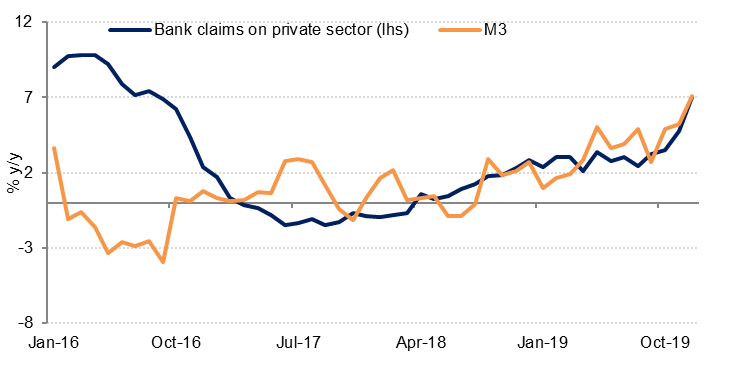

M3 growth accelerated to 7.1% y/y in December 2019, the fastest rate of growth since June 2015. While narrow money (M1) growth slowed slightly to 5.5% y/y, this was offset by sharp increase in time and savings deposits (17.5% m/m and 13.2% y/y). However, the commercial banks’ deposit data show that this was entirely due to a 43.4% m/m increase in government entities’ deposits that are likely related to the partial IPO of Aramco.

Private sector credit growth surged 7.0% y/y in December, the fastest growth rate since August 2016. The sharp rise in private sector credit in November and December likely also reflects increased borrowing by investors (including corporates) to participate in the Aramco IPO.

As a result, we expect both deposit and loan growth to moderate in Q1 2020.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

Net foreign assets at the central bank declined slightly in December but were up USD 4.5bn over the year as a whole, indicating an improving balance of payments dynamic. Data for the year to September show that while the current account surplus was smaller than in 2019, net outlfows of funds on the financial account declined significantly.