020, easing to a still strong 14.0% y/y in December from a 2020-peak of 15.2% y/y in October. Public sector borrowing accelerated to 16.6% y/y at the end of 2020, the fastest growth rate since August.

Net foreign assets at the central bank declined –USD3bn to USD 449.2bn at the end of December, down -9.1% y/y.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

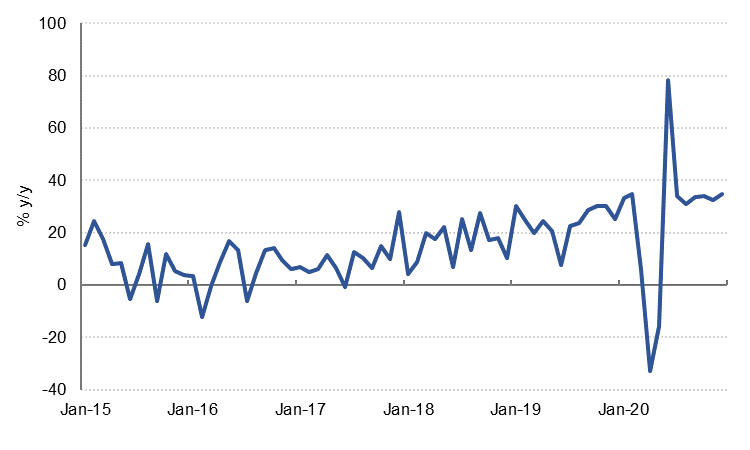

Point of sale (POS) transactions grew 9.8% m/m and 34.7% y/y in December. The rate of annual growth has been relatively steady around 33% since July, when higher VAT and customs duties came into effect. The POS transactions figure is a nominal indicator so will include the impact of inflation, as well as the sharp increase in the number of POS terminals and the accelerated shift to cashless payments in the wake of Covid-19.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research