M3 growth accelerated slightly to 10.2% y/y in May from 10.0% in April and 6.6% y/y in January 2020. The main driver continues to be strong growth in narrow money (M1) with cash in circulation up 8.5% y/y and demand deposits up 15.7% y/y last month. SAMA bills and repo liabilities increased in May to SAR 90bn from SAR 60bn in April, indicating the central bank mopped up liquidity in the banking system last month.

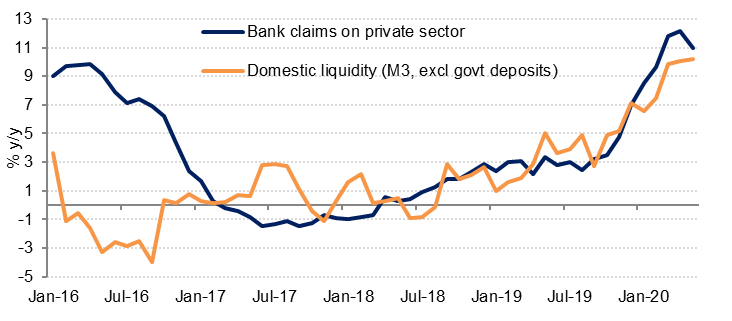

Private sector credit increased just 0.1% m/m in May, the slowest monthly rise in almost a year, while the annual growth rate slowed to 11.0% y/y from 12.2% y/y in April. Public sector borrowing rose 1.6% m/m and 18.2% y/y in May.

Central government deposits at SAMA declined by another SAR 22bn in May, bringing the total decline since the start of the year to SAR 58bn. The government’s current account balance increased last month but the drawing down of the reserve account more than offset this.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

After three months of decline, net foreign assets at SAMA rose slightly to USD 444.9bn in May. The finance ministry had indicated that transfers made to PIF in March and April had contributed to the sharp decline in NFAs in those months.

Point of sale transactions rebounded by 45% m/m in May as lockdown restrictions were eased in most of the Kingdom and as Ramadan typically boosts household spending. However, on an annual basis, the value of point of sales transactions was down almost -16% y/y. We expect sales to recover further in June ahead of the implementation of the 15% VAT rate from 1 July.

The current account of the balance of payments posted a surplus of SAR 10.7bn (USD 2.85bn) in Q1 2020, down almost -80% y/y. This is likely to have moved into deficit in Q2 as oil prices declined further in April and as new production cuts came into effect in May.