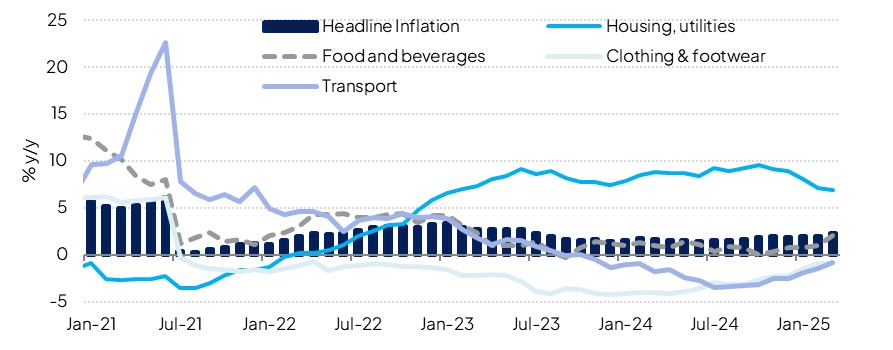

CPI inflation in Saudi Arabia picked up to 2.3% y/y in March, from 2.0% the previous month. This marked the fastest pace of annual price growth since July 2023. On the monthly measure, inflation was at 0.3%, up from 0.2% in February. Headline annual inflation averaged 2.1% in Q1, up from 1.9% the previous quarter and a modest acceleration on the 2024 average of 1.7%. The Q1 pace remains in line with our 2025 forecast for an annual average of 2.0%, and we are maintaining this outlook for now despite the March acceleration. While the dollar, and by extension riyal, has weakened against the major developed market currencies, it has performed more strongly against other regional currencies including the INR, CNY, and EGP and this should alleviate import price pressures to some extent, and the US was the second largest source of imports after China in 2023. Moreover, firms have been discounting, and most components of the basket continue to see fairly weak inflation.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

The notable driver of higher annual inflation in March when compared to February was the food & beverage component, which account for 21.7% of the basket and accelerated to 2.0%, from 1.0% the previous month. This is likely related to the holy month of Ramadan falling in March, with Saudi consumer spending reportedly jumping 35% in the week prior to Ramadan with nearly a third of that record spending concentrated in food stores and food outlets, likely leading to some price growth in the following weeks. Restaurants & hotels inflation also accelerated in March, rising 1.3% y/y compared to 0.8% in February. The upwards pressure related to these dynamics should fade over the following months.

Housing & utilities prices were up 6.9% y/y in March, and at 20.5% of the basket the component remains the key upwards driver of price growth, though it is worth noting that this was down from 7.1% in February and was the slowest pace of growth since January 2023. A rapidly growing, and urbanizing, population, has driven up demand for housing especially in Riyadh and other centres, and rents rose by an average 18% in the capital last year. Strong demand is likely to underpin housing costs this year, though a mooted cap on residential and commercial rent increase in Saudi Arabia could see the pace of inflation slow further through the year if it is introduced.

Most other components of the basket saw either weak or outright deflationary price growth in March. Clothing & footwear was down 0.8% y/y, as was transport, communication was down 1.4%, while prices for household furnishings were 2.6% lower than a year ago. The weaker price pressure generally was reflected in the PMI survey for March, where businesses on aggregate cut their prices charged to consumers from the previous month as they sought to remain competitive. They were enabled to do so as their input prices, both in terms of purchase and staff costs, rose at only modest rates.