Saudi finance minister Mohammed AlJadaan said on Wednesday in an interview that Saudi Arabia would look to sell assets that were not previously considered for privatisation in the coming years, including those in the healthcare and education sectors. He estimated that SAR 50bn could be generated through privatisations in the next five years. Saudi Arabia selected buyers for two flour milling companies earlier this month at an agreed price of SAR 2.77bn (approx. USD 740mn) together. Another two mills are likely to be sold by next year. Mr AlJadaan also said that there were no imminent plans to introduce income tax in the kingdom, but that nothing could be ruled out in the future.

Markets showed little conviction to take either a risk-on or risk-off tone overnight as data flow from major economies was scarce. Following the conclusion of the EU mega-deal earlier this week focus will shift to the US where a new stimulus plan remains under debate. Supplements to unemployment insurance will expire at the end of July and the administration and Congressional Republicans appear to be debating whether to include their rollover in a broader stimulus package. Elsewhere, US-China relations took another turn for the worse after the US ordered the closure of the Houston consulate. The measures were protested by Chinese officials and there may be retaliation against US diplomats in China.

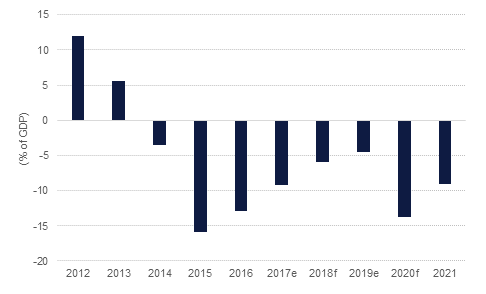

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Benchmark bond markets saw yields drift mostly lower as the US stimulus standoff is in focus and escalation tension between the US and China remains front of mind. Yields on 10yr USTs moved down to a 0.59% handle for the first time since April. Yields across all of Europe were lower with 10yr gilts down by more than 1bp and bunds lower by around 3bps.

EM bonds marched higher even as risk-off tone appeared to permeate in bond markets. Regional issuance is largely quiet at the moment.

The dollar continued its losing streak on Wednesday. The DXY index has dipped just below the 95 handle at 94.990, recording fresh four-month lows after US President Donald Trump warned that the coronavirus situation in the country will likely worsen before it improves. USDJPY rallied above the 107 level during the session and has consolidated minor gains at 107.15.

The euro has continued to climb, at one point breaching the 1.16 mark, meeting resistance and eventually declining to 1.1570. This was still an advance on Tuesday's closing price of 1.1527. Sterling was largely unchanged for the day at 1.2730, still holding its ground just above the 200-day moving average of 1.2704 for now. Similarly the AUD has traded mostly sideways for the day at 0.7130 whilst the NZD recorded modest gains to reach 0.6660.

In the US, equity investors largely shrugged off the rising tensions between the US and China, seemingly preferring to focus on the prospect of a new stimluls package and some form of vaccine for Covid-19. This sent the S&P 500 up 0.6% to a five-month high, while the Dow also gained 0.6%. Investors in Europe were perhaps more perturbed by the latest round in the spat, as the Dax lost 0.5%, the FTSE 100 1.0% and the CAC 1.3%, though they were coming from a relatively high position after recent days of optimism regarding the Eurozone rescue package.

Oil prices were slightly lower overnight but failed to show much conviction during the course of trading. Brent prices are still holding onto USD 44/b while WTI is just shy of USD 42/b. Data from the EIA showed a build in US crude stocks of 4.9m bbl last week while product gains took total petroleum inventories up by over 8.8m bbl. Production actually rose by 100k b/d while product supplied slipped by over 800k b/d with kerosene/jet losing ground along with distillates.

Gold prices continue their ascent, closing up 1.6% at USD 1,871/troy oz. A break above USD 1,900 looks to be more a matter of timing, particularly as risk-off assets continue to receive support.