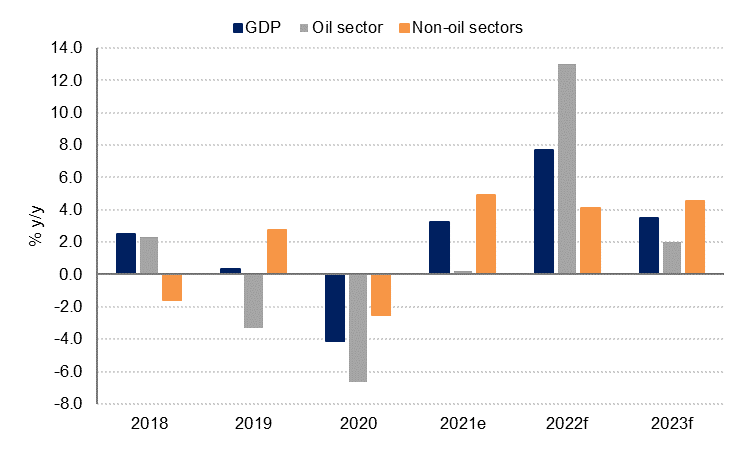

Saudi Arabia’s economy grew 3.2% in 2021, faster than we had expected. Mining & quarrying, the component measuring oil & gas output, was a drag on growth at -1.1% y/y despite recovering in H2 2021. However, the official estimate for total oil GDP was higher at 0.2% y/y. The non-oil (private) sector grew 6.1% y/y, while value added by government services grew 1.5% y/y. Overall non-oil GDP grew 4.9%, in line with our 5% forecast.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

The fastest growing sector last year was manufacturing at 11.6% y/y, more than offsetting the contraction of -9.0% y/y in 2020 as both oil and non-oil manufacturing recovered sharply from the pandemic. Wholesale and retail trade and hospitality grew 8.7% y/y, also fully rebounding from the contraction in 2020. Financial services (5.8%) and transport, storage & communications (3.8%) also contributed to the overall non-oil sector recovery, as did utilities and construction.

On the expenditure breakdown of GDP, private consumption (which contracted -6.3% y/y in 2020) was the main engine of growth in 2021 rising 9.7% in real terms, the fastest rate since 2012. This was likely due to covid-related travel restrictions on Saudi nationals limiting their travel abroad as well as increased opportunities and avenues for leisure and entertainment spending in the kingdom in recent years.

The other main driver of growth in 2021 was gross fixed capital formation, which rose 10.1% y/y after contracting almost -12% in 2020. This was driven by private sector investment, according to the official statistics, with public investment declining for the third year in a row. This is consistent with declining capital spending in the government’s budget from 2018-2021 and suggests that sovereign wealth fund investment may be classified as “private”.

For 2022, we retain our expectations for significantly faster hydrocarbons GDP growth this year as oil production and investment rises. We expect oil & gas GDP to grow 13.0% in 2022, and there is upside risk to this forecast given the current oil/ geopolitical dynamics. We have increased our estimate for government spending this year slightly, to take into account some slippage as oil revenues are expected to rise sharply, and as the government is likely to absorb some of the increase in global food and energy prices rather than fully pass these on to consumers. Nevertheless, we still expect fiscal discipline to be broadly maintained. As a result, we think total non-oil GDP growth (including government services) is likely to slow to 4.1% this year from 4.9% in 2021. Headline GDP growth should come in at 7.7% this year, before slowing to 3.5% in 2023.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

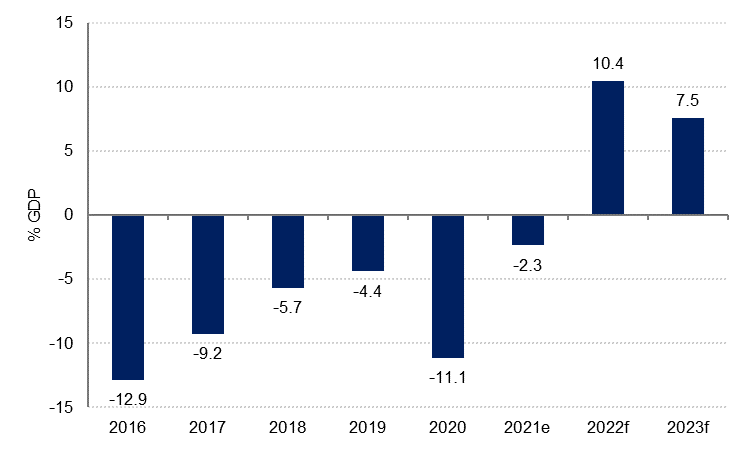

Taking into account our new oil price forecast of USD 112/b for Brent, we now expect the budget to post a surplus of 10.4% of GDP, compared with a deficit of -2.3% in 2021. We expect the budget surplus to be used to boost foreign reserves at the central bank and to fund the Public Investment Fund, which has committed to investing USD 40bn in the Saudi economy every year through 2025.